AuthorPeter Ghilchik

Head of Multi Commodity Analysis View profile

AuthorWill Young

Customer Success Specialist View profileOver Q1 2020, Covid-19 has developed from an emerging threat to a transformational reality with potentially long-lasting effects on economic growth.

All optimism for commodity markets at the start of the year was quickly extinguished as the coronavirus emerged in Wuhan, China. Prices have been dragged down further by dire market fundamentals which were a result of government-imposed lockdowns in the major global economies. Both supply and demand have been lowered across the board, but demand has been harder hit and will be slower to make a recovery. Most commodities have further to fall from here. There has been a profound human cost to the pandemic and the economic fallout of governments’ responses is just starting to be counted.

China’s first ever quarterly GDP contraction

China’s published a GDP growth rate of -6.8% y/y in Q1 2020 and -9.8% q/q. This is the first negative growth figure since the start of the economic reforms initiated by Deng Xiaoping in 1978. This number is not surprising given the lockdown brought the economy near to a standstill for almost two months. China’s growth rate bears particular significance for commodity markets as its economy has come to account for roughly half of global commodity consumption and production. Furthermore, with many economies around the world still in lockdown, we are looking to China to gauge the economic cost of the Covid-19 containment. The economic repercussions will be significant.

Read the full analysis of China’s first ever negative quarterly GDP growth by CRU’s Economist, Yingrui Wang; published 17 April 2020.

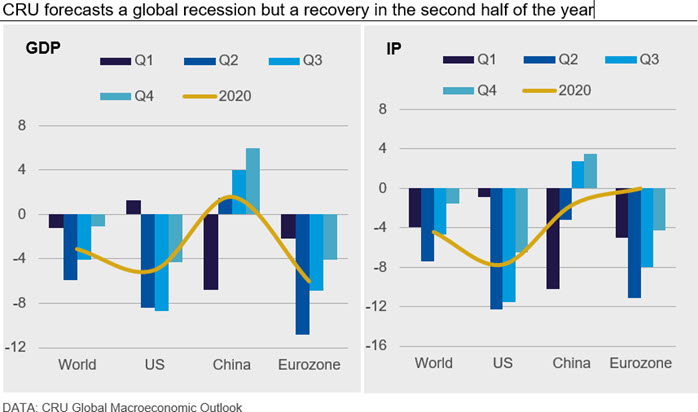

Months of lockdown lowers global GDP

At the beginning of May, many economies were starting to lift lockdowns or at least discuss exit strategies, with the caveat that we are entering a ‘new normal’. CRU is assessing the full economic impact of bringing swaths of the global economy to a standstill. Using estimates of the loss of output by sector, one month of the lockdown lowers the level of annual GDP by 2–3%. CRU is now forecasting a global recession in 2020, with growth in the Eurozone and USA turning negative, and China suffering a “hard landing”, with China’s economic growth slowing to just 1.6%.

Read the full Global Economic Outlook by CRU’s Chief Economist, Jumana Saleheen; published 30 April 2020.

Automotive hit hard during troubling times for OEMs

While construction and automotive, two key end-use markets for metals, have both seen activity has slow substantially because of the lockdowns the two sectors have fared quite differently. Construction has slowed, with significant divergence between countries, but the majority of sites continued to operate. CRU expects that global construction output will contract by 1.9% this year and then recover to 6.2% in 2021.

By contrast, the automotive sector has been hit especially hard. CRU forecasts the global auto industry will contract by a massive 15.9% in 2020.

The European Car Manufacturers’ Association estimates that across the EU shutdowns have resulted in the lost production of more than 2 million units. Car sales dropped by more than 50% across EU during March. CRU expects EU automotive production to contract by 21.6% in 2020.

Despite China’s announced a policy stimulus to support the auto industry on 31 March, which included a reduction in VAT, with the focus of EVs. CRU expects Chinese auto production will contract by 10.5% this year.

North America car sales in April were -16% yoy and assembly restarts are expected to come in May. Auto demand will largely depend on what the second stimulus will look like and how the US government steps in to help. CRU forecast North American vehicle production will contract by 19.6% in 2020.

