Costs Services

With more than 50 year’s experience of analysing commodities markets, CRU is a trusted source independent data and insight.

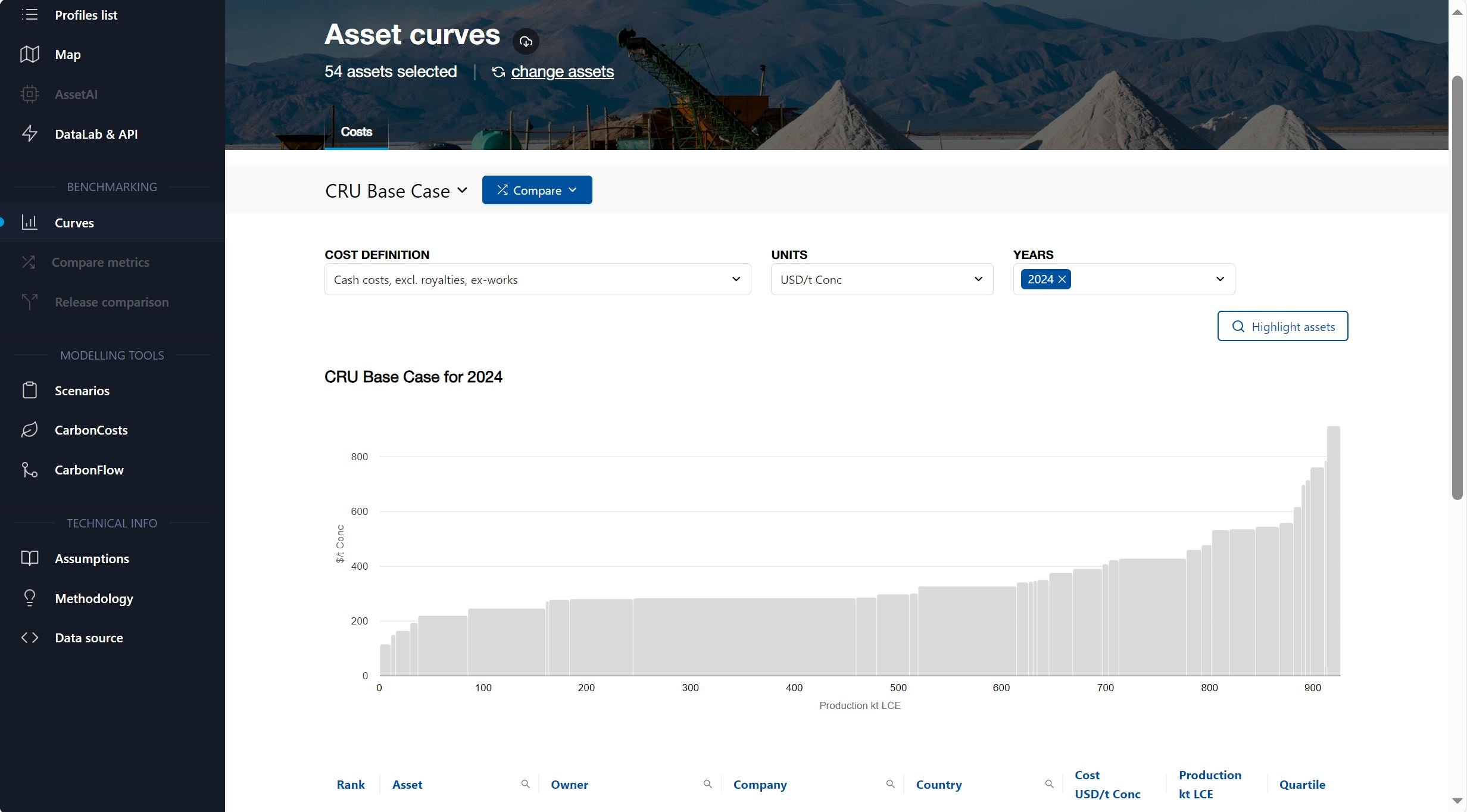

Market participants across mining and metals industries use CRU’s costs, cashflow and valuations data to understand the cost profile of assets, producers, regions and the wider sector.

Build a competitive market position by getting an accurate view of costs performance for individual assets and projects, including existing and prospective sites. Compare assets, producers and regions, benchmark costs and understand key cost drivers. Analyse cost drivers by operation and production volume, and compare cost curves by commodity.

Cost data is available with CRU’s Asset Services.

Stay ahead of the curve with CRU Asset Services

The web-based Asset Platform is the gateway to CRU’s Asset Services, offering seamless access to comprehensive, cost, cashflow, valuations and emissions data.

-

Access detailed bottom-up volume, cost, and technical data from our models in an easy-to-use, structured format for thorough understanding and benchmarking.

-

Modern UI design enables you to drill down quickly and easily into cost or emissions values, to understand underlying drivers such as inputs, material flows, and processes.

Analysis to drive informed decision-making

- Instantly benchmark key parameters against industry standards with dynamic tables and curves, to get to insights, fast.

- Compare cost curves against previous data with the release comparisons tool, to quickly track changes.

Advanced tools to build custom views and scenarios

- Create and upload scenarios to analyse potential impact on site cost positions.

- Integrate data seamlessly into in-house applications for enhanced accessibility, unlocking the full potential of data.

Sign up to receive CRU’s Newsletter

Sign upRelated commodities

Aluminium

Over 20 experts to help you understand the aluminium value chain inside out

Learn More

Base Metals

Market analysis, price assessments and forecasts, and costs and emissions analysis tools, providing data and insights through subscription services.

Learn More

Battery Materials

Our data, analysis, and expertise covers every step of the battery supply chain, driven by our unrivalled understanding of battery and raw material markets.

Learn More

Energy Commodities

CRU helps organisations understand the energy transition in the power sector, delivering insights and a wealth of data on power generation and capacity, using traditional thermal coal to cutting-edge solar PVs

Learn More

Ferroalloys

Comprehensive market analysis and forecasts, price assessments and cost services across ferroalloys worldwide.

Learn More

Fertilizers

Robust insight into the fertilizer, nitrogen, phosphate, potash and sulphur value chains

Learn More

Precious Metals

We provide market analysis for gold, silver, platinum and palladium, as well as price forecasts and cost analysis tools, giving you access to data and insights through subscription services.

Learn More

Silicon

Our data and expertise cover every step of the silicon and solar value chain, driven by our unrivalled understanding supply, demand, costs and technology

Learn More

Stainless Steel

Based in London, Beijing and Mumbai, CRU’s Stainless Steel team brings you global market analysis, forecasts and price assessments along the supply chain.

Learn More

Steel

Our steel market data and intelligence help you unlock competitive advantage.

Learn More

Wire & Cable

Best-in-class coverage of wire and cable consumption, production, trade and price forecasts, providing data and insights through subscription services.

Learn More