CRU was approached by a junior miner to provide an overview of the lithium industry for inclusion in their IPO prospectus.

Our recommendation

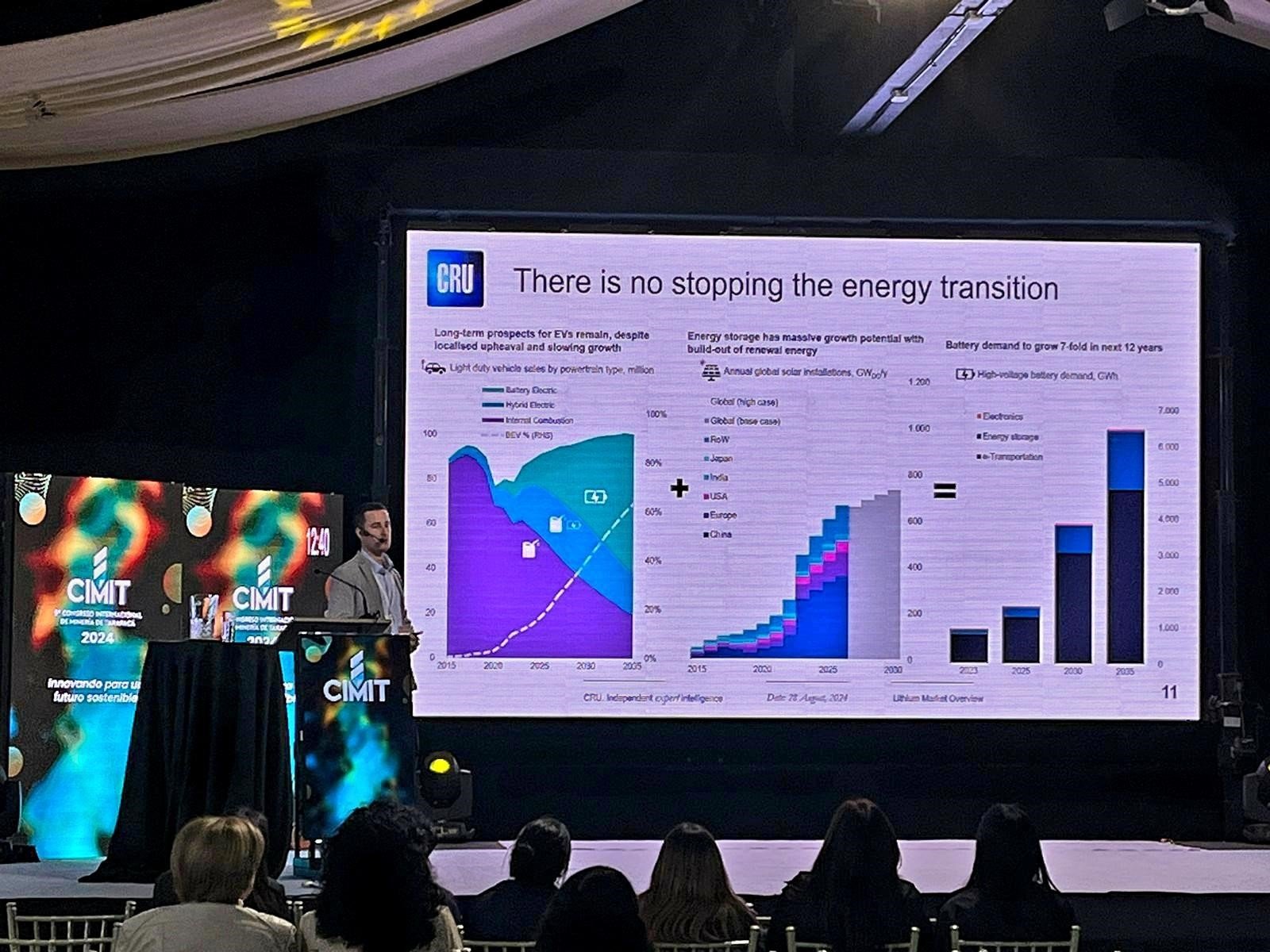

Our recommendation was that the short supply in the lithium market is unlikely to endure as there is in fact no shortage of lithium available. Demand growth will be strong but as it is largely policy driven it is dependent on government’s decisions. Prices are likely to have peaked, but entrants with offtake agreements who are quick to market might be able to earn a return on their investments.

Methodology

To achieve this objective, we conducted primary research and worked with CRU Analysis to develop supply and demand models for lithium.

To begin the work we undertook a detailed literature review to understand who the current and potential players in the lithium market are. We used CRU's mining project Gateway methodology to assess and screen all these lithium projects. This means that we undertake an independent review of the development and progress of the project so that they can be categorised as speculative, possible, probable or committed. To move out of the speculative category, various milestones need to be met until a committed project has all permitting in place, a bankable feasibility study completed, financing structure arranged and ground broken. Each set of projects are then attributed an increasing probability of coming to the market. This enables us to build a realistic supply forecast for the market.

We also provided an overview of the key drivers in end-use industries (focussing on batteries and using our existing work from our cobalt market outlook) and expected growth in lithium demand until 2020. We developed a top-down demand model from scratch using key inputs (such as battery demand) from CRU Analysis and primary research. Therefore we have a much clearer understanding of the end use sectors and demand outlook

Our analysis of key players and markets has also enabled us to understand the entire value chain for lithium and where the competition/margins exist

Finally, we collected historical prices and analysed the supply and demand balance to provide a directional price forecast for lithium. We provided a directional price forecast and commentary on key price drivers and risks over the medium term.

Outcome

The client was delighted with our report which has been used for initial funding applications.