Alex Christopher

Senior Analyst - Aluminium View profile

Trough of the price cycle expected in 2023

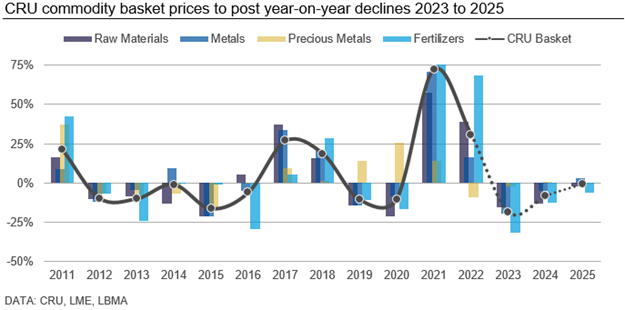

In January 2022, we wrote “Peak of the price cycle?”, suggesting commodity prices had reached a cyclical peak in 2021 as post-Covid-19 demand contended with shattered supply chains. Prices for many metals, raw materials and fertilisers have declined in 2022, despite a brief reprieve from the supply shock created by Russia’s invasion of Ukraine. Price declines are expected to continue into 2023, before slowly recovering in the medium term. The demand story, particularly for energy transition commodities remains intact, but price support may not return until the medium term as markets focus on poor near-term economic outlooks.

Downside price risks prevail in 2022

2022 has not been the year of gradual price declines expected in January. Russia’s invasion of Ukraine created a severe supply shock and price spike for metals, raw materials and fertilisers, particularly in Europe. Downside price risks have, however, prevailed, with most prices – excluding energy generating commodities – declining from post-invasion peaks through to September.

CRU’s latest Insights on the economic situation in western nations and China can be found in the Global Macroeconomic Outlook here.

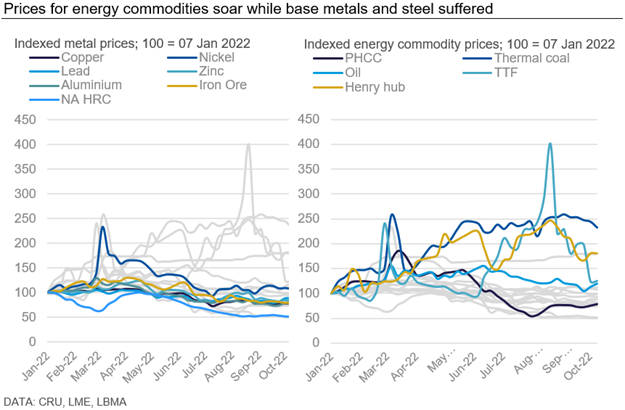

Prices for energy-generating commodities avoid decline

While the deteriorating near-term economic outlook has dragged metal prices down, energy commodity prices have soared.