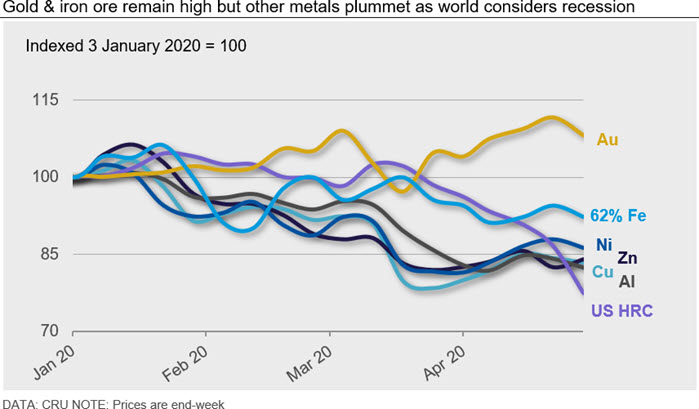

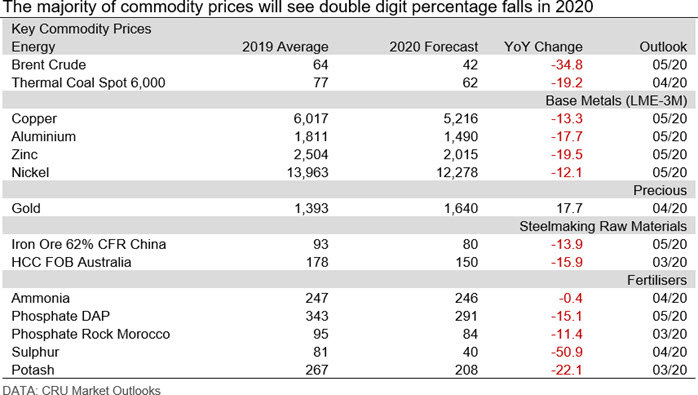

Prices driven to new lows as market fundamentals take hold

Optimism for commodity prices at the start of the year was quickly extinguished and prices were dragged down as the emergence of coronavirus in Wuhan spread into a global pandemic. In an environment of macroeconomic uncertainty, LME prices have declined, and safe-haven assets such as gold have flourished. The steelmaking value chain continues to favour iron ore miners as prices remain elevated, due largely to supply losses and low shipping costs. The steel industry is experiencing extremely weak downstream demand, resulting in a rapid stock build.

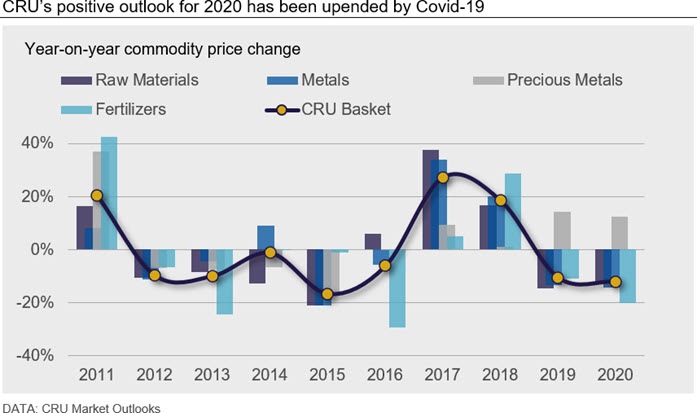

2020 price forecasts continue to be revised down

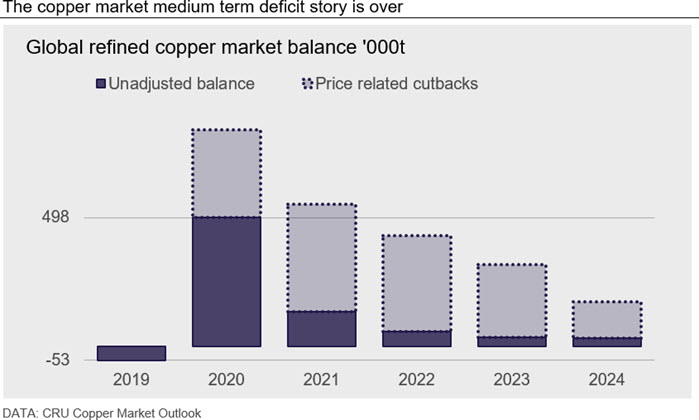

Copper sees steepest demand decline since the 70s

Copper demand is set to decline by over 5% this year, which represents the strongest downturn since the mid-1970s. Without price-related cuts, copper faces considerable market surpluses over the next five years and the much-vaunted medium-term structural deficit story appears vanished or at least pushed much further out into the future.

There is scope for some retracement of the copper price into the $4,000s/t during the second quarter but the period average is set at just over $5,000/t. Any price appreciation over the remainder of the year and 2021 will be capped by the cash costs net of by-product for the 90th percentile mine.

Read the full analysis in Copper deficits to vanish as Covid-19 grips globe by CRU’s Principal Analyst, Robert Edwards; published 30 April 2020.

