Driven by the strategic need to reduce the dependency on foreign oil and foreign critical materials, at the heart of the IRA are efforts to create a secure national supply chain. Whether this is a supply chain for energy, or energy’s direct impact on US aluminium production, or for EVs and EV batteries, the IRA provides funding for energy production and energy transmission on a never-before-seen scale. The bill will also directly support the adoption of EV cars and light trucks, along with the electrification of mid-size to large trucks.

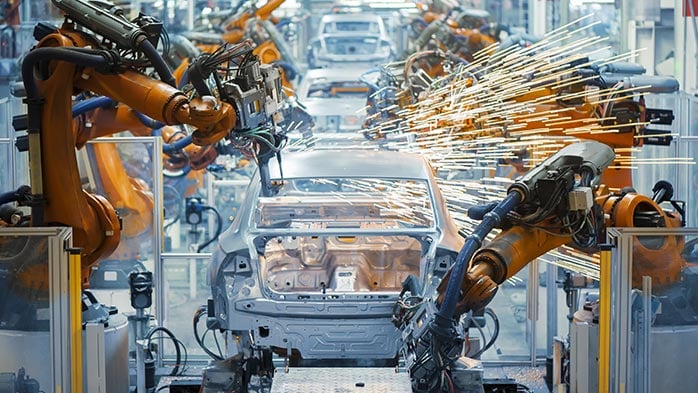

Upstream in the aluminium value chain, the Defense Production Act may be tapped to secure lower energy prices for idled US smelters. The re-development of US smelters is back on the table and seen as a vital link in the supply chain to secure critical industries and defence infrastructure. New demand for aluminium semis is expected to come from electric transmission investments, increased production of EVs, EV batteries and charging stations, while meeting the threshold for the requisite origin of material production requirements. US manufacturers and US Free Trade Partners will benefit from these incentives while foreign entities of concern will be excluded from participation.

The new law extends and refines current EV tax credits set to expire in December 2022, now good through 2032 – ample runway for industry and consumers to embrace the opportunities supported by the new legislation. Now in conjunction with the Chips and Science Act, the US looks to secure critical supply chains proven vulnerable by the Covid-19 pandemic, the war in Ukraine, and other global geopolitical tensions. Simultaneously, California has just set into law a ban on new ICE sales as soon as 2035, thereby further accelerating opportunity and necessity for the US electrification strategy.

To support this growth, CRU estimates that current EV battery foil demand to support North American EV production is presently 16,000 mt, and that demand will surge towards 70,000 mt by 2030 as consumer demand grows with the development of 100-200 kW/hr battery platforms needed to electrify SUVs and pickup trucks, which make-up 77% of current US car and light truck purchases. A recent $279 million battery foil plant investment announced for KY, aligns with billions of dollars pledged by auto companies and EV battery makers to spur the development and deployment of US EV battery production to affect the electrification of the US car and truck fleet, thereby subsequently reducing dependency on foreign oil and strategic materials from entities of concern.

CRU will continue to follow these market developments and investments. Follow these in the Aluminium Rolled Products Market Outlook and Aluminium Products Monitor which regularly feature mill production updates and market demand forecasts.