CRU is pleased to announce that we provide access to our internal Gigafactory Capacity Database, which tracks 80 different battery manufacturing operations between now and 2026, as part of our Battery Metals Market Outlook service.

Our new CRU Insight draws from our database to present our forecast for the extraordinary growth of global Gigafactory capacity in the years ahead.

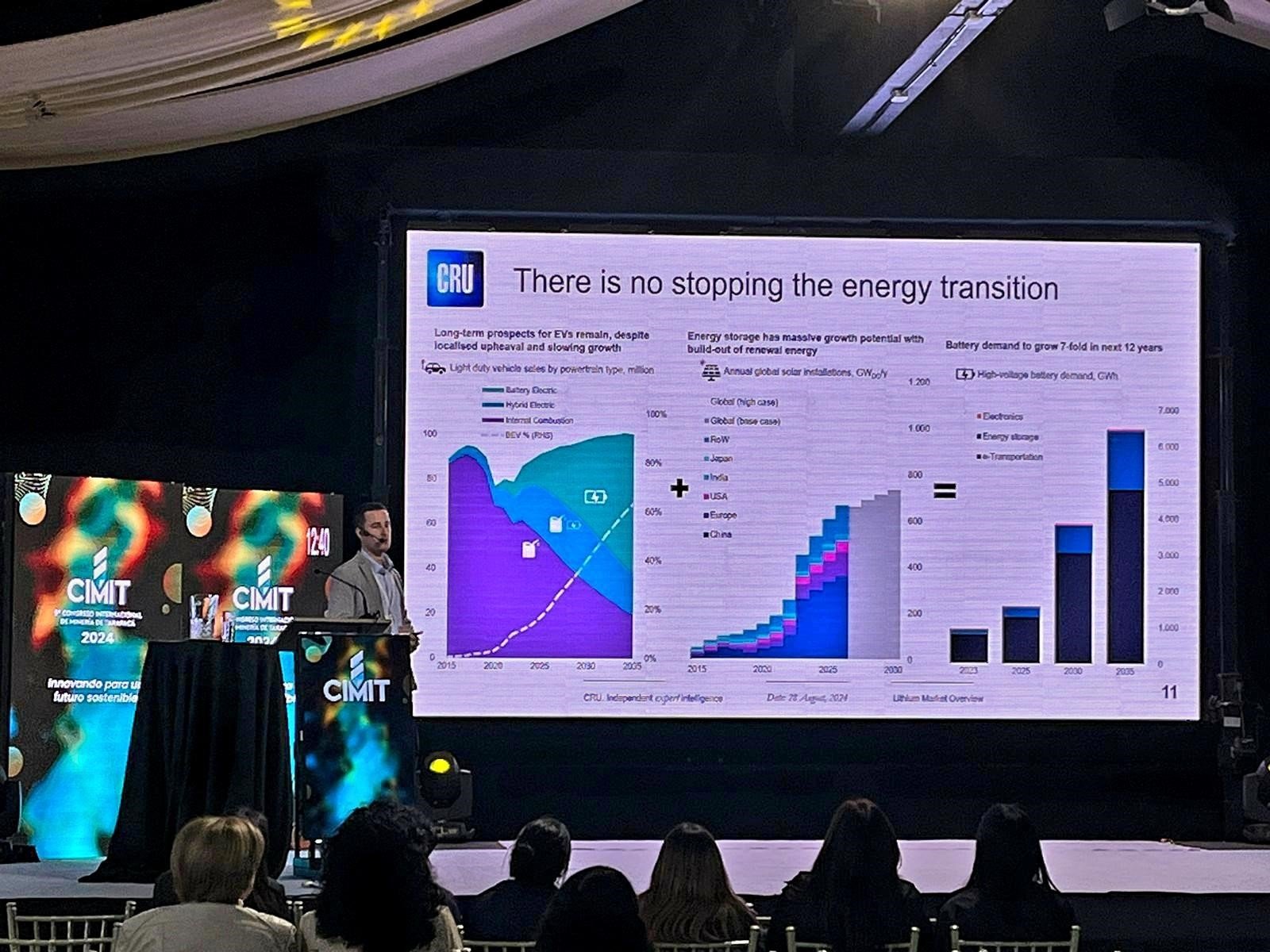

In conjunction with our robust battery demand modelling system, CRU is now able to accurately forecast the “supply-demand balance” for the battery market. This allows us to address key unanswered questions such as whether planned capacity will be sufficient to fuel future battery demand growth, and the resulting capacity utilisation rates that we can expect in the market. In a razor-thin margin market like battery manufacturing, capacity utilisation will be key to survival.

Gigafactory capacity will surpass 1,000 GWh (1TWh) by 2024

With global EV sales exploding through the 1 million mark in 2018 and interest in grid and residential storage continuing to grow, the last few years have seen a flurry of ambitious battery factory announcements across many different regions. CRU has capitalised on this surge of interest to provide subscribers to our Battery Metals Market Outlook service access to CRU’s gigafactory capacity forecast.

Our analysis covers 80 different projects, both planned and operating, between 2015 and 2026. Based on company announcements and planned gigafactory expansions, CRU expects total global battery manufacturing capacity to reach 1.048 TWh (1,048 GWh) by 2026.

CRU estimates that China was responsible for 77% of global battery manufacturing capacity in 2018. We expect this share to peak at 81% this year, before other regions begin to catch up – most notably Europe, with a flurry of gigafactories planned for eastern Europe to support the region’s sizeable automotive sector.

DATA: CRU

Bigger gigafactories mean cheaper batteries

What sets these so-called “gigafactories” apart from existing battery manufacturing capacity is the integration, sophistication and scale at which they will operate. CRU’s gigafactory database recorded 47 operating projects in 2018, each with an average capacity of just 4.9GWh. However, by 2026 we expect this to rise to a total of 80 projects – each with an average capacity of over 13GWh each.

