Silicon is viewed as one of the metals that facilitates a green development and better future for the modern society as it is used in photovoltaic solar cells, semiconductors, silicones, aluminium ingot, electrical steel etc. China is the world largest silicon metal production base, covering more than two-thirds of world production. Moreover, Chinese silicon metal exports meet around 40% the silicon metal demand in the rest of the world.

China is going to launch futures for silicon metal through the newly established Guangzhou Futures Exchange (GFEX) as part of the efforts to promote green and low-carbon economic transformation. We believe the introduction of derivatives will have profound impacts on the silicon metal industry. The traditional pricing mechanism will gradually shift to derivatives-led pricing. High volatility will be a new feature in the silicon metal price which is expected to enable quick and effective rebalancing of the physical market. In this Insight, we are going to discuss how the introduction of futures contracts will impact the silicon metal market.

Pricing mechanism will shift to the futures market

Guangzhou Futures Exchange (GFEX) has implemented feasibility studies for a variety of commodities. It finally chose silicon metal as the first batch trading commodity to kick off the financial service for green development-related materials and sectors. On 11 November 2022, GFEX published the “Draft for Comments” for a silicon metal futures contract, signalling an upcoming launch for silicon metal futures in China.

The document shows that the metallurgical grade Si5530 is designed as the standard deliverable grade, with a size requirement of 5–100mm. The substitute grade is Si4210 with a premium set at CNY2000 /t for the initial trading, although this will change according to supply and demand fundamentals. There are delivery warehouses in the production areas, i.e., in Xinjiang, Yunnan, and Sichuan, and in distribution centres like Tianjian port, and consuming areas – for example Jiangsu, Zhejiang, and Shanghai. The warehouses in consuming areas are chosen as standard delivery warehouses.

The introduction of silicon metal futures will potentially have a profound impact on the silicon metal market and on pricing, in particular. Since futures trading is transparent, integrating broad expectations of market participants and constantly adjusting, it is usually considered to be indicative for the changes on supply and demand if liquidity is enough. That said, futures price-based pricing has applied for many commodities traded on various derivatives markets. We believe silicon metal pricing will also gradually shift to futures-led pricing, with adjustments for quality and location made to physical trade.

High volatility featured in silicon metal price

Higher volatility and frequency on price movement

The futures market is open to a wide range of participants including producers, distributors, industrial end-users, investors and speculators. The diversity of the participants means that more factors could have an effect on futures prices, including but not limited to economic conditions, political events, industrial movements, weather, transportation, and company behaviours, which spans the entire silicon metal industry chain, from sourcing to production and distribution. Any factor that is believed to have impact on supply, demand and costs can be traded and priced in, possibly overly or insufficiently. The more factors, the more volatility. The continuous trading activities in months ahead of the settlement period allow the market participants to explore reasonable prices that reflect the supply and demand fundamentals.

The frequency of price movements will also increase. In the past, the silicon price in the Chinese physical market displayed slow prices movement, whereby it could stay unchanged for a month. Many silicon metal smelters also adjust the ex-work price on a monthly basis. However, the futures market will generate prices on daily basis, meaning that higher frequency price reference points will also be available for the physical market. The physical market will shift to higher frequency changes as well.

Seasonal imbalance could be enlarged by the futures market

Silicon metal supply and demand fundamentals in China have notable seasonal imbalances, with a deficit in winter (during November-February) and surplus in the rainy season (during May-October). Nearly half of Chinese silicon metal is produced in hydropower-rich locations. Smelters there try to maximise output when benefitting from cheap hydropower during the rainy season. Therefore, the availability of silicon metal is high, and the costs are low, tending to reduce prices during the rainy season.

