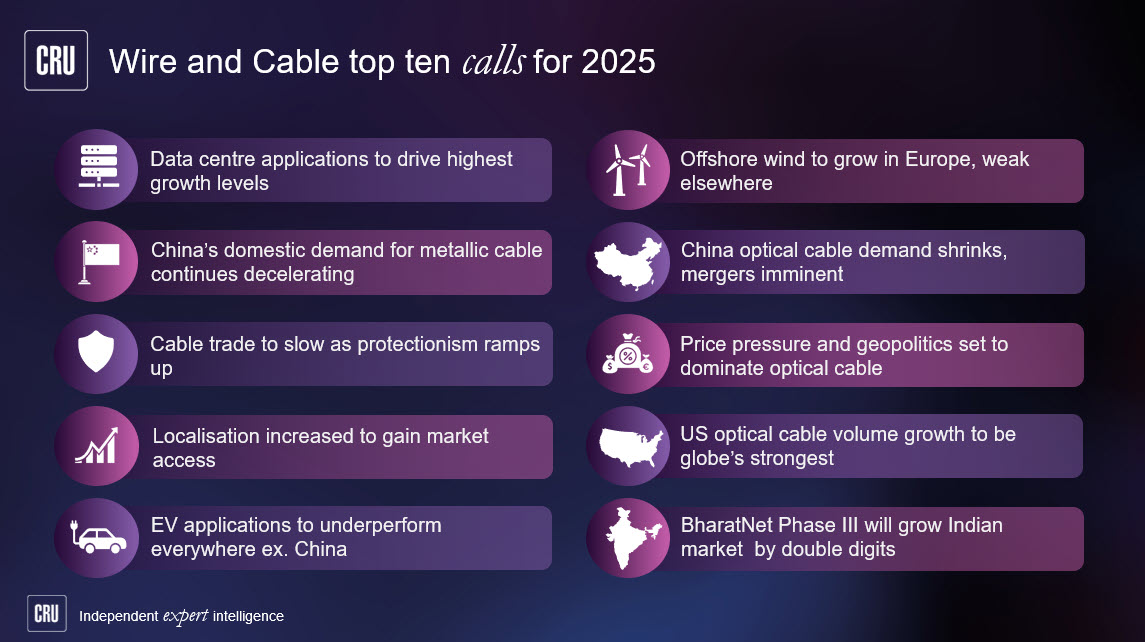

In this Insight we look at who runs the new German government, what this might mean for cable and what the new government’s plans are in regard to the end markets that consume wire and cable

Who is at the helm of the new German government?

On 8 December 2021, Germany’s new centre-left coalition government, led by new chancellor, Olaf Scholz, a Social Democrat (SPD), replaced Angela Merkel, a Conservative Christian Democrat (CDU), who had been in power for 16 years.

The Cabinet posts of interest to the wire and cable industry are:

The new government is a coalition of three parties — the Social Democrats (SPD), the Greens, and the Free Democrats (FDP). As a result, the 17-strong Cabinet running Europe's biggest economy consists of nine men and eight women, seven of which are from the Social Democrats (SPD), five from the Greens and four Free Democrats (FDP).

While the various ministries from what is also known as the traffic light coalition (red (SPD), yellow (FDP) and Greens (Green)), are in the hands of coalition partners who sit on opposite ends of the political spectrum, nothing too dramatic is expected as German politics are based on consensus building and stability. Some political observers believe that this is the government that might see the most modernisation with an emphasis on digitalisation, accelerating climate commitments and investing in affordable housing.

Who got which ministries?

The SPD gets the chancellery, along with important ministries like Interior, Housing and Labour, Economic Cooperation and Development.

The Greens scored the Foreign Ministry, with a more human rights-centric foreign policy, which could affect relations with China and Russia, but most importantly for wire and cable, is that co-leader Robert Habeck will lead a new Economy And Climate Ministry, which will give the Greens the chance to work with Germany’s all-important industrial sector as it transitions to more climate-friendly policies.

The pro-business Free Democrats won the very coveted Finance Ministry, which will give them power of the purse strings, potentially keeping any too-ambitious spending plans in check. Importantly for wire and cable, the FDP also have the Ministry of Transport and Digital Infrastructure.

What does it mean for wire and cable?

With the above factors in mind, CRU Wire & Cable News has taken a look at what the coalition’s proposed plans might mean for cable. As far as we can see, what has been proposed is fairly positive for wire and cable demand, both for energy and communication cables. Compared to the previous government, the Coalition Agreement aims for the following by 2030: a 68-83% increase in wind and solar capacities, 7% increase in EV passenger cars, 1 million EV charging points, increased rail buildouts, fuller and faster national FTTH coverage, and an increase in affordable housing new-builds, amongst others.

How the new government plans to implement these measures, in which time frames and how they will be financed is not yet apparent and will be hammered out by the coalition partners over the next few months.

