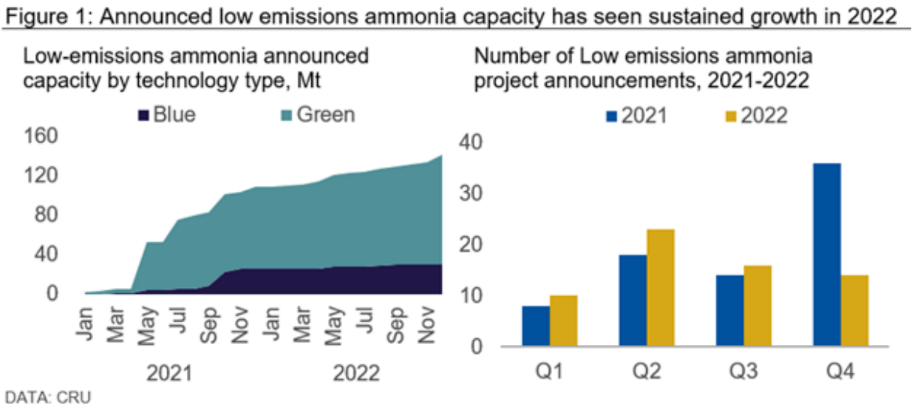

Total announced low-emissions ammonia capacity reached 157 Mt at the end of 2022 – an increase of 32 Mt year-on-year. Investor confidence for low emissions ammonia grew unabated last year in expectation for demand markets shaping up in the future.

Author Alex Amin

Analyst View profile

A total of 63 projects were announced in 2022 – a decline from the 76 announced in 2021, despite outperforming the previous year in the first three quarters. Average capacity, however, remained stable year-on-year for announced projects at 530 Kt per project when excluding those with a capacity greater than 5 Mtpa.

The slowdown in announcements is not indicative of reduced investor interest. Instead, there is a shift forward within the development lifecycle as projects begin to reach key progress milestones.

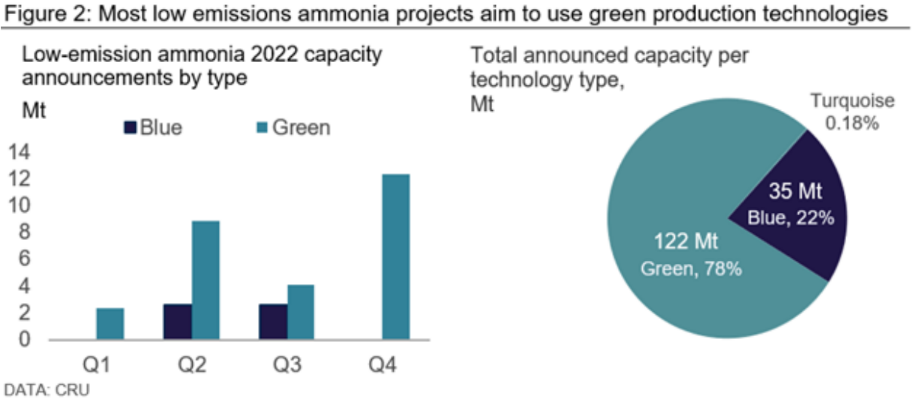

Green ammonia remains top technology choice

Consistent with 2021, green ammonia projects, which utilise renewable energy sources, made up the majority of new project announcements in 2022 at 26 Mt. Blue ammonia projects, which utilise carbon capture and storage technologies to reduce CO2 emissions, reached nearly 6 Mt. Total announced capacity has remained weighted towards green ammonia production technologies relative to blue technologies, at 122 Mt and 35 Mt, respectively.

