CRU delivers independent market analysis on a comprehensive range of global commodities – its reputation with customers across mining, metals and fertilizers is for integrity, reliability, independence and authority.

CRU's insights are built on a twin commitment to quality primary research and robust, transparent methodologies. You can rely on our work – our data, our views, our models – because we have built them ourselves, from the ground up, since our foundation in 1969.

CRU’s network of overseas offices and analysts based in key commodity hubs across Asia, Europe and the Americas, enables deep insight into local markets and gives CRU the capability to forge connections across global supply chains.

Our in-depth market analysis and forecasts – where commodities meet economics – provide you with reliable and authoritative views. CRU’s global teams ensure that you have up-to-date, objective analysis of the latest industry events and market trends. We offer bespoke services like the Specialty Phosphate Service with data-rich industry analysis and insight into the growth of the emerging Lithium Iron Phosphate sector, the role of phosphate within LFP, LFMP and the growth and demand for specialty phosphates. For organisations that want to reduce their environmental impact and achieve long-term sustainability goals, we also provide a comprehensive Sustainability and Emissions Service. Exawatt's recent integration into the CRU family also amplifies our ability to support global clients with vital insights for decarbonisation efforts.

CRU's cost services help users gain an understanding of industry cost structures, to rank facilities against each other, investigate investment opportunities and conduct accurate strategic planning.

As part of our cost services, stakeholders across the copper industry and beyond are empowered to make informed decisions, optimise costs, and enhance operational efficiency through CRU’s Copper Smelting and Refining Asset Service. In addition, we also offer a bespoke Solar Technology and Cost Service providing a full view of the solar PV supply chain, analysing changes in technology and manufacturing cost that will define the future for manufacturers, end users and investors. To drill down into emerging energy storage technologies, we also provide the Energy Storage Technology and Cost Service, guiding subscribers on where costs and prices are heading.

Explore our market analysis coverage by entering a commodity name in the search bar above, or alternatively view our product directory.

View our product directory View our Economics team

Find out more about CRU’s Analysis services

CRU's unique services are the product of both our in-depth understanding of the markets and close contact with our customers. We want to hear from you.

Request a demonstrationThe Latest from CRU

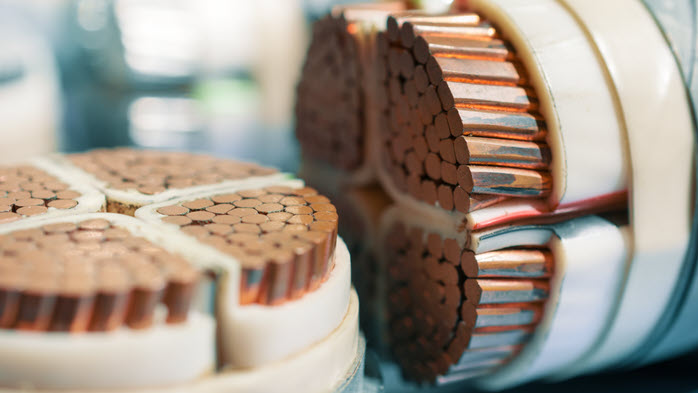

Key takeaways from CRU’s Wire and Cable Amsterdam conference

CRU held its seventeenth consecutive Wire and Cable conference in Amsterdam, during 24–26 June 2024. Day 1 kicked off with a warm welcome to around 200 conference...