The high-grade ore premium through 2018 contributed significantly to improved cost competitiveness for Chinese iron ore miners and resulted in over 80% of Chinese concentrate being profitable last year. Our new and exclusive CRU Insight breaks down the situation in more detail and illustrates how the cost competitiveness of Chinese mines is expected to reduce moving forwards.

Chinese mines benefitted in 2018 from high-grade ore premium

The high-grade ore premium was elevated through 2018, given the stunning steel margins underpinned by supply-side reform and environmental restrictions on ironmaking, especially in the Beijing-Tianjin-Hebei region. Chinese concentrate is characterised by high Fe, low alumina, and fine particle size, which is generally suitable for pellet production. Such properties mean Chinese concentrates fetch a premium to benchmark prices. CRU has conducted in-depth research on the differences in iron ore value as evaluated from the steelmakers’ perspective under different market conditions and has implemented a VIU module in CRU’s Iron Ore Cost Model to reflect this. It demonstrates that Chinese concentrates received an average VIU premium of $13.9 /t in 2018 compared with only $3.0 /t in 2015. This higher VIU is the leading contributor to the reduction in Business Costs observed.

Given the falling costs and elevated price premia, CRU’s Iron Ore Cost Model shows that 82% of Chinese concentrate output was from mines operating with Business Costs lower than the 2018 annual average benchmark price, a higher percentile compared with 2015 and 2016, when only 29% and 50% of operations achieved Business Costs lower than the benchmark price, respectively. The relatively high proportion of the domestic industry remaining at or above breakeven costs illustrates that despite the improvement in average Site Costs made in recent years and a more favourable pricing environment, China will continue to play a pivotal role in global marginal supply and therefore price formation.

Cost improvements to partly offset falling premia

Looking ahead, we expect average Site Costs to fall further as miners continue to see the benefits of improving mining methods, however as the record high-grade premia witnessed in 2018 return toward normal levels, the cost competitiveness of domestic China concentrates will suffer. CRU’s Iron Ore Cost Model shows that average Business Costs increase by $6.2 /t during the period 2018–2023. This trend will weigh on margins for most Chinese miners.

CRU provides detailed market analysis and forecasts for iron ore mining costs, projects, supply, demand and prices in the following services:

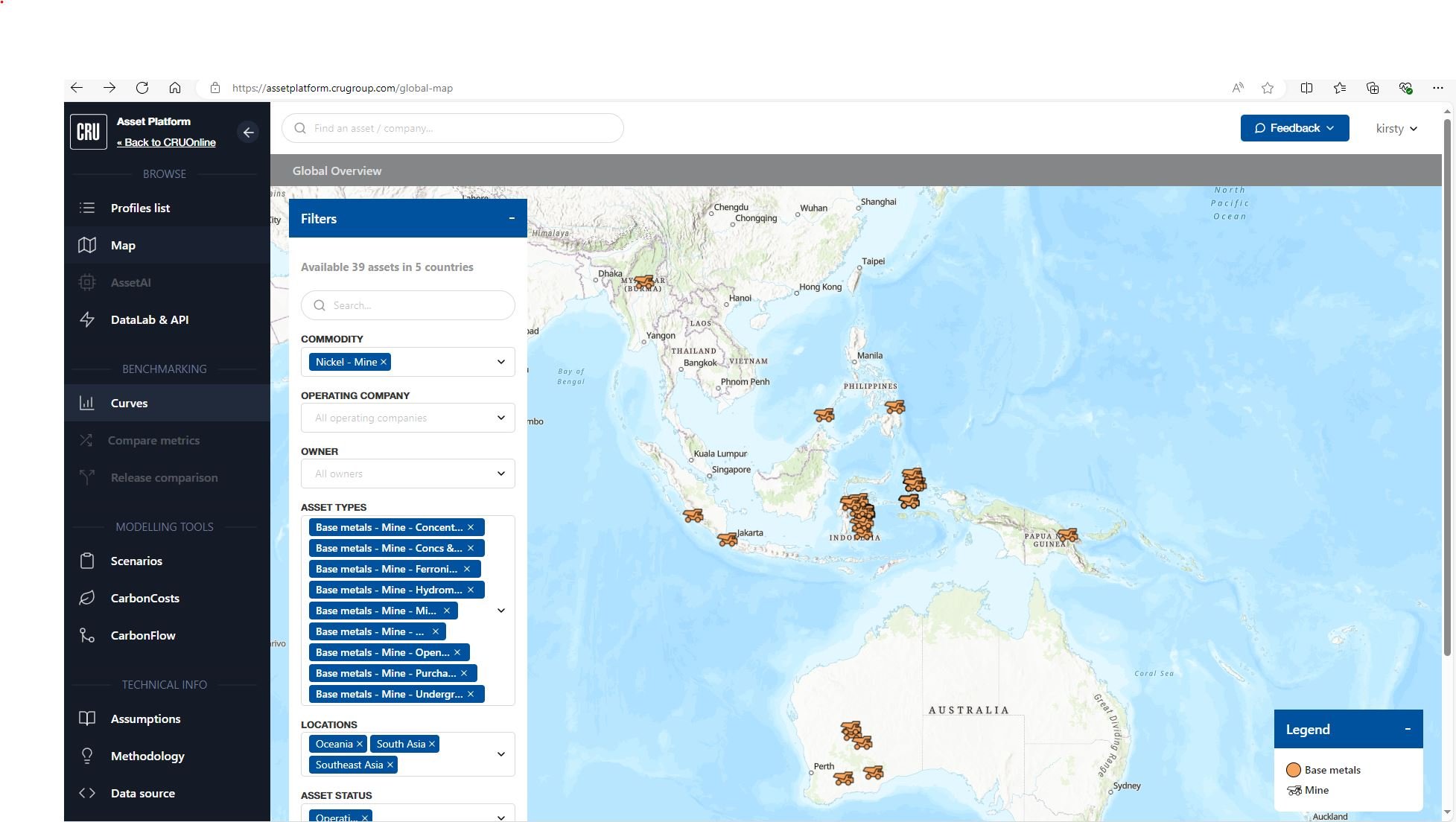

- Iron Ore Cost Service - Asset by asset cost benchmarking and evaluation tool

- Iron Ore Long Term Market Outlook - Outlook to 2035 for supply, demand, projects and prices

- Iron Ore Market Outlook - 5 year forecasts for supply, demand, trade and prices

- Steelmaking Raw Materials Monitor - weekly price assessments and market analysis for iron ore, metallurgical coal and metallurgical coke

If you would like to speak to CRU's team in your region about how our services can support you and your colleagues in your market activity, please let us know and we will be delighted to discuss further with you.