Loss of Russian supply pushes energy prices higher again

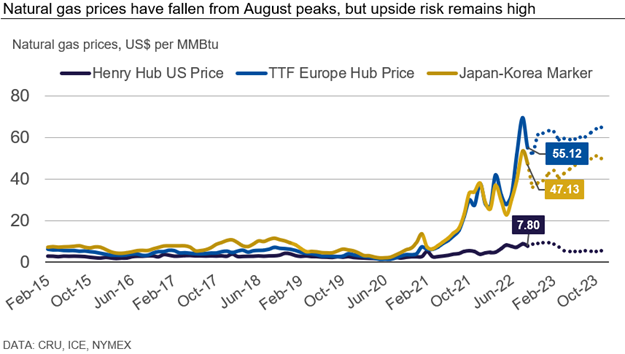

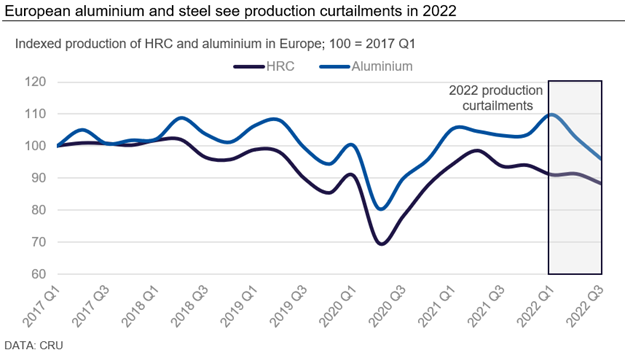

Even against the backdrop of volatile metal and fertiliser price movements this year, energy commodities price rises have been pronounced. In response to the invasion of Ukraine, Europe has sought to remove its dependence on Russia. In 2021 Russian supply accounted for 39.7% of European natural gas imports and 25.9% of petroleum oils. The replacement of this supply from other markets has been difficult and has caused prices to increase to unprecedented levels, reaching a peak of 69.52 $/MMBtu in August 2022. High European energy prices have led to cuts in industrial production. Aluminium smelting capacity in operation has declined by 25% since 2021 Q3; and 54% of nitrogen production was impacted at its peak in September 2022. Several zinc smelters have curtailed capacity – most recently Glencore announced that its Nordenham smelter will close 175ktpa of capacity from 1 November. In addition, 15–20% of BF-BOF steel plants are currently idled.

Natural gas prices have fallen from August peaks but remain significantly above 2021 levels (which were already historically high). Supply disruptions have continued from Russia, along with the delay of the Freeport LNG restart. Demand reduction and an increase in LNG imports have kept Europe afloat ahead of winter 2022. According to Gas Infrastructure Europe (GIE), going into winter inventory levels sit above average at 91%. However, much will depend on how cold this winter is in Europe, and how much household demand responds to high prices.

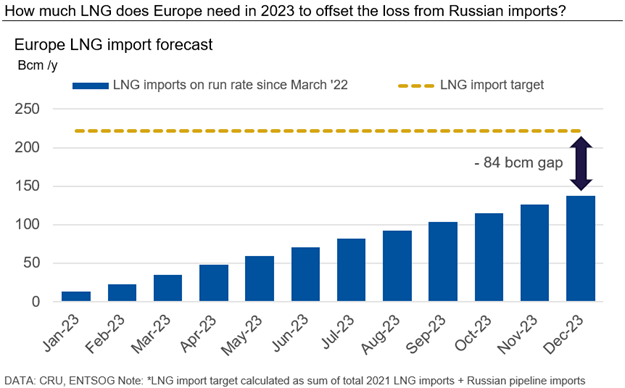

CRU Analysis suggests the greater risk for gas supply to Europe may be yet to come. The current high inventories have been built up with the aid of Russian gas which continued to flow through pipelines up until August. If Russian gas is completely unavailable in 2023, it will be extremely hard to rebuild inventories ahead of winter 2023. The run-rate of LNG imports would have to increase dramatically from current rates. This will be challenging. Currently, Europe does not have enough LNG import (regasification) infrastructure in places that are well connected to the pipeline system. While huge investment in this infrastructure is being planned, only a limited amount of extra capacity will be available in 2023. For this reason, we expect a premium of TTF over JKM to persist through 2023, and prices to stay high in absolute terms.

Furthermore, the global LNG market is likely to remain tight for the next five years. Europe is competing with East Asia for LNG cargoes, and it will take some time for additional export capacity (in Qatar, the US and other places) to come online. For this reason, we expect gas prices in both Europe and Asia to remain high in the medium term.

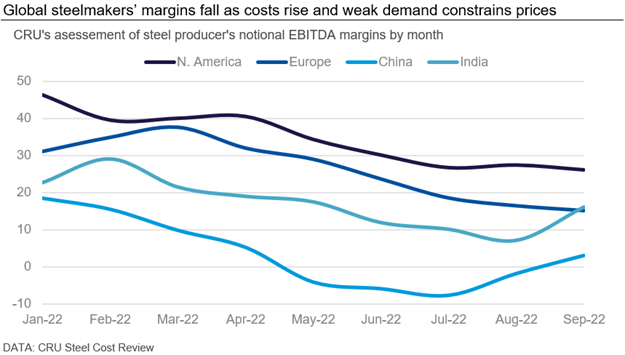

Margins fall with weakening demand

Margins remained wide for many miners as well as metal and fertiliser producers at the start of 2022 – as tight supply and the release of pent-up, post-Covid-19 demand supported high prices. These wide margins have, however, shrunk as 2022 progressed, with the risk of negative margins for marginal producers rising in certain markets.

Soaring energy costs – the result of Russia’s invasion of Ukraine – and falling prices have squeezed margins for producers. Energy intensive metals, such as aluminium, zinc and EAF steel, as well as nitrogen-based fertilisers have been particularly affected, especially in Europe and the JKT region.

