Nickel

Unlock transparent data and objective analysis for the nickel supply chain

As demand for critical metals accelerates, CRU is here to shed light on complex factors shaping the nickel supply chain. From electric vehicles to infrastructure upgrades, we deliver unparalleled insight across the base and battery metals markets.

Whether you need reliable data to plan procurement and transactions or in-depth analysis of costs, supply and demand, our independent market outlooks, price assessments and forecasts have got you covered. We help you stay ahead of the curve with detailed coverage of regulatory changes, geopolitical factors and industry trends, equipping you to adapt quickly and manage risks.

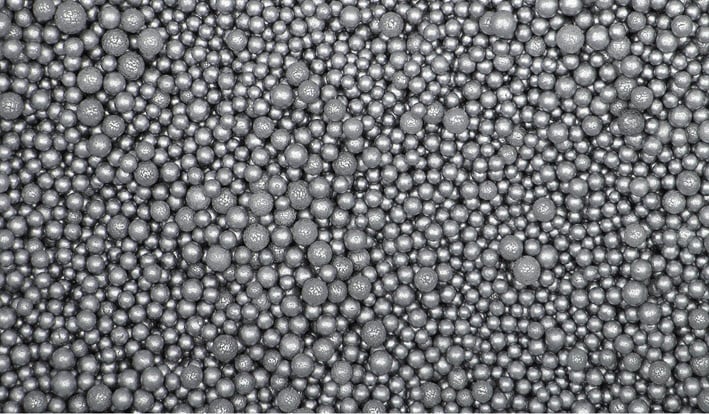

Upstream

We offer in-depth analysis of upstream mining operations and nickel ore processing, giving clients a solid foundation to better understand the overall nickel supply chain. Our market outlooks and forecasts paint a detailed picture of nickel supply, demand and price fluctuations throughout the industry. What’s more, we provide granular coverage of sulphur market developments and their impacts on costs for HPAL operations.

Midstream

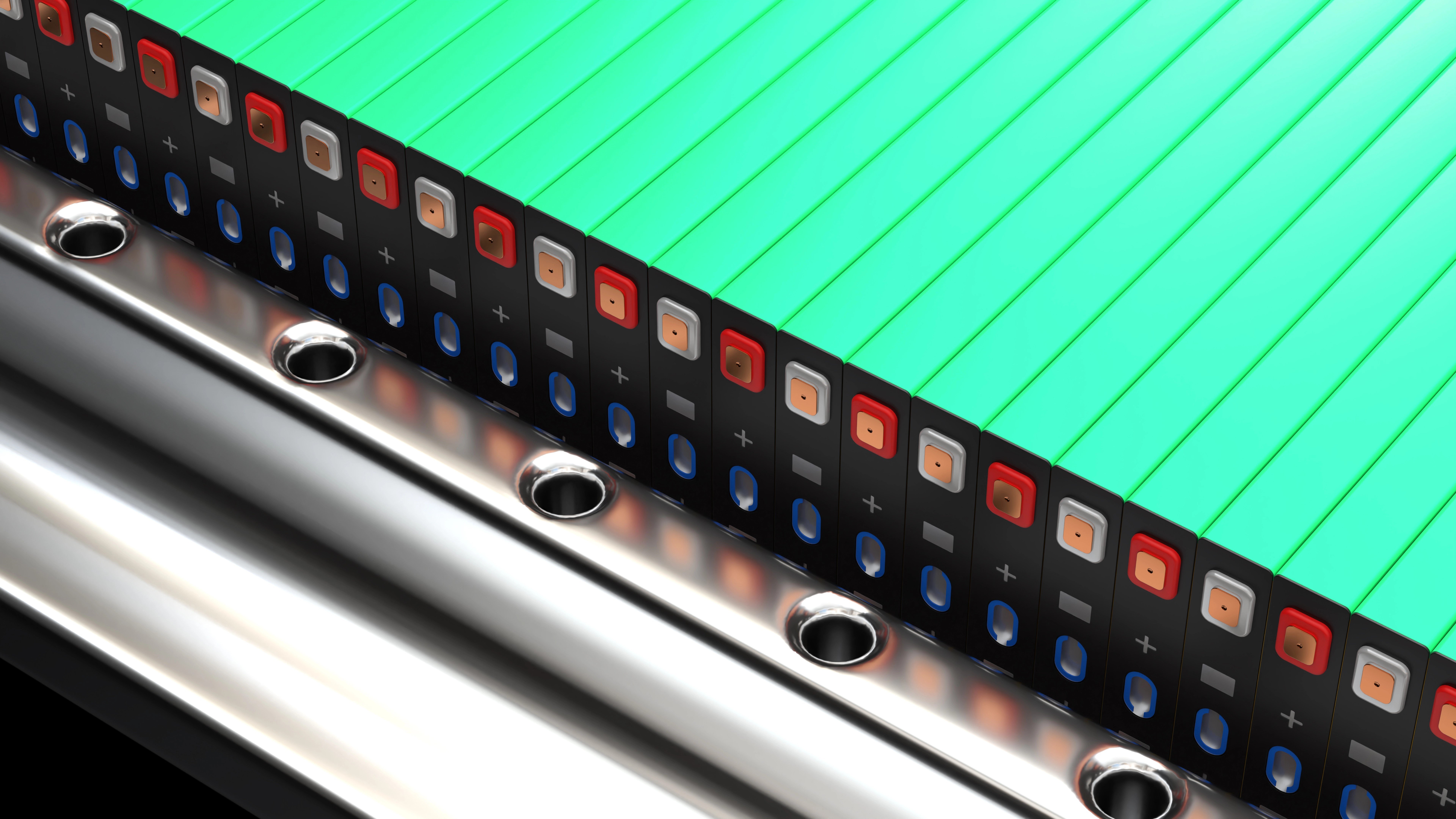

Our nickel services dive into midstream processes like smelting and refining, while also covering supply, demand, prices and forecasts for nickel sulphate and nickel matte. We deliver comprehensive analysis of cathode manufacturing, as well as capacity fluctuations that influence production and demand – ensuring you have a clear picture of each step in the supply chain.

