Sodium-ion batteries (NIBs) are an emerging battery technology, which, in many instances, could replace lithium-ion batteries (LIBs) without much change in configuration of manufacturing or use.

Ultimately, sodium-ion technology will progress to a point where it has a performance close to some current LIBs, such as those with lithium iron phosphate (LFP) chemistries. Importantly, it will offer this but at lower costs. Despite its worse energy density, these factors will combine to mean NIBs see mass penetration in battery energy stationary storage (BESS) and will also be used in some small and cheap electric vehicles (EVs).

Key takeaways:

- NIBs will become a viable cheaper alternative for lithium-ion chemistries in stationary energy storage as well as small and two-wheeled EVs. It will proliferate in China before growth is seen in other regions in the medium term;

- Sodium-ion batteries (NIBs) are still an unrefined technology but they are undergoing rapid research, development, and commercialisation, with Chinese companies leading the efforts;

- Current costs are high, but an unprecedented rate of industrialisation is expected to dramatically drive these costs down in the medium term.

Powering tomorrow: NIBs will see mass adoption by stationary storage and small electric vehicles markets

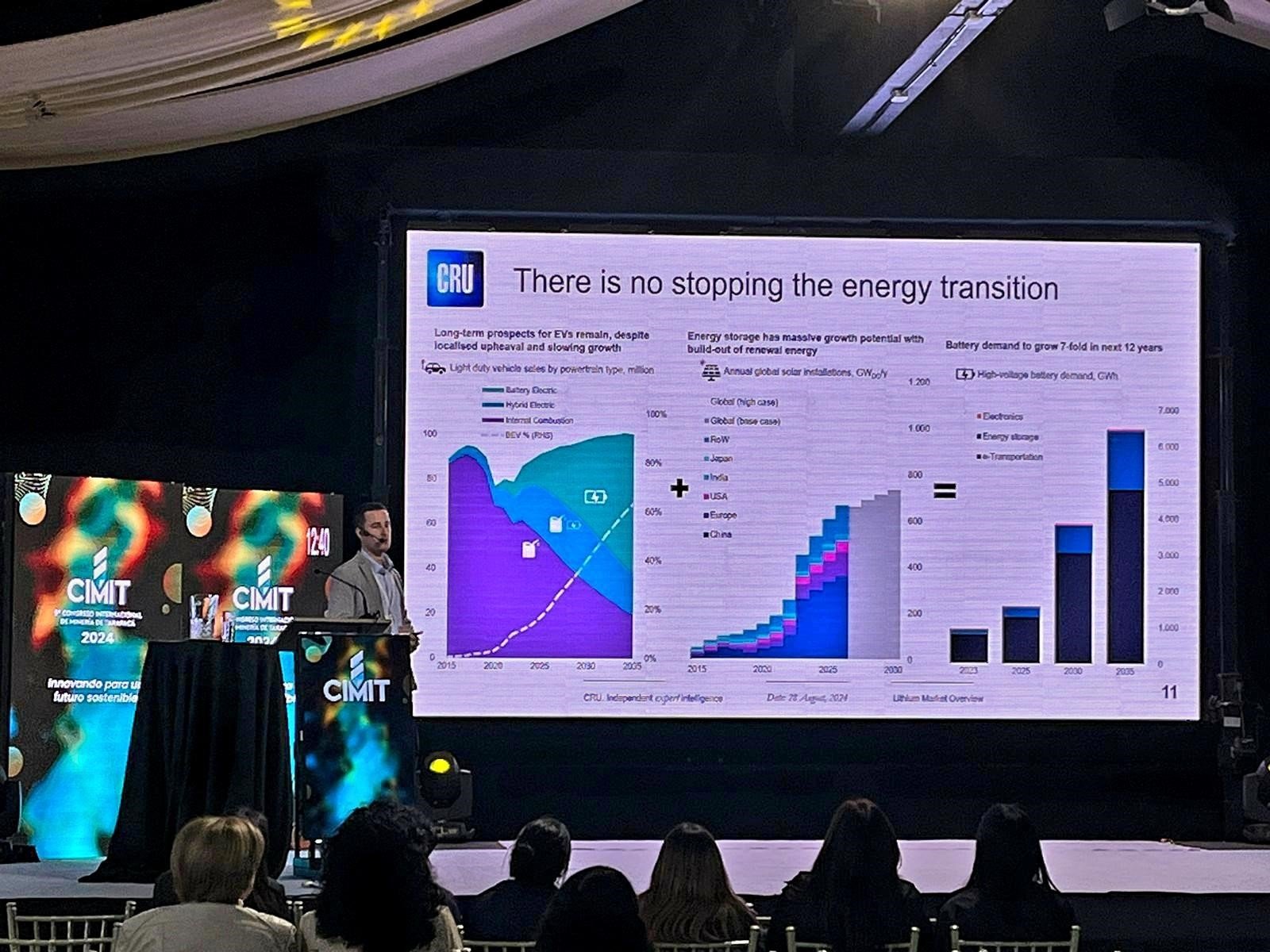

The energy transition is driving rapid demand growth for batteries, with the two core markets being battery energy stationary storage (BESS) and battery electric vehicles (BEVs).

