One of the surprise bright spots for aluminium demand in 2017 were the heavy-truck and trailer markets, and strong demand from these end-use markets has continued in 2018.

December 2017 orders for Class 8 trucks posted the highest level since 2014, and total 2017 order levels were 58% higher than 2016, according to industry statistics. For trailers, data show that orders in 2017 grew by 40% y/y over 2016. Due to strong orders in both heavy truck and trailers, large production backlogs existed at the end of 2017. This was a good sign for aluminium demand from the truck and trailer sectors for 2018, despite previous market expectations that this sector could remain weak in 2018.

Through the first four months of 2018, demand for Class 8 trucks and trailers remains at record levels. In Q1 2018, Class 8 truck orders were up nearly 100% from Q1 2017, posting the largest total of any quarter in history, according to industry statistics. Through April 2018, year-to-date orders for Class 8 trucks are 85% higher than the same period in 2017. Likewise, orders for trailers have also been robust, as YTD orders through Q1 2018 were 26% higher than in Q1 2017. Consistently strong order levels are expected to push OEMs and their suppliers to increase production levels in 2018, and market participants expect this momentum in the heavy truck market will carry into 2019 as well.

Factors behind the frenzy

These high order numbers are the result of several factors. Trucking conditions in the US are strong, and there is a lack of trucks to satisfy demand for freight. As a result, carriers continue to place large orders to secure manufacturing slots at the OEMs and add more trucks to their fleets as quickly as possible. Industry experts state that freight growth and demand for trucks and trailers are growing due to a strong US economy, growing online sales, low unemployment, and tax law changes that incentivised investment.

Trucks typically have a four to five-year life cycle. The prior peak in truck sales was in 2014-2015, so a large amount of these trucks will need to be replaced over the next two years, but that also means a lot of used trucks will be coming on to the market to compete with new trucks.

Another contributing factor is the implementation of regulations from the Federal Motor Carrier Safety Administration that require the use of Electronic Logging Devices (ELD) in commercial trucks, which limit the amount of time in a given day that a driver can operate their vehicle. With these new rules in effect, there have been delays in shipments, putting pressure on carriers to bolster their truck fleet to keep pace with demand.

Are dark clouds on the horizon?

While these factors have created a wave of demand that we expect will remain strong in the US due to high order and backlog levels, there are some risks to consider. While current trucking conditions are very healthy, the industry is heavily reliant on NAFTA, as a large majority of products that go to Canada and Mexico are transported via trucks. As such, if negotiations to rework NAFTA are not successful, this would have a negative impact on trucking conditions and would therefore be bearish on new truck and trailer demand.

There are new entrants to the heavy truck market, notably Nikola, Thor and Tesla. So far, there has been decent interest in these new technologies, as Tesla’s semi-electric truck has received some sizeable pre-orders (25 from Loblaws, 15 from Walmart, 40 from JB Hunt, 40 from Anheuser Busch). In addition, Nikola will reportedly build up to 800 of its hydrogen-electric trucks for Anheuser Busch.

While carriers currently prefer to purchase these and other new fuel-efficient, technology-laden trucks, as opposed to used trucks, a growing inventory of used trucks coming into the market from the prior production peak in 2014-2015 could push prices down, making them more affordable, which could eventually cut into new truck orders.

Another major issue in the US freight market at the moment is a lack of qualified drivers. The American Trucking Association estimated that the industry was 50,000 drivers short in 2017, which could increase to 175,000 by 2026. Without drivers to operate them, carriers would not need to purchase new trucks and trailers, thus being a potential inhibitor of future growth.

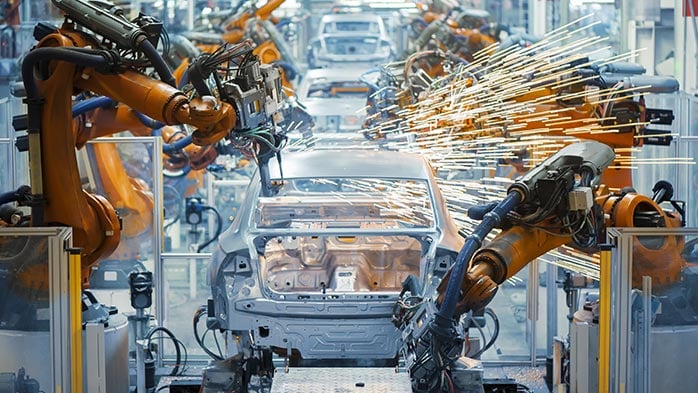

Utilizing the light metal in heavy trucks and trailers

Gains in fuel efficiency prove to be extremely beneficial for trucking companies, as fuel is second highest operating cost after labor.

Aluminium can now be found in a wide variety of applications in trucks and trailers. In trailers, this includes wheels, tanks/silos, front wall, curtain rails, side boards, floors, bumper beams, crash boxes, suspension systems, rear doors, and structural components. In trucks, it includes wheels, doors, chasis, powertrain, and others.

A variety of aluminium products are utilised in the production of these truck and trailer applications, like rolled products, extrusions and castings. For rolled products, the most commonly used alloys in truck and trailer applications include 3003 for the trailer roof, 6061 and 5052 for the sidewalls, and a variation of 6061 for the cab. For extrusions, the most predominant alloy is 6061 T-6, but 6063 is utilised as well. Forging for wheels is all 6061, while castings for wheels in A356.2. Castings for the engine and powertrain is A380 with some A319.

In 2018, CRU expects that consumption from the truck and trailer markets will account for 8% of total consumption of aluminium rolled products, 14% of total aluminium extrusion consumption, and 2% of total aluminium castings consumption.

When will the production/consumption peak be reached?

One thing the market has been keeping an eye on is whether or not these record levels of orders and production can be sustained, as some expect that 2018 will be a peak. CRU expects that production of trailers will peak in 2018, heavy trucks in 2019, and that demand for aluminium products from these end use markets will start to tail off.

The aforementioned large order backlogs for heavy trucks and trailers that carried into 2018 will push production higher this year, and positively impact the consumption of aluminium products. However, this demand will come at the expense of demand in 2019 and 2020 for trailers, as some of it has been pulled forward to 2018. This explains the negative y/y growth expected in trailer demand in 2019 and 2020. Truck production and aluminium consumption, however, will remain flat y/y in 2019, as demand for new units will persist. This market will soften in 2020, as the backlog should be worked down and carriers look at lower-priced used trucks instead.

All good things must come to an end

We understand that capacity constraints have become increasingly tight, and that fleets are adding trucks and trailers as quickly as possible. Some companies may have waited to see if freight growth would continue into 2018 and if the ELD mandate would stick. With the mandate fully in place, such delayed orders have now been placed. We understand that many of the truck and trailer orders are for H2 2018, which is a good sign for continued demand from these markets. Production has reportedly been increasing and will likely remain strong this year.

While CRU expects trailer production and aluminium consumption to peak in 2018, truck production and aluminium consumption will remain steady through 2019 before tailing off. These expectations could be disrupted if there is a major setback in NAFTA negotiations. But overall, market conditions continue to promote strong demand for aluminium products from the truck and trailer markets.