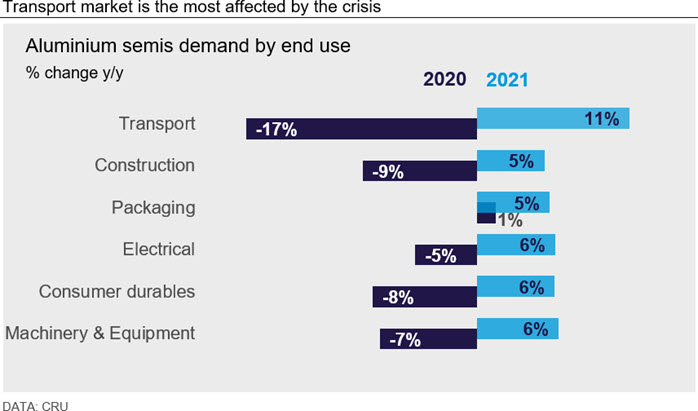

Déjà vu – the aluminium market is in crisis

Given the steep declines in demand from almost all end-use sectors, the aluminium market would have faced a 6 Mt global surplus without smelter closures. Chinese smelters are under pressure and curtailments are happening. Given the need for closures, CRU is forecasting the LME 3-month price will fall to $1,360/t in Q3 2020. As closures happen, inventories will be drawn down but only over the next few years, allowing prices to gradually recover. The aluminium price is only expected to return to 2019 levels in 2023. Still, nearly all Chinese smelters are profitable. Outside China, 16% of smelters are losing money. Margins will worsen in the next quarters delivering the closures the market requires.

Read the full analysis in Aluminium market in crisis: we’ve been here before by CRU’s Senior analyst, Lais Santos; published 29 April 2020.

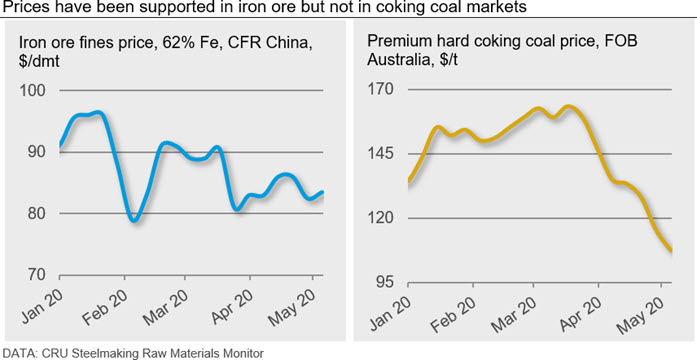

Iron ore price remains resilient even as steel and coal suffer

Iron ore prices have held at high levels in 2020 and are currently trading around $84/t. Iron ore inventories in China are at extremely low levels. This is due to disruptions to seaborne supply. The premium hard coking coal price in contrast has fallen fast to below $110/t as buying interest outside China remains extremely weak. We estimate that the absolute floor price for Premium HCC is $95/t FOB Australia.

Access the Covid-19 disruption tracker by CRU’s Senior analyst, Erik Hedborg and Manjot Singh; published 1 May 2020.

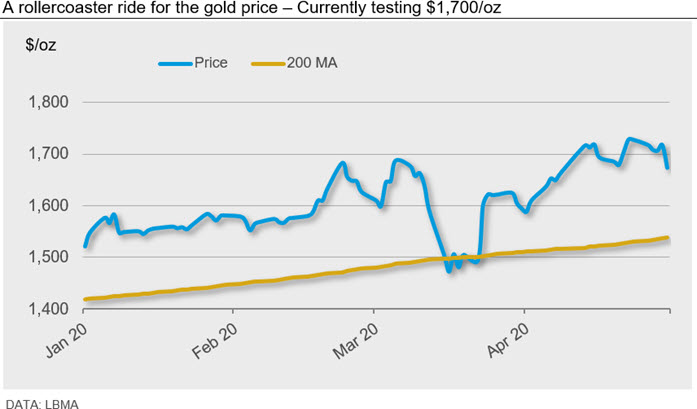

Is this gold’s new super driver?

Gold traded at its highest levels in seven years as fears of coronavirus spread worldwide. This led to a sharp selloff in the stock market and pushed investors to retreat to traditional safe-haven assets. Gold’s rise has been capped by forced selling from investors seeking liquidity in the short term, which expect to see more continue. The overall macroeconomic background has not been this positive for the gold market since the last Global Financial Crisis. A prolonged period of risk aversion will continue to stimulate safe-haven demand, an environment in which gold prices are likely to flourish. CRU expects the gold price to average USD1,640/oz in 2020.

