This year brings several opportunities and challenges for commodity markets participants.

We have identified three global economic themes—China’s stimulus, recession, automotive tariffs—that can be expected to a drive commodity supply, demand and price in 2019.

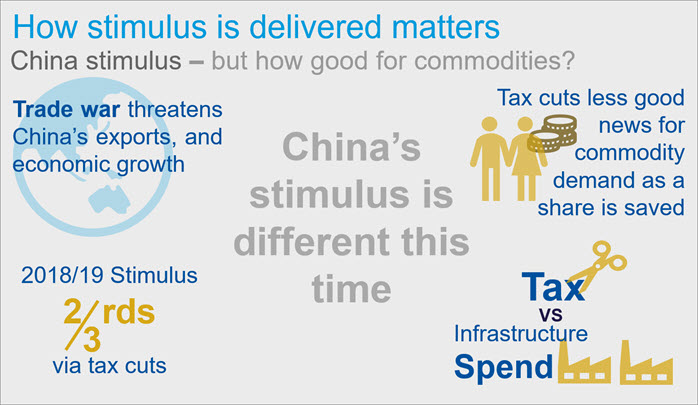

China Stimulus

The Chinese government is determined to avert a sharp economic slowdown in 2019 and stimulus is expected. How might the next stimulus compare to previous episodes in size, how it is delivered, and which sectors will be most impacted, when does the hangover hit and how will this influence commodities demand?

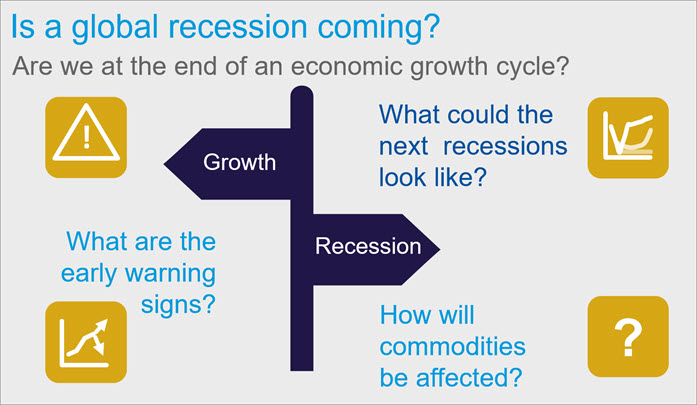

Recession

Many of our customers fear increased probability of a recession after the long run of expansion since the GFC. How do we define a recession? what have previous recessions looked like and how will the next compare? What are the early warning signs and are we seeing them? How will it affect commodities markets?

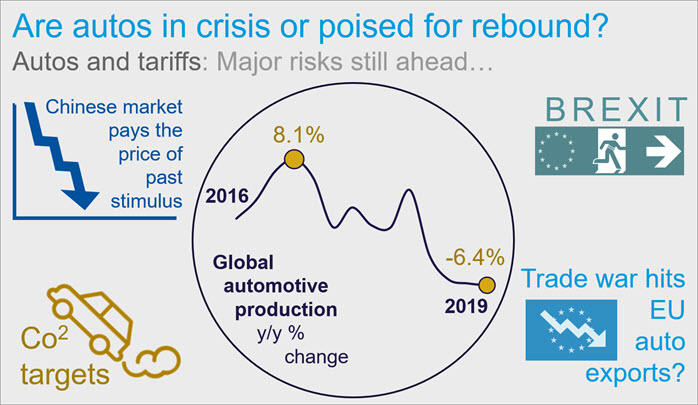

Automotive Tariffs

The shift in the political landscape has led to rising trade barriers, including for metal and manufactured goods. The US may impose duties on automotive imports under Section 232. How will markets react? Will other regions impose retaliatory tariffs? How will this impact global automotive production? How would a S.232 auto tariff hit different regions and metal demand?

Economic Team