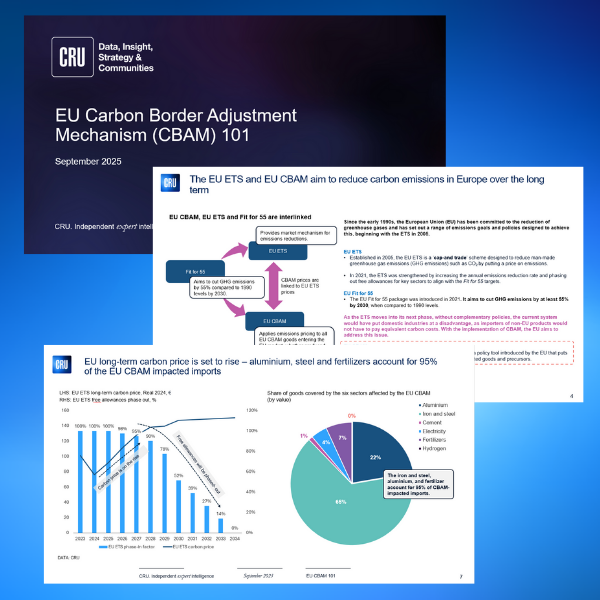

Since the early 1990s, the European Union (EU) has been committed to the reduction of greenhouse gases and has set out a range of emissions goals and policies designed to achieve this, beginning with the Emissions Trading Scheme (ETS) in 2005. The Carbon Border Adjustment Mechanism (CBAM) is a policy tool introduced by the EU that puts a price on the carbon emissions embedded in certain imported goods and precursors.

Why is CBAM such a hot topic?

The high level of interest in CBAM is due to the following factors:

- Businesses need to comply with rules coming into force in January 2026 as CBAM enters the definitive phase

- CBAM will significantly impact prices and market dynamics

- Businesses will need to optimise production and supply chains in light of changes

- In many cases, doing so will not be straightforward

- Businesses need to stay on top of further changes, such as a move to cover downstream products

Standing by for CBAM: Ask the Experts Webinar

Join our expert panel for a concise Q&A on the latest CBAM developments for Aluminium and Steel. We’ll clarify confirmed versus uncertain points after recent European Commission activity, outline actions for importers before year end and from 1 January, and explain submissions, certificate purchases, data needs and common pitfalls.

Explore the videos below to learn more

For those looking for the carbon border adjustment mechanism explained, the videos above provide concise overviews of scope, payment points, regional coverage and treatment of specific materials.

| Downstream inclusion in CBAM | Where is CBAM paid? | UK CBAM |

| EEA states Norway inclusion | Will CBAM happen? | Scrap in CBAM |

CRU expertise can help you to navigate these changes

CRU’s vision is to develop data-led services that are integral to helping companies navigate the energy transition.

- CRU’s CBAM Special Report - consolidates a range of CRU insights from across the business in a single source. This analysis has been developed by our world-class team of experts across the steel, aluminium and fertilizer supply chains to help you understand the potential impacts CBAM will have on your business and the wider industry. The CBAM 101 overview provides an outline of what to expect from this Special Report.

- Stay Ahead of Policy Shifts - Global carbon pricing is accelerating. The carbon border adjustment mechanism UK will reshape cross-border trade and compliance frameworks. Our experts are tracking every move – subscribe to CRU’s Energy Transition and Decarbonisation Service for comprehensive data and insights for a greener future.

- Backed by data, market insight and experience, CRU experts can advise you on what CBAM developments mean for pricing and market dynamics, so that you can reduce risk and optimise supply chains and plant operations