Some projects are expected to be substantially larger of course. Although rumoured to be suffering production issues, Tesla’s Gigafactory in Nevada was reported to have a capacity of 20GWh in July of last year, and the company has announced plans to build capacity to 105GWh over the forecast period.

This increase in manufacturing scale will be the principal driver of declining battery costs over the next decade. BloombergNEF’s annual battery price survey suggested that average battery pack costs have declined by 20% y/y on average since 2010, with average pack costs in 2018 being just $176/kWh. Scale of manufacturing operations will be the key contributor to lower battery pack costs in the coming years, and will be vital to push battery pack costs through the $100/kWh threshold.

Will global capacity be sufficient to meet growing battery demand?

While significant research has been made in into the battery gigafactory pipeline in recent years, this hasn’t answered the fundamental question of whether the capacity will be sufficient to fuel the EV revolution – as well as growth from other battery sectors.

CRU’s Battery Metals Market Outlook service combines our latest Gigafactory Capacity Forecast with our sophisticated long-term Battery Demand Model, allowing us to effectively model the “supply-demand balance” for batteries in GWh terms and answer this question.

Our analysis framework also allows us to model long-term capacity utilisation rates in the battery sector. Margins are expected to remain extremely thin in the battery manufacturing sector due to strong price competition and heavily integrated supply chains, and average capacity utilisation rates will need to be extremely high to limit unnecessary costs. This means that the market may be unable to absorb surplus capacity.

CRU provides more detailed analysis of the market implications of these events, as well as forecasts for supply, demand, prices and costs in the battery metals sector, in the following services:

- Battery Metals Market Outlook

- Cobalt Market Outlook

- Lithium Market Outlook

- Lithium Hydroxide Cost Service

- Nickel Market Outlook

- Nickel Sulphate Market Outlook

- Nickel Sulphate Cost Service

If you would like to speak to CRU's team in your region about how our services can support you and your colleagues in your market activity, please let us know and we will be delighted to discuss further with you.

ill be enough to incentivise renewed demand for alumina imports.