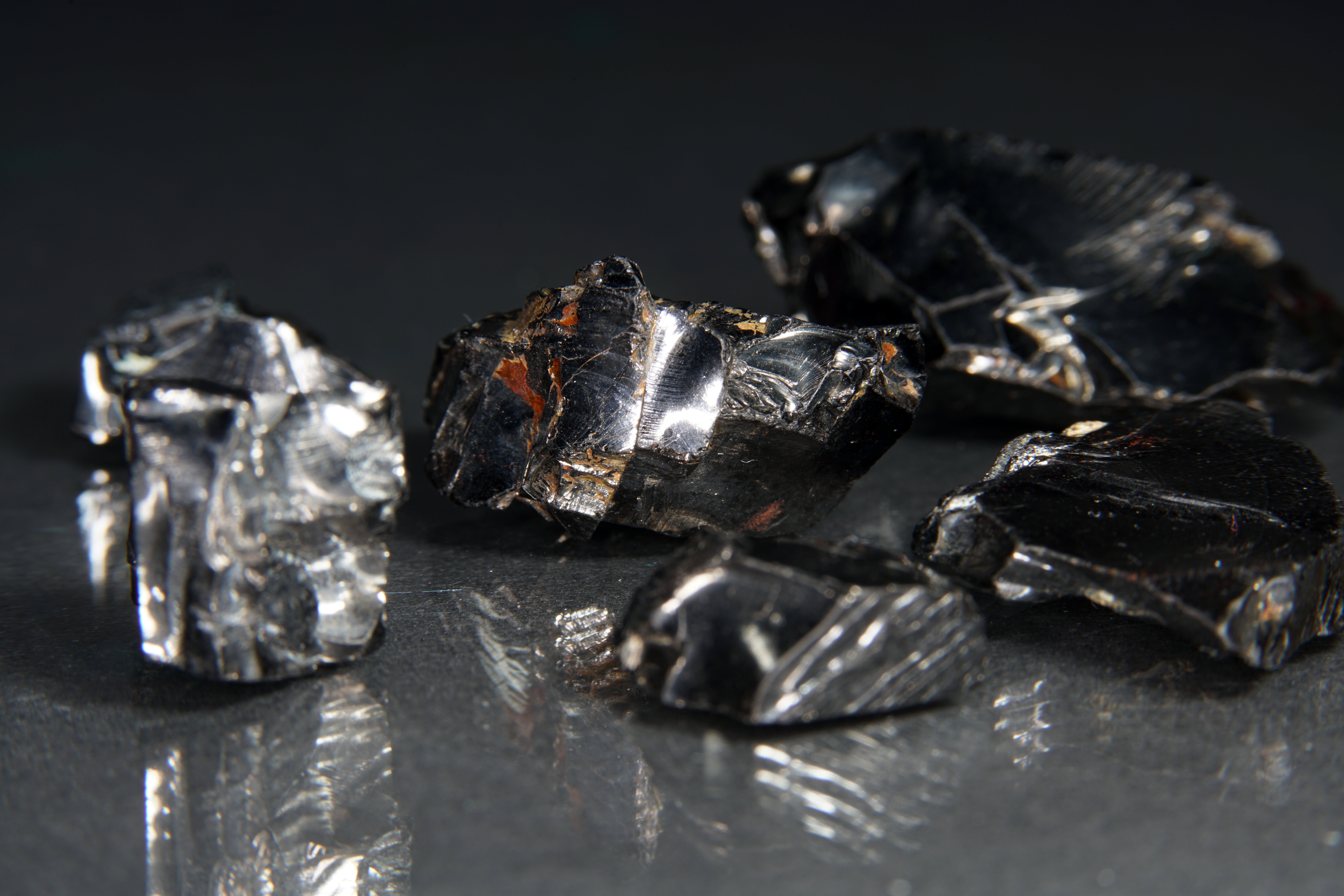

On 15 January 2021, China’s Ministry of Industry and Information Technology (MIIT) released a draft regulation document outlining its proposals for the regulation of the country’s rare earth elements (REE) industry.

MIIT expressed its openness to comments and revisions up to 15 February, a window that has now passed. Given China’s dominant position in all steps of the value chain – mining, refinement, separation and subsequent manufacturing – international eyes are watching closely. Among others, the electric vehicle and wind power industries, as well as various military engineering groups, stand heavily exposed to changes in the global supply chain.

China is tightening supervision of the REE industry and again signalling the national importance of these elements

The draft document on the new management and control of the rare earths industry provides an idea as to the direction of Chinese policy here. Although not yet definitive, the draft legislation is comprehensive in scope, and unlikely to see significant changes upon review. The aims of this regulation are stated to be:

- To regulate the management of the rare earths industry,

- To ensure equitable, rational development and utilisation of rare earth resources,

- To ‘promote sustainable development’ in the rare earths industry, and

- To improve environmental protections, safety, technological innovation and talent development.