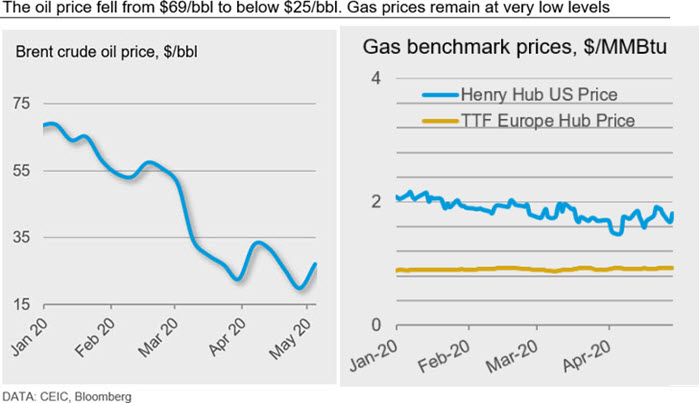

US oil prices turned negative for first time in history

The Brent crude price has averaged $28/bbl so far in Q2 2020. In response to plummeting oil prices OPEC+ buried the hatchet on April’s price war and agreed an historic 9.7Mbbl/d of production cuts starting 1 May. These cuts are based on an October 2018 baseline, making the cuts only 3.5Mbbl/d compared to March figures. Far below what is needed to balance the market.

CRU expects prices will recover later in the year as demand for oil products slowly returns, but the 2020 price will average just $42/bbl rising to $51/bbl in 2021.

Global spot gas prices reached a decade low for the season as a significant amount of liquefied natural gas (LNG) entered the market. Demand growth has slowed due milder seasons, the slowing global economy, and the impact of the coronavirus outbreak. CRU expects gas prices to remain weak in 2020.

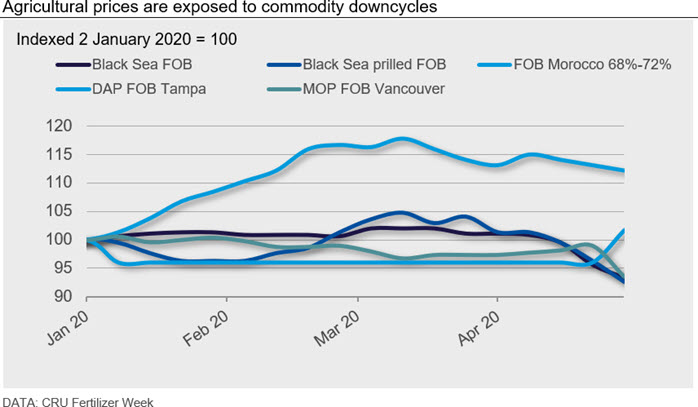

Lockdowns and logistics threaten the fertilizer markets

Despite the global spread of Covid-19, CRU expects fertilizer demand to remain robust in 2020, forecast at 197.6 Mt nutrient, 1.5% higher year-on-year. Although some downside risk has come from supply bottlenecks from lockdowns, this growth will largely be driven by improving agricultural fundamentals, supportive weather conditions and favourable affordability levels.

Global fertilizer affordability remains favourable in terms of historic trends due to low fertilizer prices and firm crop prices, an upside for nutrient use. For example, production disruptions, which could tighten supply and result in fertilizer price increases have been minimal on a world scale, as most governments recognise fertilizer as essential business.

Changes in foreign exchange rates impact both fertilizer production costs and affordability. The industry is heavily exposed to four major economies: China, Brazil, Russia and India (BRIC economies) - all are major producers and consumers of fertilizers.

The volatility in foreign exchange rates could significantly disrupt underlying price support as production costs in US dollars are lower for exporters. Meanwhile, importers face higher prices in local currency terms.

The BRIC economies account for nearly 50% of total capacity and demand of the key products across nitrogen, phosphate and potash markets. The impact of shifting exchange rates on each individual fertilizer products will vary depending on its geographical supply and demand structure.

Access our Covid-19 disruption tracker by CRU’s Editor in chief, Ben Farey; published 6 May 2020.

Gold stands alone – CRU calls lower prices across markets

Covid-19 came at a time of cautious optimism that we had reached the trough of the commodity prices cycle in 2019 and there was hope that price would recover in 2019. In January we forecast relatively benign market fundamentals and surmised commodity prices in 2020 are more likely to be driven by events. The global coronavirus pandemic has affected all markets and made double-digit year-on-year commodity price falls the new reality.

Full versions of these articles are available with a CRU Subscription. If you would like access or would like to discuss the topics raised please contact CRU via the form below.