Over the past two years China has become a net exporter of cobalt metal, following the boom and bust of the global cobalt market. China’s net exports of cobalt metal stood at 2,611 tonnes last year; in September alone net exports hit 488 tonnes.

In this Insight, we examine the drivers of production switches between metal and chemicals at Chinese smelters and how this could help shape the market in the future. Moreover, Huayou, the world largest cobalt smelter, has recently been included on the LME’s approved list; what this means for the Chinese net trade position is still unclear. We believe the short-term impacts will be muted but in the longer term this could mean spreads between European and Chinese material close more rapidly.

Major Chinese cobalt metal producers

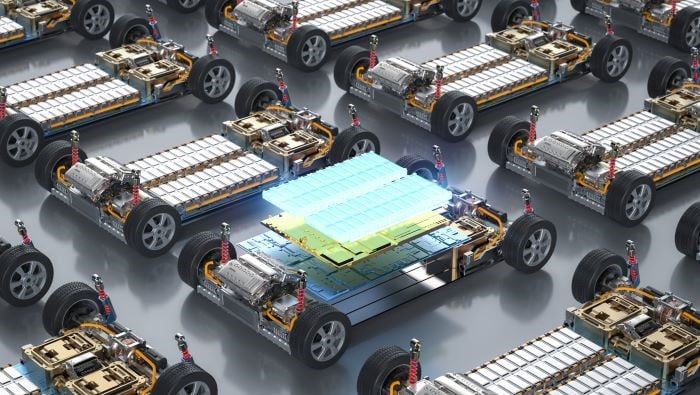

There are four main Chinese players in the metal business, Huayou, KLK, Yantai Cash and Jinchuan, which have all now registered on the LME for its physically delivered contract. They have aligned their strategies with the lithium battery sector now more than ever, as all have expanded across the value chain and refined metal sales are shrinking as proportion of their total sales.

- Huayou is the world’s largest cobalt smelter. In 2018, its refined cobalt production hit 23,600 tonnes (NCM precursor to 12,800 tonnes). Huayou’s cobalt metal line was brought onstream in 2017, the most recently commissioned major project in China. The company wishes to grow its presence in the lithium battery cathode sector and has entered joint ventures with LG Chem to build some 100,000 tonnes-per-year (tpy) NCM cathode and precursor plants.

- KLK, a subsidiary of GEM, has a long history within metal markets. GEM has shifted its focus to make precursor materials, with the company selling more than 40,000 tonnes last year, meaning it ranks with the global top 3 producers according to CRU’s analysis.

- Yantai Cash, added cobalt sulphate line this year, with the company looking to take advantage of the huge potential of battery demand as it expands.

- Jinchuan is China’s biggest and oldest battery metal producer. Its products have a strong reputation both in China and in the USA. Jinchuan are increasing their precursor making business, with plans to build additional 100,000 tpy capacity.

Why smelters switch production

Within the market, there are many misconceptions surrounding the drivers of Chinese metal production. Importantly, it is not always the case that the lower the European price gets, the less Chinese smelters will produce. Indeed, while the European metal price has fallen to $12.80 - 14.00 /lb according to CRU’s latest assessment, our market surveys show that some smelters in China continue to see very high utilisation rates. We believe there are two main reasons behind this:

- Spreads between cobalt salts and metals in China: Lower than expected EV sales in China have hit demand for cathode material, causing cobalt sulphate to be sold at a significant discount to metal and making the latter more profitable to produce. The impact of this will increase, as the major four companies invest further in large integrated precursor or cathode capacity – for which cobalt sulphate is a key ingredient.

- Business practices: Metal markets are generally settled via cash payments, while salts products, such as sulphate or oxide, generally take 45 days for settlement. This has weighed on cash flow for some producers, who are often choosing to take cash upfront rather than waiting for higher returns in the future due to the tight credit conditions in China.

CRU expects that Huayou’s registration on the LME will have only a small influence on the market in the short term. This is because spreads between the EU and China metals markets are currently lower than last year (see graph below) and it is currently not that profitable to export the material. However, in the long run, this move will help ease concerns over Huayou’s business in the DRC as it will be subjecting itself to the tough scrutiny from the exchange and international consumers. This may make it easier for Huayou to make inroads into the EU market.

In the future, we may not see large spreads between the EU and China last for so long as they did in Q4 last year, as arbitrage opportunities will be closed more rapidly. However, the spreads will not be the only factor driving Chinese metal production and a more rounded nuanced view of the Chinese industry is required.