Downstream

Through our stainless steel, automotive and battery materials services, you can access comprehensive insight on downstream products impacting nickel markets. We offer in-depth analysis of nickel as an alloy and its use in various batteries, ensuring you understand all the factors influencing costs, supply and demand.

Track nickel prices with robust, independent data

CRU provides accurate, up-to-date price benchmarks for nickel and other base metals, enabling confident negotiations and contract settlements. We track 9 series so you can effectively manage costs, procurement and planning.

Get ahead of the curve with comprehensive nickel asset data

Our Nickel Asset Service provides comprehensive cost and emissions data to benchmark and compare site performance. From emissions tracking to cost insight and benchmarking, we empower you to meet ESG standards, evaluate project potential, make the right investments and optimise operations for sustainable growth.

Beyond this, we offer coverage of more than 900 global base metal assets for copper, lithium, lead, zinc and gold. With our centralised Asset Platform’s advanced analytics tools, you can swiftly extract the insights you need for effective decision-making.

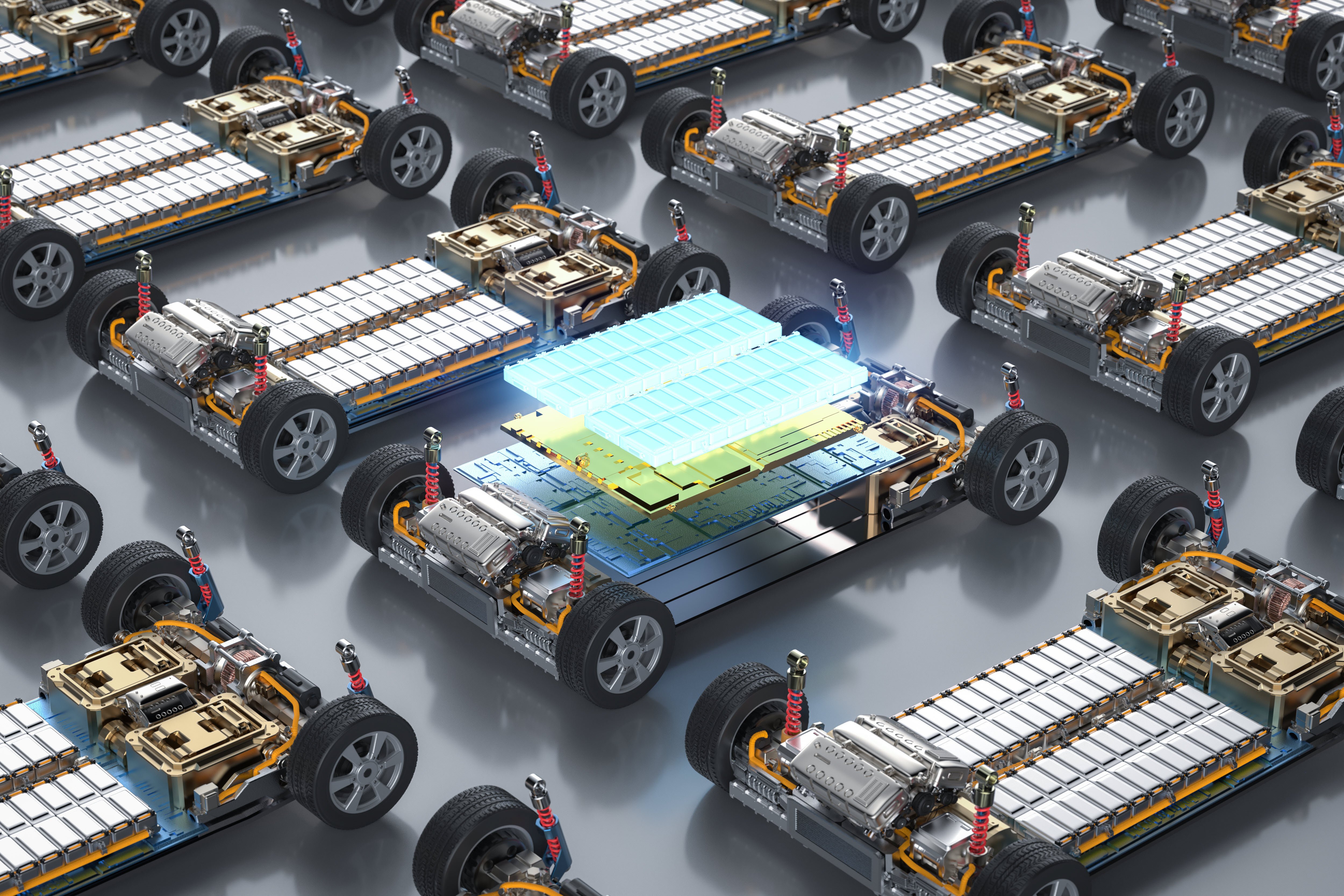

Automotive

Industries

Discover solutions that empower your industry to meet raw material demand, innovate sustainably, and lead the transition to a cleaner, greener future

Learn MoreSign up to receive CRU’s Newsletter

Sign UpRelated Solutions

Request a DemoSolar Technology and Cost Service

Learn More

Power Transition Service

Learn More

Sustainability and Emissions Service

Learn More

Power, Energy, Renewables and Utilities

Learn More