Our client, a European metals industry association, was looking to understand and influence the design of a future Carbon Border Adjustment Mechanism (CBAM).

Introduction

The EU steel industry face carbon costs associated with the EU Emissions Trading Scheme (ETC). This created a level playing field issue, by exposing European producers to policy costs which imports are not subject to. This issue rose in significance as carbon prices in the EU ETS rose spiralled in response to the establishment of the Market Stability Reserve and the prospects of further regulatory reforms as part of phase IV of the ETS.

In this context, CRU Consulting were engaged to assess the impact of a CBAM under different potential policy rules on the EU steel industry with a view to assessing the effect on steel imports, domestic production and profitability. This was intended to both inform the upcoming policy dialogue with EU regulators, and develop the tools to enable industry players to successfully prepare for such an intervention. Some specific questions addressed as part of the study included:

- How does CBAM impact steel prices, production, value add and import displacement?

- What is the distribution of these impacts across Member States and market segments?

- How does CBAM perform alongside wider ETS reform (including removal of free allocations & carbon price increases)?

- Is the EU steel industry at risk of cost absorption by importers?

- How is the policy impacted by inclusion of scope 3 emissions?

Data: CRU

Our recommendation

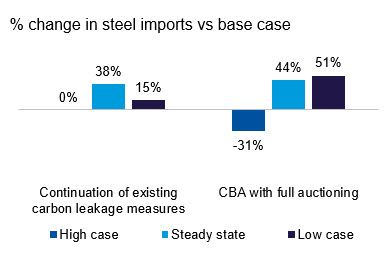

Our analysis highlight the potential for moderate price increases for some steel products as a result of the imposition of a CBAM. These inflationary effects were found to be greatest in the event that allowance rules & emission cap are reformed in parallel. However, high steel prices were not sufficient to ensure higher industry value add, because prices and unit margins could be inversely related, particularly where the emissions intensity of domestic steel makers is high on average relative to marginal supply sources. Overall we identified significant import substitution effects, albeit with displacement effects generally moderate relative to impacts of current anti dumping duties.

Our approach

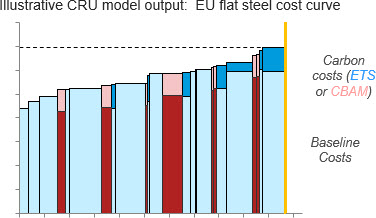

CBAM impacts were assessed through a robust methodology across four steel product segments, leveraging CRU’s mill level cost and Scope 1 & 2 emissions data. Scope 3 emissions were modelled for stainless steel. CRU Consulting conducted scenario analysis on a range of CBAM design options for its impact assessment study, with analysis undertaken individually for each product market, using a dynamic, bottom up, partial equilibrium model. Different ETS and market conditions were examined to test the potential market response to a CBAM during changes in policy and different stages of the business cycle.

Data: CRU

Results

We quantified the impacts of the CBAM on 4 key metrics: imports, capacity utilisation, product price and industry profitability. These were assessed at market participant level, allowing for granular analysis. But they also served to understand how EU steel industry product segments respond in aggregate to a CBTA.

Through the analysis of the cost curve, CRU was able to provide detailed insights on the steel market composition under various policy and market conditions.

Data: CRU