Stationary storage applications are essential for load-following and peak shaving in combination with intermittent renewable energy sources. The need for them will grow rapidly as grids increasingly shift towards renewable sources. Our Energy Storage Technology and Costs Service (ESTAC) provides an overview of energy storage supply chains – from key raw materials to final storage costs, analysing changes to key technology and manufacturing cost developments.

In the short term, the BESS market will remain dominated by lithium-ion batteries (LIBs), with almost exclusively LFP cathodes. However, as sodium-ion costs fall, the technology will see its penetration rate increase steadily and will likely become a major battery technology for BESS applications before the end of this decade.

Recent announcements by several Chinese companies have made it clear that NIBs are not just for stationary storage but offer a viable alternative for some BEVs. Improvements made to chemistry and geometry are enabling the once-believed insufficient properties of NIBs to pose as a real contender to lithium for battery-powered mobility. This is particularly true for small cars and electric two-wheelers that benefit from sodium’s lower costs and do not require the highest energy densities available on the market. However, small cars and electric two-wheelers constitute only a small part of overall battery demand.

Lithium’s domination of the battery market has been assisted by decades of research, during which NIBs were continually overlooked due to their underperformance in volumetric energy density when compared to nickel-rich LIBs. However, recent years have seen an increase in interest and investment into this competing chemistry due to the low raw material costs, large operating temperature range, high round-trip efficiency, and excellent safety. The price spike of lithium in 2022 fuelled the industrialisation efforts for NIBs.

Unveiling China’s ‘Na’-tional power surge in the sodium-ion industry

Nowhere is the NIB industrialisation priority more obvious than in China. Here, over 15 different companies are working on NIBs including large-scale manufacturers CATL, BYD, and EVE. CRU forecasts that China’s production capacity of NIBs is expected to exceed 130 GWh/y by 2030, over 75% of our global forecast.

Meanwhile, the USA, Europe and India are following behind, with a handful of companies scaling up their manufacturing to compete with China. Production tax credits such as the IRA MPTC 45X offers the potential to make the USA cost competitive with China for NIBs production – providing the US can reach a competitive manufacturing scale. Further commentary and analysis on the developments in the NIB industry can be found in our ESTAC service.

What is the ‘salt’ in the wound for NIBs?

Elemental sodium has a mass over three times that of lithium, leading to an intrinsically lower gravimetric energy density and historically poorer transport kinetics. However, rigorous research and development have led to rapid improvements, and it is becoming clear that the benefits have the potential to outweigh the detriments in certain applications.

CRU’s soon to be released Battery Cost Model demonstrates that it is largely the costs of NIBs that are holding them back when compared to competing chemistries, like LFP. While the cathodes used in NIBs have lower costs than lithium-based cathodes, owing to the more abundant raw materials used, the anode material in NIBs comprises a significantly greater portion of the cost stack.

Hard carbon is the industry standard anode for most NIBs, with only a few alternatives currently being explored but, due to the its undeveloped supply chain, it is produced at low volumes, reflected by high prices. In contrast, LIBs typically use graphite as an anode material. This is an industry that has been upscaling over the last few decades to keep up with battery demand, so its costs have dropped almost as low as is feasible.

CRU forecasts that NIBs will reach cost parity with LFP in the medium term as manufacturing costs fall, thanks to industrialisation and a scale-up throughout the supply chain, particularly for the hard carbon anode active material sector. The rate of this development is expected to exceed the historical precedent established by LIBs due to the considerable overlap in manufacturing processes, especially in systems based on layered oxide (LO) cathodes, which pose as a drop-in technology replacement.

Sodium is coming, the question is when and how much

Thanks to low cost and abundant raw materials, large operating temperature range, high round trip efficiency, competitive cycle life and safety, sodium-ion batteries are well suited to battery energy storage systems. While they exhibit poorer energy density than their lithium counterparts, they will pose a threat to lithium’s dominance in small BEVs in China. However, hard carbon price reduction is critical for the wide-spread commercialisation of this technology and cost competition with LFP.

CRU expects the NIB development is essential to keep the price of battery grade lithium in check, especially in times of high demand such as 2022 Q4. Continued buildout of sodium technology will enable more lithium to be used in mobility applications and ensure a smoother adoption of renewable energy generation.