Producers faced a similar cost issue in 2021 as the price of raw materials rose due to supply constraints. In 2022, however, cost inflation is met with weak demand, leading to price and margins declining. The result has been curtailments to production of energy-intensive metals and gas-intensive fertilisers, particularly in Europe.

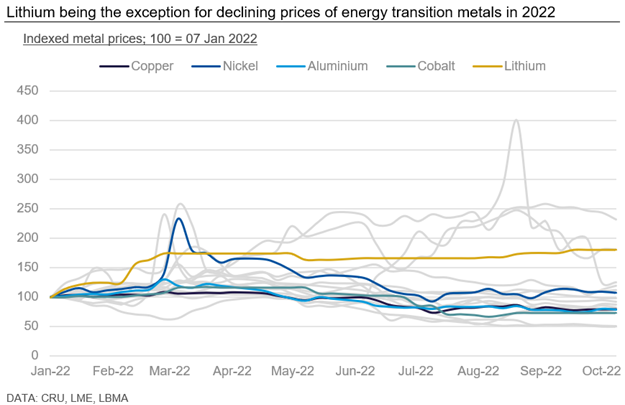

Green energy transition trumped by short term issues

The spike in thermal coal and gas prices shows that western nations do not yet have the capacity to ensure energy security through renewable energy sources. Increased focus on gas and thermal coal supply for short term energy requirements and bleak economic outlooks have diverted attention away from the metal intensive ‘green energy transition’. This has removed price support for green transition metals which, excluding lithium, have seen prices decline in 2022.

Recent high commodity prices and wide margins mean most miners are entering the coming economic downturn with budget headroom. The demand shock of green energy demand will return when countries shift focus back to electrification and renewables as short-term energy security concerns wane. It is important, therefore, that miners continue to invest in new assets as well as expansion and modernisation of current assets.

Prices to slide in 2023 on short term market concerns

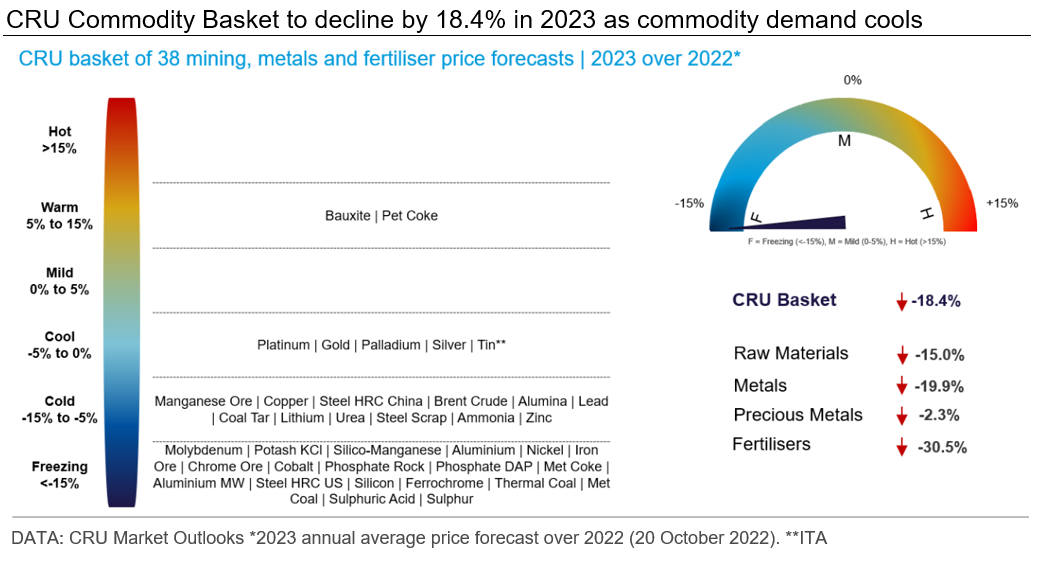

Looking ahead to 2023, we expect the CRU Commodity Basket to decline -18.4% compared to 2022. Raw materials prices will decrease as demand weakens globally due to the negative near-term global economic outlooks and steel production contracts in China. Metals prices will also be pressured in 2023.

The gloomy outlook for prices in 2023 is indicative of the severe concern in markets over short-term economic downturn. In the medium-term, demand from the ‘green energy transition’ will provide support for metals and raw material prices.

Explore this topic with CRU

Alex Christopher

Senior Analyst - Aluminium View profile