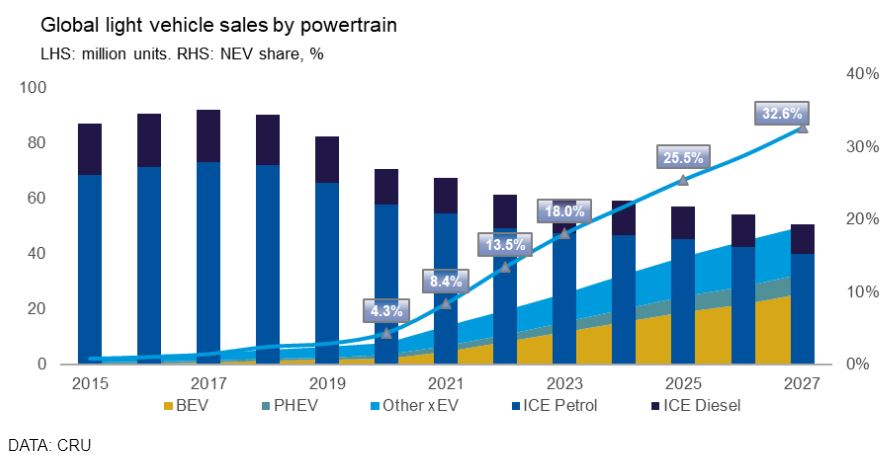

New Energy Vehicle (NEV) sales were strong in 2022, despite the gloomy overall trend in the auto market. NEVs are defined as Battery Electric (BEV) and Plug-in Hybrid (PHEV) vehicles. Although data for the full year is not available, we expect NEV sales to reach 14% of global light vehicle sales in 2022, and we expect they will reach 18% in 2023. Market share growth has slowed slightly compared with 2021, but we forecast NEVs will comprise almost one-third of the global market in 2027 as more NEV models are developed and produced and emission controls get tougher.

Explore this topic with CRU

Author Arthur Wang

End Use Economist View profile

Figure 1: Global NEV sales remain strong despite the struggling auto market

China has led the way in the adoption of NEVs, supported by government incentives and a well-developed battery supply chain. We expect 2022 China BEV sales to have reached 5.5 M units (88% y/y growth) and PHEV sales 1.4 M units (135% y/y growth). This would mean total NEV sales reaching 6.9 M units (96% y/y growth) in 2022, with a 26% share of total light-vehicle sales, almost double the 13.8% achieved in 2021. Following the sudden roll-back of the zero-Covid policy, high Covid infection rates may negatively impact the auto market in early 2023. Thereafter, Chinese economic activity may start to normalise and consumer sentiment may return. This will support NEV sales this year.

Although market share is still lower than China, NEV adoption has accelerated sharply in Western Europe over the past two years, most noticeably in the Nordic countries but also in major markets such as Germany, France and the UK. For Western Europe, we expect 2022 BEV sales to have grown by 16% y/y, reaching 1.38 M units, with PHEV sales declining 12% y/y, reaching 0.9 M units. We expect NEV sales growth to have been just 3% y/y in 2022, compared with 138% in 2020 and 65% in 2021. However, NEVs have continued and will continue to increase market share. Strong demand for NEVs in Europe has helped to drive higher imports from China.

So far, North America has been in the slow lane of EV adoption, despite the success of Tesla. We expect 2022 North America BEV sales to have grown by 66% y/y, reaching 0.77 M units, with PHEV sales growing 1.9% y/y, reaching 0.22 M units. In total, we expect NEV sales in 2022 to have grown 49% y/y, in contrast to a contraction of 7% in total light-vehicles sales. NEVs achieved a 6% share of the market. Going forward, we expect the Inflation Reduction Act – which includes generous subsidies for NEVs – to help to accelerate NEV adoption.

These and other economic developments that impact commodity markets are discussed with CRU subscribers regularly. To enquire about CRU services or to discuss this topic in detail, get in touch with us.

CRU experts discussed the impact of the war in Ukraine on commodity markets in a recent webinar. Experts from all major commodity areas joined CRU’s Head of Economics and an energy specialist to discuss markets one month on from the invasion of Ukraine. The webinar is available to watch on-demand here.

Explore this topic with CRU

Author Arthur Wang

End Use Economist View profile