AuthorPeter Harrisson

Principal Analyst, Sulphur and Sulphuric Acid View profileClients of the CRU Fertilizer cost services cite 3 key reasons why they use our cost service: strategic planning; benchmarking and pricing/marketing strategy.

Meeting the industries needs

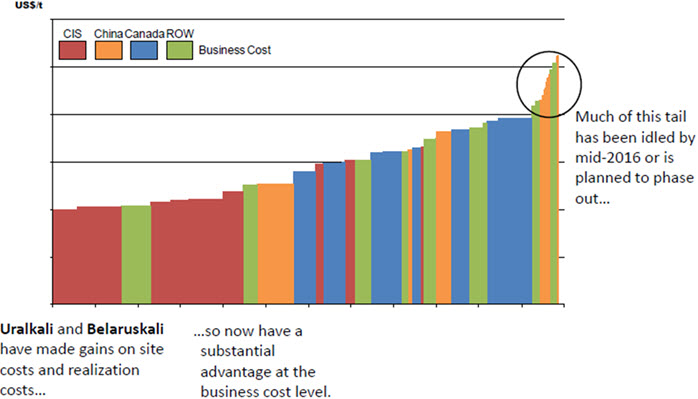

From a strategic planning standpoint the CRU cost services can provide an understanding of current and future cost structure of competitors in each region and the globally traded market. For example the chart below shows the 2016 Potash business cost curve and the benefits that CIS producers received from the Russian rouble depreciation. Additionally, the CRU cost services can be used to understand how new producers will compete in the market on an opex and capex basis by comparing current and new plants on a comparable per tonne basis. Primary research to mine and plants is a key part of CRU cost services, which contrasts with more traditional desk based research. CRU has more than 10 offices around the world, in Europe, the Americas, China, Asia and Australia – our Fertilizer analysts in Beijing gives clear insights on Chinese costs. CRU’s forward looking forecasts also embed our economics team energy/exchange rate and macroeconomic forecasts, which have been key considerations in relative competitiveness in recent years.

For benchmarking against competitors plants, CRU provides 2 dimensions of granularity. The CRU cost services provide granular excel data on a cost basis including raw material; conversion; labour; power; freight cost and product premiums/ discounts. Additionally, granular data is provided per mine or plant to allow a detailed focus on specific plants. Furthermore, these granular sets of data are provided in an easy to download excel format, which allows clients to integrate quickly into their models or workflow.

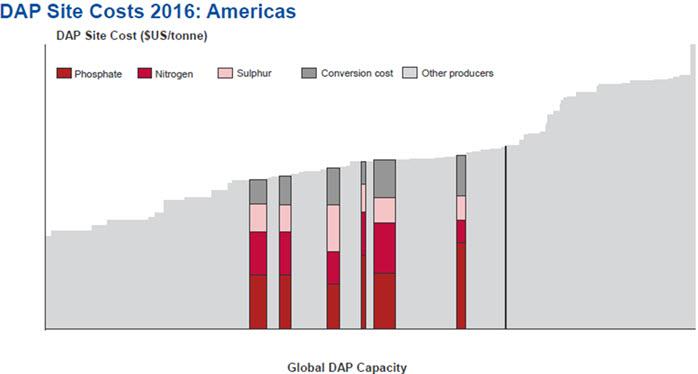

Finally, clients use CRU cost services to guide pricing/marketing strategy. The shape of current and prospective cost curves can provide an understanding of the costs that marginal producers face and a floor to market prices. This can be done on a global basis or by region and an example is shown below from the 2017 Phosphate Fertilizer cost service. CRU’s methodology also allows for product premiums and freight advantages/disadvantages through our business cost calculations. This can allow a tactical focus for producers on regional markets that are advantageous to them.

Analyst access is also a key part of the CRU Fertilizer cost services to help put the results into your context. CRU brings together a diverse and international group of experts across the fertilizer markets to give you an expert understanding of production cost for nutrients. Clients have access to excel data files for all costs and per plant cost; a report on key cost issues; cost curves; a summary powerpoint presentation and updates through the year (including special focus articles on select plant visits).

Primary research

Site visits to fertilizer producers play a major role in CRU research for cost reports. The site based research complements data gathered via desk research and validates the inputs and assumptions in our cost models. This ensures that our models are the most detailed and accurate in the market and built from the bottom up, asset by asset, incorporating the different elements of each individual mine or fertilizer manufacturing facility. In particular, two challenges that site visits help address are the timeliness and lack of availability of information through other channels. The data published by the industry statistical organisations is often delayed by 12-24 months. Furthermore, data gathered online or in company reports is typically limited. In emerging markets such as China, limited data transparency and prevalent use of only local languages further complicate data collection. CRU overcomes these challenges through extensive primary research. For example since 2011, the CRU Phosphates team has visited over 40 major sites and see the chart below. Across CRU Fertilizer we have visited over 100 mine and plants over this period. Through each visit, CRU analysts have gathered comprehensive information and operational parameters data sets across the value chain – from sourcing of raw materials to the distribution of final products. Site visits have also helped improve CRU’s judgement and assumptions on the variables that producers do not reveal directly. After each trip, the gathered information is incorporated into CRU’s models, which substantially improves the accuracy of our cost reports. Furthermore, in a major market such as China, we are able to obtain additional insights via CRU’s local office, which also make it possible to visit Chinese sites given the need for local market contacts and language skills.

Quality primary research and robust, transparent methodologies

We do not rely on other people’s models and methodologies. Our cost work is based on a proprietary foundation, developed over many years. This means that by understanding a commodity at all levels of the market, our final insight delivers a complete view. Where customers come to us with a question on a specific trend, issue or event, our consultants and analysts work together to find the answers in a consistent way. The basis of our responses are transparent. Our methodology is detailed, documented and transparent. Where answers depend on uncertain assumptions and data, we will say so.

CRU Fertilizer team