AuthorHumphrey Knight

Principal Analyst, Phosphate & Potash View profileThe world is watching as Sirius Minerals’ unprecedented 10 Mt/y Woodsmith polyhalite mine, under development in northern England, approaches its final stage of capital raising.

As part of our Potassium Sulphates and Potassium Nitrate Market Outlook, this insight considers the multi-nutrient product’s current market position, looks at the potential impact of large volumes of previously little used product on the fertilizer industry and we consider what is an achievable sales price.

Introduction to Polyhalite

Polyhalite is a mineral currently mined in small volumes, but one which has accumulated significant interest over recent years as large-scale projects look to attract funding and ‘disrupt’ the fertilizer market. A hydrated potassium, calcium and magnesium sulphate evaporite mineral, polyhalite historically attracted little interest from exploration or fertilizer companies due to its lower potassium content and solubility compared to other potassium-bearing ores.

However, the industry has continued to evolve and Israel Chemicals Limited’s United Kingdom subsidiary (ICL UK) now distributes around 500 kt/y from its Boulby mine as a direct application fertilizer or bulk-blend/compound NPK additive.

Polyhalite’s characteristics as a fertilizer

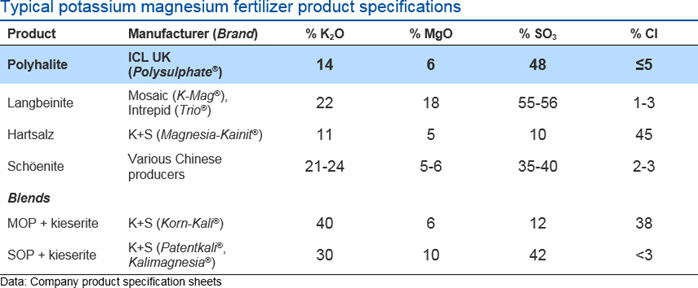

Polyhalite’s composition is most similar to the other major potassium magnesium sulphate (“SOPM”) fertilizers: langbeinite, schöenite and Patentkali®. All are marketed as low-chloride potash fertilizers with additional magnesium and sulphur components. ICL UK markets polyhalite as a multi-nutrient, low-chloride fertilizer under the brand name Polysulphate®. Sirius plans to market its polyhalite as POLY4®. Both product’s value components are:

Primary nutrients: 14% K2O

Secondary nutrients: 6% MgO, 19% S, 17% CaO

Low-chloride potash (some crops are chloride intolerant)

The SOPM market remains small and insular

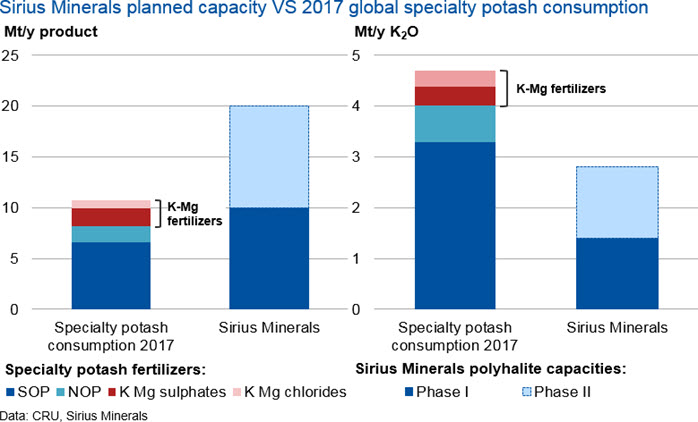

CRU estimates the global consumption of potassium magnesium sulphate (SOPM) fertilizers in 2017 at 1.7 Mt total product, a comparatively small total compared to the widely traded 65.5 Mt potassium chloride (MOP) market. Polyhalite accounted for around 450-460 kt of SOPM fertilizers. ICL UK is currently ramping-up production to 1 Mt/y (140 kt/y K2O) by 2020 as it simultaneously phases out MOP production at the Boulby mine. At current production levels, this will be equivalent to almost 40% of the current SOPM market in K2O terms.