This regulation spans from mining, through smelting and refining to separation; and crucially it extends regulatory reach even beyond this to all REE product circulation within the PRC. This means that the entire value chain, including end use consumption, are within scope. In order to achieve this, the state council will establish a Rare Earth Management Coordination Mechanism (RCM) , which will conduct research and recommend policy action for the industry. Based on the recommendations of the RCM, MIIT will formulate development plans in order to promote and guide the development of the rare earths industry. This guidance includes aims to standardise the rare earths industry, which could have negative implications for illegal production.

Articles 6, 7 and 8 pertain to the approvals of permits and governmental management of REE mining. In broad terms, this legislation will increase scrutiny on production quota allocation, improve governmental information gathering on the industry at large, and give the state more legislative teeth. Quotas will henceforth be allocated on the following basis:

- National or regional economic development policies,

- The needs of the rare earths industry,

- Existing production capacity and the condition of those operations – with respect to raw material conversion efficiency and “intelligent production”, the asset’s safety record, environmental damage / protection, and the like, and

- The prior year’s production quota.

It is notable that environmental concerns have made the list (and these are expounded in more detail in Article 13). However, it remains to be seen whether this represents a substantial change of direction, or simply provides pretext for the reduction and/or closure of supply capacity.

We note that while mine operations have to limit their output in accordance with national quotas, smelting and separation facilities may use imported rare earth concentrates (which are typically from Myanmar, but more recently include Mountain Pass in the USA) for smelting and separation in addition to the total quota. This would give the midstream processors (and holders of some of the world’s most useful intellectual property) scope to expand their operations to shut out emerging international competition; meaning that even if a number of international rare earth mining assets come online to diversify the source of material, the trade flows would still primarily pass through China.

The legislation seeks an improved information flow from industry to the state, but does not set out whether or how much of this will be shared to the public. We know that the enterprises will be legally bound to publish a list of their operating mines, smelters and separation facilities each year. Article 7 further states that the project approval authority must submit lists of approved REE mining, smelting and separation investment projects to the MIIT, which will review these before announcing them to the public. Article 17 establishes that the government has the power to conduct random inspections at any of these sites; and Article 19 includes mining, smelting and separation firms into the nationwide social credit system.

Elimination of illegal sources of supply and generation of stockpiles are both highly bullish signals for REEs

A strong crackdown on illegal production – a category that might contribute as much as 10-15 kt per annum to global supplies – is also under way. MIIT reiterates here that all REE mining must be carried out in accordance with the law, and that no new mining facilities may be built without the appropriate approvals.

- Article 8 has a clause that allows the state to restrict mining, smelting, and/or separation to protect natural resources or the surrounding environment.

- Article 18, meanwhile, states local authorities will now have more authority to act if they discover illegal activity, giving them the power to detain products and equipment, or to close down illegal markets.

One area in which the Chinese government has sought to deepen its understanding and to exert more control is the recycling of REEs, which may perhaps have been a vehicle for illegal production in the past. Article 12 states that ‘comprehensive utilisation enterprises’ (read: circular economy) may not use any rare earth feedstocks other than secondary scrap as the raw materials for their smelting and separation activity.

Moreover, the state council will establish a rare earth product traceability system, requiring all Chinese enterprises in this space (and perhaps tangential ones) to upload production and sales data, as well as their packaging and invoice information, onto a tracking system. The packaging of rare earth products will have to comply with national standards and will indicate its company of origin, making governmental supervision simpler and more effective.

As a final note, Article 16 sets out that the state will establish a strategic reserve of rare earth resources and products. A reserve mechanism will be implemented, combining national and corporate reserves; purchased and stored REE-bearing products will be included in the national quota for smelting and separation, and will not be used without state approval. Meanwhile all reserves will be deemed national strategic reserves and will not be exploited without express approval of the natural resources department of the state council. Any sort of stockpiling is of course good for prices; a national-scale stockpile may well be one of the factors that has sent REE prices soaring since November 2020, alongside international trepidation at the announcement of stronger Chinese export controls. In particular, Neodymium – the key permanent magnet metal underpinning electric vehicle drivetrains – is trading at double the prices seen even in October 2020.

The consequences of this regulation may vary dependent on what changes are incorporated from the review, before it is enacted. But assuming it remains largely intact, we can expect China’s rare earth industry to experience much more top-down control, and to be more closely aligned with broader national policy objectives. The possibility of a second ‘Rare Earths Crisis’, akin to the situation in 2010-11, looms larger than at any time in the past decade. Rare earths remain important strategic elements, as well as being crucial to the transition to a greener global economy – so the impacts of how these new legislations are enforced will be felt broadly across the global supply chain.

Talk to CRU – our experts are waiting to hear from you

When it comes to rare earths, CRU is one of the world’s leading research and consultancy firms in the market. We have dedicated a wealth of resources to analysing and tracking these markets in recent years, including the development of long-term automotive and renewable demand modelling, supply cost modelling and price forecasting across a range of rare earth elements. We have worked closely with a wide range of industry participants that includes established miners, aspiring projects, investors and regulators in order to improve market understanding of these elements and in turn refine our own knowledge and modelling capabilities. In addition to this, our dedicated teams of analysts and consultants in Shanghai and Beijing give us strong insight into the rare earths market which is unavailable elsewhere. If you would like to discuss any of the issues raised within this Insight with a CRU Analyst, contact us via the button below.