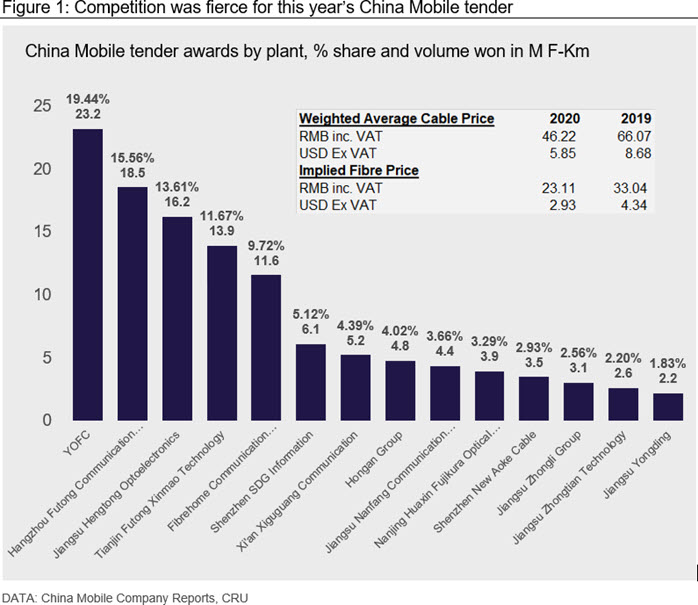

From just a volume basis, there were a number of clear ‘winners’ and ‘losers’. The 119.2M F-Km was split between a total of 14 companies with YOFC taking the top spot having been awarded a 19.44% share, equivalent to 23.2M F-Km. This is a significant improvement from the prior tender, where YOFC were only awarded 4.6M F-Km despite a relatively competitive bid. In this case, they certainly could be deemed a ‘winner’. Regarding Futong, if we include their Tianjin Futong Xinmao Technology facility, their group total beats that of YOFC.

Conversely, ZTT, who were awarded the 3rd spot in last year’s tender winning a 15.81% share equivalent to 16.6M F-Km, were awarded just 2.2% (or 2.6M F-Km) of the 2020/2021 tender. Regarding the awards to the other ‘Big 5’ companies, Fiberhome lost over 12M F-Km and Hengtong’s total volumes were little changed.

While there are some individual ‘winners’ with respect to volumes awarded, overall, the price point to which this tender has been settled is worrying for many industry participants, not just in China, but internationally. YOFC led with the most competitive bid which equated to RMB39.23 / F-Km, when converted to US dollars, this stands at record low levels of just $5.61 / F-Km of standard loose-tube cable.

CRU believes this translates to an implied bare fire price of between $2.80 - $3.00 / F-Km. This fall in tender prices is much in line with CRU’s expectations, slipping well below current spot price levels which recorded a marginal uptick in early-July to $3.20 / F-Km. In a similar manner to last year’s tender, spot prices have quickly fallen in line with this new ‘price normal’. It also provides zero support for higher prices as part of the upcoming China Telecom tender, yet further cementing this new price floor.

CRU estimates the cost of production, at the majority of efficient facilities in China to be in the region of $3.30 / F-Km (marginally lower in exceptional circumstances). At this level, it is reasonable to suggest some volumes must be coming direct from stock which we know to be elevated in the domestic market currently.

Moving forwards, this weak price point will hamper profitability and squeeze margins harder than ever, which ultimately could help spark some form of supply rationalisation over the next 6-18 months. Something which CRU’s Wire and Cable Team will be tracking closely in our regular services; Optical Fibre and Cable Monitor and Telecom Cables Market Outlook.

The Latest from CRU

Key takeaways from CRU’s Wire and Cable Amsterdam conference

CRU held its seventeenth consecutive Wire and Cable conference in Amsterdam, during 24–26 June 2024. Day 1 kicked off with a warm welcome to around 200 conference...