What is clear is that digitalisation of the government and German society, an enhanced focus on science and technology as well as speeding up of approvals processes for infrastructure and important projects, as well as accelerating climate goals stood out as key features that permeated the new governments agenda.

“CRU remains bullish on Germany’s near-term and mid-term energy cable demand. With the new coalition government’s emphasis on the green energy transition, railway system expansion and construction investment, we forecast the country’s energy cable demand to grow at a healthy 2.9% CAGR between 2021 and 2026. Specifically, we expect power cable demand to grow as much as 6.6% y/y in 2022, thanks to the start of the German Corridors projects,” explained Chenfei Wang, Senior Analyst, Wire & Cable at CRU.

“The weakness in the automotive sector for the past two to three years has acted as a drag on Germany’s automotive wire and cable consumption. We anticipate demand for this cable type to improve notably in the coming years, with a gradual easing in the chip shortage situation and solid demand for EVs,” Wang added.

“CRU has made a number of upwards revisions to German optical cable demand over the last 18 months. During the peak of the Covid-19 pandemic it became clear fast and reliable broadband has become essential and as such, a number of carriers have increased capex and ramped up FTTH cable deployments. The new coalition’s goal to provide nationwide FTTH certainly is ambitious given Germany’s current coverage rate, which sits at approximately 11% (number of homes connected with FTTH vs. total available households),” commented Michael Finch, Head of Wire & Cable at CRU.

“However, with measures that allows faster approvals and greater subsidies, the ‘full-fibre’ target seems increasingly attainable, especially given recent developments at the likes of Deutsche Telekom, which are ramping up FTTH deployments by 67% in 2022. As shown in the chart below, CRU now expect German optical cable demand to surge over the coming years, growing in excess of 15% y/y on average over the 2022-2026 period,” concluded Finch.

The following is a summary of key proposals by cable end markets made by the coalition in its 177-page agreement titled “Dare More Progress – Alliance for Freedom, Justice, and Sustainability”:

FTTH, Mobile Communications

- Provide nationwide fibre-to-the-home (FTTH) coverage and the latest mobile communications standard.

- Speed up infrastructure expansion by streamlining digital application and approval procedures and standardizing alternative installation technologies.

- Strengthening consumer protection with regard to guaranteed bandwidths, if necessary, by means of lump-sum compensation claims.

- Push ahead with fibre-optic expansion subsidies even without a take-up threshold. In the case of full public financing, the operator model has priority. It is also focusing on the promotion of entire clusters and making market investigation procedures faster and more binding.

- Initiate voucher funding to complement FTTH and in-house fibre optic cabling where necessary.

- Bundle competencies and tasks for fixed and mobile networks. Align the allocation of frequencies with specifications for area coverage; negative auctions are also to be used.

- Accelerate measures for better mobile communications and WLAN reception on the railways.

Rail

- Rail has been given extra priority, with the new government wanting to invest considerably more in rail than the roads.

- Emphasis on getting projects from the Deutschlandtakt[1] completed. These include the expansion/new construction of the Hamm-Hannover-Berlin railway lines, the Middle Rhine corridor, Hanau-Würzburg/Fulda-Erfurt, Munich-Kiefersfelden-Grenze D/A, Karlsruhe-Basel, “Optimised Alpha E+”, the Eastern Corridor South, Nuremberg-Reichenbach/Grenze D-CZ, the Hamburg, Frankfurt, Cologne, Mannheim and Munich nodes.

- Continue to develop the Rail Transport Master Plan[2] and implement it more quickly, increase rail freight transport to 25% by 2030 and double passenger transport performance.

- Electrify 75% of the of the rail network and support innovative drive technologies by 2030. Prioritize the digitization of vehicles and routes.

- Maintain Deutsche Bahn as an integrated group, including the group’s internal labour market, under public ownership. Make internal structures more efficient and transparent. The infrastructure units (DB Netz, DB Station und Service) of Deutsche Bahn AG will be merged within the Group to form a new, public-interest infrastructure division.

Electric vehicles (EVs) and charging infrastructure

- A goal of at least 15 million fully electric passenger cars by 2030, up from a previous goal of 14 million.

- The coalition government also aims for 1 million charging points in Germany by 2030

- The three coalition parties did not agree on an end date for the combustion engine but on a reform of subsidies for electric cars.

- Only CO2-neutral vehicles to be registered in EU in 2035, but no fossil fuel car ban planned.

- The current government BEV subsidy of up to €9,000 ($10,200) will remain until at least 2025.

- To start on 1 January 2023, the parties want to reform the subsidy in such a way that from then on only vehicles “that have a demonstrable positive climate protection effect defined only by an electric driving share and a minimum electric range” will be subsidised. This is to be 80 kilometres from 1 August 2023. It is not clear whether the subsidy rates will also be adjusted in 2023.

