Co-authorVictor Rodriguez

Head of Consulting, EMEIA View profile

Co-authorRicardo Horvath

Business Development Manager, Central and South America View profileCRU was delighted to present at the Brazilian IBRAM 2019 conference and exhibition in Belo Horizonte in September 2019.

A team from our CRU Santiago, CRU São Paulo and CRU London offices spent a week with customers and business contacts to discuss global market challenges and opportunities in the Brazilian commodity sector.

Below are the hot topics that were repeatedly discussed during our time in Brazil

1. ESG was the top issue raised by mining leadership teams.

The dam failure at Brumadinho, in January 2019, caused shockwaves throughout the global and Brazilian mining sector. The Brazilian industry has a massive challenge to re-gain public support – and seems to be taking important steps to build that trust. For example, IBRAM announced it is to adopt the Towards Sustainable Mining (TSM) initiative developed by the Mining Association of Canada (MAC). There is also a growing recognition that the adoption of more transparent & robust ESG standards are needed to both attract talent to work in the mining sector and to retain as wide a pool of global investors as possible. Such efforts could be bolstered by a more coordinated communication strategy for the industry.

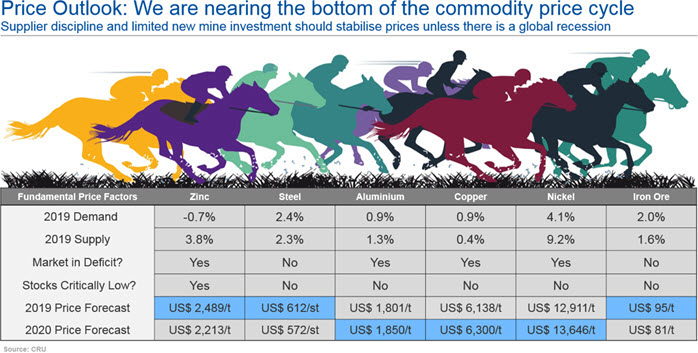

2. Global uncertainty has reduced demand growth impacting commodity prices…

Whilst 2018 was the year of “synchronized global growth” 2019 will be remembered as the year of “global uncertainty” with disappointing commodity consumption. However, during discussions there was limited concern that there would be a global recession in 2020 and even some optimism that trade war resolution could boost commodity prices next year. Most of our clients agreed with the CRU View that we are unlikely to see commodity prices break-out from their current malaise in 2020 and it is difficult to identify a compelling investment story for the sector today.

3. …but the sector is better prepared to face market uncertainty…

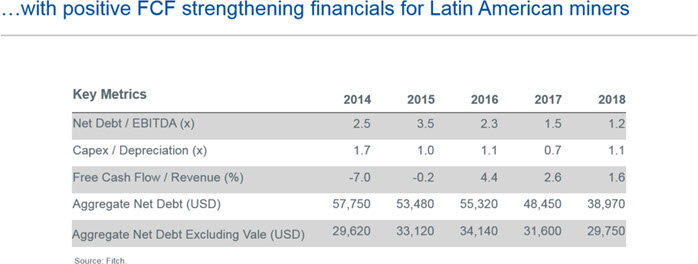

Despite the noticeable price slowdown in 2019, the price environment has been broadly positive for miners since 2015. Underlying prices have increased and the market has paid higher premiums for high quality bulk commodities and other specialist metals. As Fitch Ratings Latin American Miners analysis has shown, industry free cash flow turned positive in 2016 and these additional funds have been used to reduce debt, pay dividends and increase capex spend in selected cases.

There was also a strong belief, shared by CRU, that the mining sector is in a much better position than in 2014 to manage future market uncertainty with stronger balance sheets and seasoned management teams. Their recent experience of how to mitigate for market downturns could be invaluable.

4. …and the Brazilian miner sector has growing confidence in the Government

Industry leaders are cautiously confident that the new Government is creating better investment conditions for the mining sector; for example, by reducing bureaucracy or by offering better ‘terms’ to attract junior explorers. In many meetings we were told of initiatives that were being implemented that were allowing executives to consider future investments again. However, infrastructure remains one important area where it was felt that the government must accelerate investments to support potential mining projects.

The Monetary Policy Committee, Banco Central do Brasil (Copom) also commended ongoing reforms when it announced a lowering of the Selic rate to 5.50% p.a. on 18th September. Positive economic data and comfortable inflation levels were cited as proof that the Brazilian recovery will occur at a gradual pace allowing interest rates to be cut now.

The Copom also highlighted progress in the process of reforms and necessary adjustments in the Brazilian economy, but emphasised that persevering in this process was essential for the reduction of structural interest rates and for sustainable economic recovery.

In conclusion

We left Brazil with more confidence than expected. There is a recognition in the industry that is faces unique challenges to rebuild trust with the Brazilian population. Efforts are being made to address this. There is also a realisation that ESG issues must also be tackled, to attract talent to the sector and to retain investors in the medium term.

However senior metals & mining leadership teams think they are well positioned to weather any economic uncertainty, and with government backing, are even exploring strategic investment opportunities in the Latin American region.

CRU Consulting