Metallic Wire & Cable: market booming amid backdrop of risks

We still expect global cable consumption in 2021 to remain a touch below its 2019 size, driven by growth in China and a full recovery in North America and North-East Asia.

(点击这里查看中文版本)

Europe is forecast to remain 1.6% below its 2019 size, while Indian demand has failed to rebound strongly despite some containment of Covid-19 cases.

A key driver of the cable market’s recovery is a boom in residential construction and automotive harness orders. While we expect momentum in the former to remain, albeit at a lower level, we continue to contribute a notable amount of automotive cable orders to stock building. Consequently, we expect a drop in harness orders from OEMs in 2021 H2. Moreover, sustained high commodity prices are expected to keep cable prices elevated.

Looking ahead, with a more bullish outlook on future real estate completions and renewable-related utility and infrastructure projects, China accounts for the majority of upgrades to mid-term global cable demand.

Optical Fibre: Outlook for demand robust, although prices still lag

The global optical fibre and fibre optic cable market has turned a corner and is now fully on the road to recovery following the Covid-19 pandemic.

Renewed and increasingly ambitious FTTH targets in key telecom nations has buoyed our mid-term outlook for demand outside of China. Such elevated targets and faster deployment speeds have been enabled by rising private and public investment, which continues to flow into the industry at an increasing pace. This is especially true for the US, where FTTH-related deployments have surged as funding from the RDOF program ($20.4 bn over two phases) kicks in and begins to meaningfully address rural connectivity issues. The US now accounts for the vast majority of global upgrades versus the May 2021 update as shown in Figure 1 below.

Elsewhere, CRU continues to temper its mid-term outlook for cable demand in China, while marginal upgrades across key telecom markets in Europe has seen over 2M F-km added to our outlook in 2025. Buoying our outlook for cable demand in Europe, the French government has allocated €570 million to roll out fibre to the country’s rural areas, with the aim of achieving full coverage by 2025. Deutsche Telekom is also entering into an agreement with financial investor KKR to accelerate fibre rollout by the creation of a JV called Open Dutch Fibre, through an initial investment volume of €700 million.

Meanwhile in China, CRU understands demand has stabilised at a healthy level currently, although increasing volumes are highly anticipated as part of the impending China Mobile tender. This has seen a number of delays, but current intelligence suggests this will be announced during the month of September.

Prices on a global level do, however, remain an issue. This is despite a rebalancing in China and marginal gains since the start of the year. Prices and profitability at producers in certain markets will remain supressed unless excess preform and draw capacity can be removed globally. The one exception currently is the US, where robust demand and protectionist trade measures mean both bare fibre and cable prices average around 30-50% higher compared to China and this is unlikely to change drastically in the mid-term.

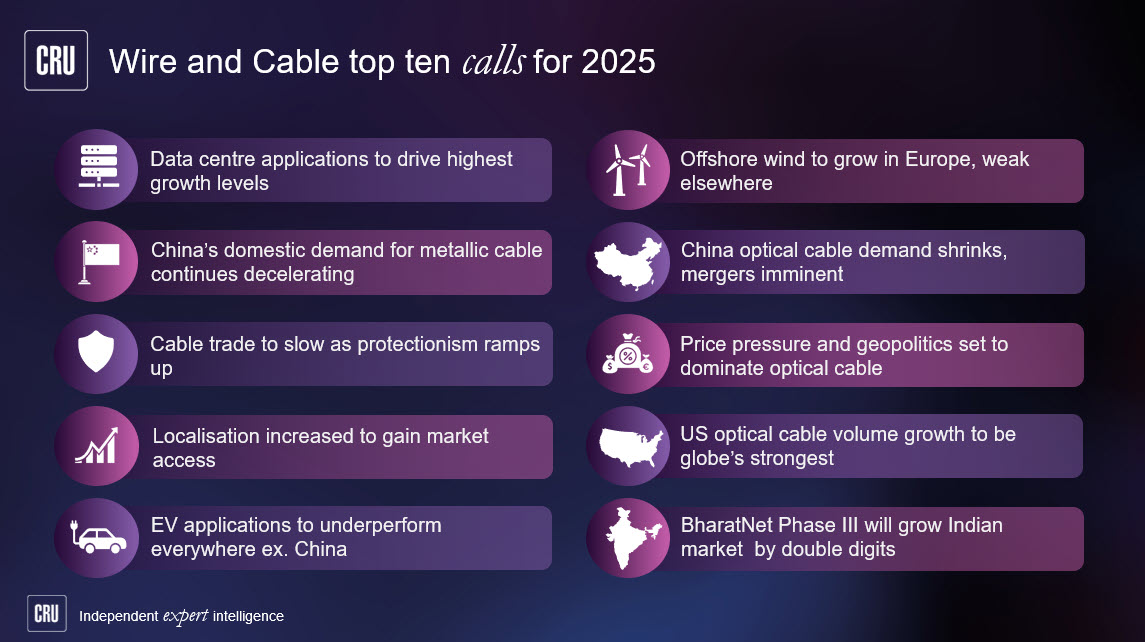

We cover the above and more detailed research in our Metallic Wire and Cable Market Outlook and Telecom Cables Market Outlook. Here we include demand, supply (plant by plant), trade and price forecasts for the next five years broken down by major regions and countries.