Electricity and hydrogen grids

- Accelerate the planning and approval procedures for faster planning and implementation of electricity and hydrogen grids.

- Investment priority given to high-voltage direct-current transmission lines like SuedLink, SuedOstLink and Ultranet, which are central to the energy turnaround. Further projects will be added, the government said.

- Present a “Roadmap System Stability” by mid-2023 and regularly review security of supply and the rapid expansion of renewables. Modernize and digitalize the distribution grids, including through forward-looking planning and greater controllability.

- Significantly accelerate the rollout of smart metering systems as a prerequisite for smart grids while ensuring data protection and IT security.

- Legally define storage as an independent pillar of the energy system.

- The hydrogen strategy will be updated in 2022 to allow the government to achieve an electrolysis capacity of around 10 GW by 2030. The first priority is domestic production based on renewable energies, particularly through the expansion of offshore wind energy. This will require a dedicated build-up of the necessary infrastructure. To this end, the government will create the necessary framework conditions, including efficiently designed funding programs, and in particular also strengthen European cooperation in this area.

Renewables

- In H1 2022, the government will initiate all necessary measures in order to organize the accelerated expansion of renewable energies and the provision of land necessary for these expansion. The government will accelerate grid expansion and adjust annual tender volumes for renewables.

- The government is gearing its renewables target to a higher gross electricity demand of 680-750 TWh in 2030, compared to the previous estimated 658 TWh for 2030. Of this, 80% is to come from renewables, compared to the 65% agreed by the previous government.

- A mix of instruments to achieve the massive expansion will be implemented: In addition to the EEG, it will strengthen instruments for subsidy-free expansion, such as long-term power supply agreements (PPAs) and Europe-wide trading in guarantees of origin in the interests of climate protection.

- Photovoltaics (PV) will be expanded to around 200 GW by 2030. To achieve this, solar panels will be mandatory on every new commercial building. It will speed up grid connections and certification, adjusting remuneration rates, and reviewing the obligation to put large roof systems out to tender.

- Two percent of the state’s land area is to be designated for onshore wind energy. Targets for onshore wind have not been determined by the coalition agreement. The coalition agreement states that the idea is to get all levels of administration together, from a federal, state and local level, to find these areas and secure them with the help of the Federal Buildings Law (Baugesetzbuch).

- Increase offshore wind energy capacity to at least 30 GW in 2030, 40 GW in 2035 and 70 GW in 2045. The government said it will continue to drive forward European offshore cooperation and strengthen cross-border projects in the North Sea and Baltic Sea.

- Offshore wind will be connected in an “accelerated, intervention-minimizing and bundled manner”. The government said it will make the necessary technological decisions immediately, for example on the role of hybrid interconnectors, meshed offshore grids or multi-terminal connections, while also keeping an eye on onshore grid integration.

Climate and energy foreign politics

- The government will use the German G7 Presidency in 2022 to launch an initiative to establish climate partnerships and an international climate club open to all countries. its goals include climate neutrality, the massive expansion of renewable energies and their infrastructure, and the production of hydrogen. The new German government said it is “striving for a global emissions trading system that will lead to a uniform CO2 price in the medium term”.

Robotics, automation, technology

- Measurably strengthening and prioritizing investments in artificial intelligence (AI), quantum technologies, cyber security, distributed ledger technology (DLT), robotics and other future technologies. Strengthening strategic technology fields, e.g. through Important Projects of Common European Interest (IPCEIs) and driving forward the announced EU Chips Act.

Datacentres

- Align datacentres in Germany with environmental sustainability and climate protection, including by using waste heat. New data centres are to be operated in a climate-neutral manner from 2027. Public datacentres will introduce an environmental management system in accordance with EMAS (Eco Management and Audit Scheme) by 2025. For IT procurements of the Federal Government, certifications such as the Blue Angel[3] will become standard.

Construction

- Build 400,000 new homes per year, including 100,000 publicly subsidized homes. To this end, the new government will continue and financial support for social housing construction, including the promotion of social housing for owner-occupiers.

- Set up an “affordable housing alliance” with all important players. The government will launch a new non-profit housing association with tax incentives and investment subsidies.

- Reduce the costs of housing construction through serial construction, digitalization, bureaucratization and standardization. We want to accelerate modular and serial construction and refurbishment through type approvals.

Notes:

- The aim of the ‘Deutschland Takt 2030’ programme is to make the rail network and public transport easier to use, with connections between services timed to optimise journeys and thus encourage a switch to rail instead of driving or flying, in the process doubling total rail passenger numbers from seven to 14 million daily.

- On 30 June 2020, the so-called railway Masterplan for Germany was approved and presented by the Federal Ministry of Transport and Digital Infrastructure (BMVI). Further information on the plan can be found here.

- The Blue Angel is an environmental label in Germany that has been awarded to environmentally friendly products and services since 1978.