Global demand for refined cobalt will exceed the 100 kt mark for the first time next year and could exceed 150 kt by 2025. The rapid growth in demand is attributed to the increasing popularity of Li-ion batteries in electric vehicles and a range of modern electronic devices (mobile phones, tablets, portable PCs, power tools).

CRU forecasts cobalt demand for these applications to grow by 8% per annum for the next five years. If mining and refining capacity growth fails to keep pace we could see a considerable deficit opening in the market before the end of the decade.

How will demand evolve?

CRU estimates that global consumption for refined cobalt is set to reach 100 kt in 2017. Whilst demand growth for most metals has stalled in recent years, cobalt demand continues to grow strongly - spurred on by the increasing popularity of Li-ion batteries. CRU estimates that demand for cobalt will grow at an average rate of approximately 5% per annum for the next ten years.

The cobalt market can be split into two major segments:

Cobalt for metallurgical uses - Key sectors include superalloys (aircraft rotating parts, thermal sprays, prosthetics etc.), high-speed (HS) steel, carbide and diamond tools and magnets.

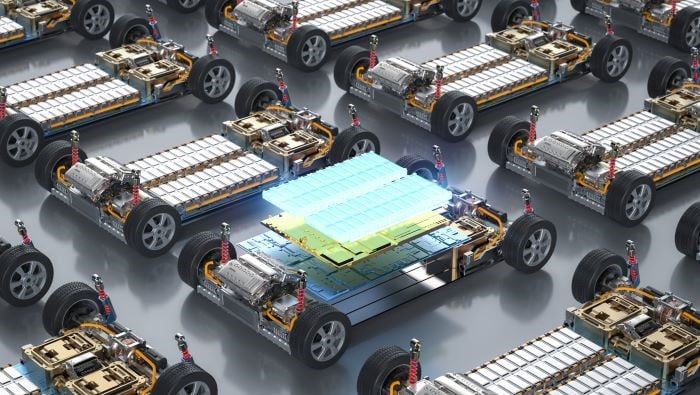

Cobalt for non-metallurgical uses - Key sectors include Li-ion batteries for electric vehicles (EVs), Li-ion batteries for other applications (laptops, PCs, smartphones etc.), polyester and tyres.

Last year, around 37% of cobalt was consumed in metallurgical applications, with the remainder consumed in non-metallurgical end-uses. This is in stark contrast to ten years ago when the split was 50:50. Whilst CRU expects demand for cobalt metal to grow robustly, the increasing popularity of Li-ion batteries, particularly in the EV sector, will continue to shift global demand towards non-metallurgical applications.

Cobalt-bearing NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminium) batteries are rapidly becoming the technology of choice for the EV sector. By 2025, we forecast that 80,000 tonnes of cobalt will be consumed in Li-ion batteries alone, driving overall demand to over 150,000 tonnes. This figure includes 30,000 tonnes for EVs, based on the assumption that NMC and NCA batteries will remain the most suitable types.

As it typically takes 7-10 years to adopt new battery technologies, we do not anticipate a fundamental shift in battery technology in the forecast period.

What are the bottlenecks?

Cobalt is predominantly mined and refined as a by-product of copper and nickel operations, meaning that future supply hinges on developments in these markets. As cobalt demand is forecast to grow at a greater rate than copper and nickel demand, an excess amount of primary metals will need to be mined and refined in order to meet the world's growing cobalt needs.

CRU assesses the asymmetrical demand for cobalt in the metallurgical and non-metallurgical sectors. Based on current reported capacities we believe that both sectors could fall into a small deficit this year and will remain tight for the next five years. The increasing competition for raw materials from metal and chemical refineries will make the complex market increasingly prone to supply bottlenecks.

Improving nickel and cobalt prices in the mid-term will help support increased production at major integrated metal refineries. Meanwhile falling copper prices could result in a decrease in by-product cobalt supply from African copper operations. CRU estimates that just over 60% of the world's mined cobalt will come from the DRC and approximately 80% of the world's refined chemicals will be produced in China this year.

CRU estimates that Chinese refineries currently receive over 80% of their usable cobalt from copper operations in the DRC. If there are delays to the reopening of Katanga, the ramp-up of Sicomines and the commencement of ERG's Roan Tailings Reclamation (RTR) project - all in the DRC - or if there are shortfalls in material induced by energy or political disruption or falling copper investment, we could see a significant shortfall in the availability of concentrates and hydrometallurgical intermediates to Chinese refineries. This could stunt the growth of refined chemical production capacity, resulting in the opening of a theoretical deficit of up to 10,000 tonnes by 2020.

What does this mean for prices?

The cobalt metal price fell to a monthly low price of around $10/lb in December 2015 but has since gained ground. In August metal prices rallied particularly well - with weekly average US 99.8% min prices increasing from $11.6/lb to $12.7/lb. We expect prices to perform well in H2 and onwards into 2017 as the market becomes increasingly tight and traders look to secure material ahead of expected price gains.

We believe that as demand increases beyond our capacity estimates, new capacity will be created in response to "demand pull" - which should prevent prices from exceeding the $20/lb mark in the next five years. Increasing prices should help maintain growth in China's chemical refining capacity and could entice additional cobalt-rich mines in Africa, North America and China to enter the market.

With the forecast tightness, there are numerous upside risks to our price forecast. As well as the potential supply bottlenecks, CRU has modelled EV sector growth conservatively: If production proceeds as leading manufacturers such as Tesla suggest or if cobalt-bearing batteries become the technology of choice in Chinese EVs and grid storage systems we could see an even larger deficit opening in the mid-term.