Sirius Minerals’ planned Phase I capacity (10 Mt/y product) is on a different scale altogether; around four times larger than the current SOPM market in K2O terms. It is also approximately the same size as the global potassium sulphate market, the most popular low-chloride potash fertilizer, outside China. Additionally, the majority of SOPM consumption has traditionally been concentrated close to production sites, nurtured by the marketing efforts of producers.

Sirius has sought to address this through its multiple take-or-pay agreements and the establishment of a global network of importers. At the time of writing, firm annual offtake agreements total 4.4 Mt, rising to 5.5 Mt with options. The company aims to reach 6 to 7 Mt in commitments by the end of 2018.

Polyhalite’s value remains unclear

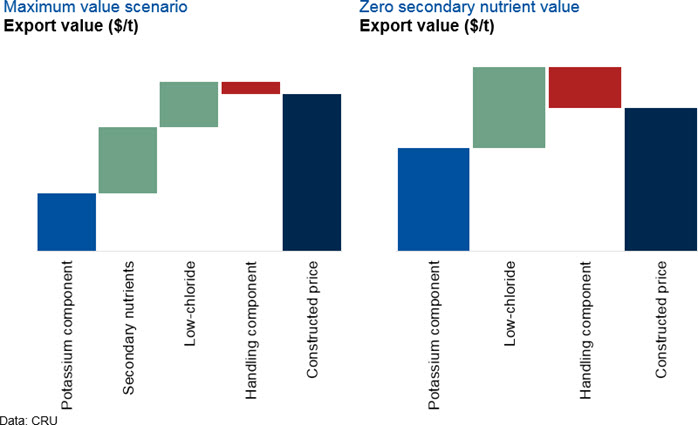

Despite the inroads ICL and Sirius are making in the specialty potash sector with polyhalite, its achievable sales price is a major unknown. With such large volumes potentially set to enter the market in the next five years, a true value of polyhalite needs to be derived to assess its capabilities and return on investment. Potassium magnesium fertilizers typically realise a premium per unit K2O over MOP due to the provision of magnesium and lower chloride. If chloride sensitivity is not an issue it is often cheaper to purchase potassium chloride and a source of magnesium such as kieserite.

Multi-nutrient fertilizers like polyhalite should attract a combination premium to reflect the relative savings in handling, transportation and application compared to acquiring the contained nutrients individually. However, this must be balanced against the handling and transportation costs incurred with a less nutrient-dense product. Additionally, the value ascribed by consumers to factors such as secondary nutrients is generally more subjective. Some will pay a premium for such attributes depending on desired crop quality or soil requirements whereas others will ascribe little value.

The prices realised by specialty potash fertilizers represent a sum of their parts. CRU conducts component value analysis to calculate how much each attribute, such as the potassium and magnesium components or low-chloride premium, is worth. In the Potassium Sulphates and Potassium Nitrate Market Outlook we use this approach to construct a range of polyhalite pricing scenarios.

Based on 2017 average values, the full component value price for polyhalite would have been under USD200/t at export. In this methodology, we assume that consumers place full value on the provision of secondary nutrients and low-chloride potash. This calculation falls well under this USD200/t figure if value is assigned only to the potassium content and low-chloride premium.

What is the future for polyhalite?

Converting a fertilizer with specialty attributes into a bulk commodity is undoubtedly a major challenge given the current structure of the global fertilizer market. Nevertheless, at present, ICL UK appear to be on track for delivering 1 Mt/y by 2019/2020 as sales growth has been very strong. Moreover, Sirius Minerals has now signed offtake agreements for around half of its expected annual production. Although there is still significant development required and the pricing structure warrants clarification, the marketing efforts of both companies are gaining ground.

Polyhalite and other SOP, NOP and SOPM products are covered in further detail in CRU’s Potassium Sulphates and Potassium Nitrate Market Outlook, published in late 2017. This outlook includes data and anlysis on the supply, demand, trade and pricing of the above industries and delves further into the potential impact these projects will have on the fertilizer industry.

Explore this topic with CRU