During the winter months, which normally represents the dry season in south China, a higher power tariff is applied, and production from hydropower rich locations tends to decline by 50–80%. Silicon metal prices normally could move higher during the winter – since availability is lower but costs are higher. Having said that, silicon industrial end-users or distributors usually adjust stock cycle to buy more during the rainy season and less in winter, which diminishes the silicon metal price fluctuations. However, with the introduction of futures contracts, such natural imbalances between supply and demand could be traded aggressively, i.e. the price could overrun either too high or too low. Therefore, the price fluctuation could be enlarged as the more fluctuation there is, the more profit possibilities for speculators exist in the futures market. If the price is flat, both long and short positions cannot benefit from it.

Market imbalances vary for different grades of silicon metal

Following the seasonal movement of silicon metal production, the imbalance on a specific grade silicon can be bigger than the overall gap between silicon metal supply and demand. This is typically the case for chemical grade material. Chemical grade 4.2.1 silicon metal accounts for around one-third of Chinese silicon metal production. Around half of chemical grade in China is produced in hydropower rich provinces – principally Yunnan and Sichuan – meaning that around 80% of the annualised production occurs during the rainy season, that is, the chemical grade sees oversupply in the rainy season more than the metallurgical grade in the same season. In 2022, this phenomenon is obvious as demand for chemical grade has underperformed while production during the rainy season achieved new highs given the decent margin received by smelters.

Having said that, the premium and penalty for different grades shall shift as a response to the changing fundamental for different grades. On the other hand, the premium and penalty are also effective signals for smelters to adjust production mix or production pace to fit market dynamics.

Invisible inventory weighs on the silicon metal price

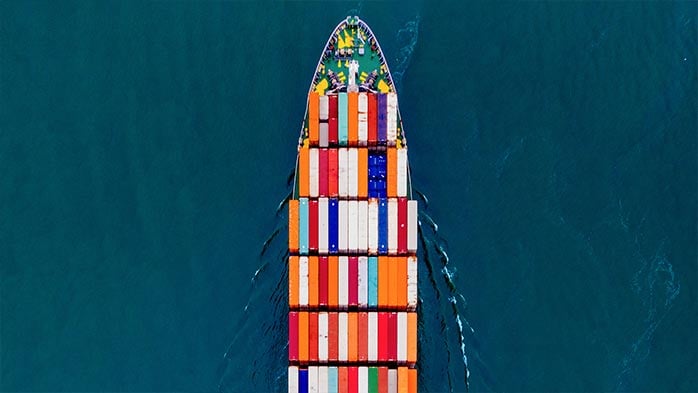

Chinese silicon metal exports meet around 40% of overseas demand and are delivered to more than 40 countries every year. Many of the exports are of small volume, and therefore coastal ports serve as warehouses and distribution centres for silicon metal – typically Guangzhou, Kunming, and Tianjin port. The silicon inventory in such ports have been tracked. However, there are more inventory at smelter sites, inland distribution centres and industrial end-users’ sites, which are hard to track. Since there are more than 250 silicon metal smelters in China and many downstream aluminium ingot plants, the invisible inventory could be higher than the reported port inventory. The sustained good margin received by silicon smelters since early 2021 has incentivised active production, while the wide expectation of escalating demand from the solar sector and possible rising costs for power tariffs led by the drought in southwest China could potentially encourage market participants to hold more stock. If that is the case, the currently invisible inventory could be traded once futures are launched. In other words, the invisible inventory shall weigh on futures prices, and therefore supress the prices in the physical market.

An effective vehicle to balance the market and manage risks

The introduction of futures contracts is a good practice for the sustainable and healthy development of the silicon metal industry in China. We believe the traditional pricing in the physical market will gradually shift to futures benchmarked pricing as seen for non-ferrous metals and many other commodities. The function of price discovery by futures can not only avoid oversupply but also mitigate shortages in the silicon metal market. The smelters and industrial end-users can also use silicon metal futures as a hedge against potentially unfavourable price changes.

We will keep tracking the market dynamics of silicon metal and provide updates on our Bulk Ferroalloys Monitor or Silicon Metal Market Outlook. Please contact us if you want to know more about the silicon metal market.