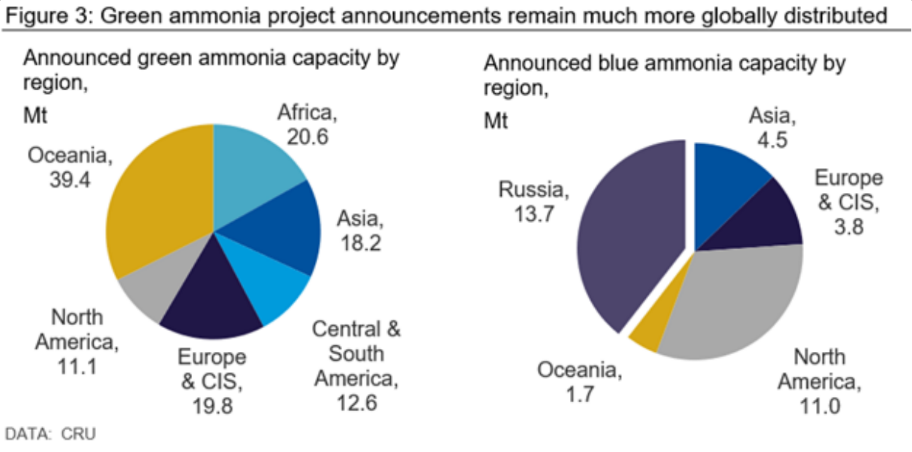

Regional distribution of projects varies by technology type

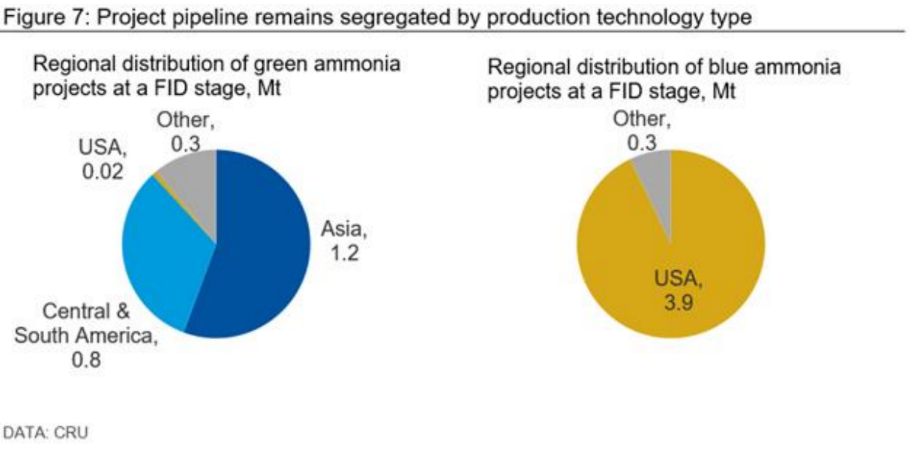

Project announcements remain geographically distinct depending on technology type. Green ammonia projects are globally extensive, with substantial capacity proposed for each of the major regions. This reflects the ability of green ammonia projects to utilise the widespread availability of different renewable energy resources. In contrast, traditional ammonia projects have historically been concentrated in countries and regions that have access to a cheap source of hydrocarbons, typically natural gas, or coal.

Blue ammonia projects are much more geographically concentrated, with announcements occurring in regions that have traditionally hosted conventional grey ammonia capacity, such as North America and Russia. This is driven by the fact that a large proportion of blue ammonia projects are brownfield conversions of existing capacity. In addition, greenfield blue ammonia projects will ultimately rely on using a hydrogen feedstock (either gas or coal), thereby placing them under similar geographical constraints to traditional grey ammonia projects.

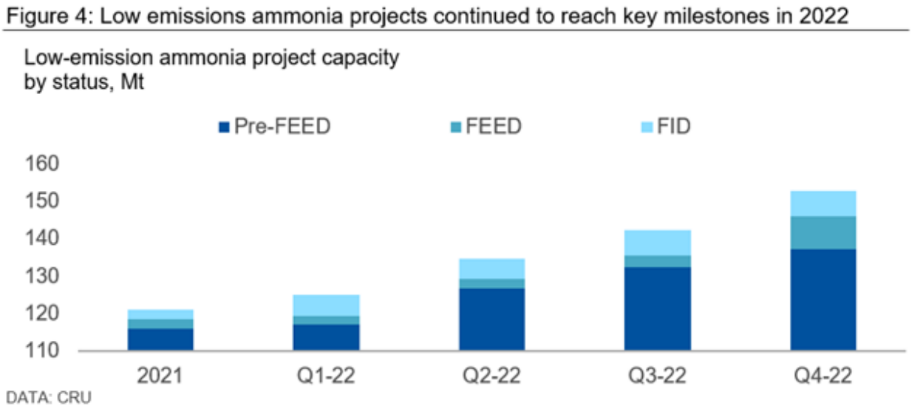

Projects continue to reach key development milestones

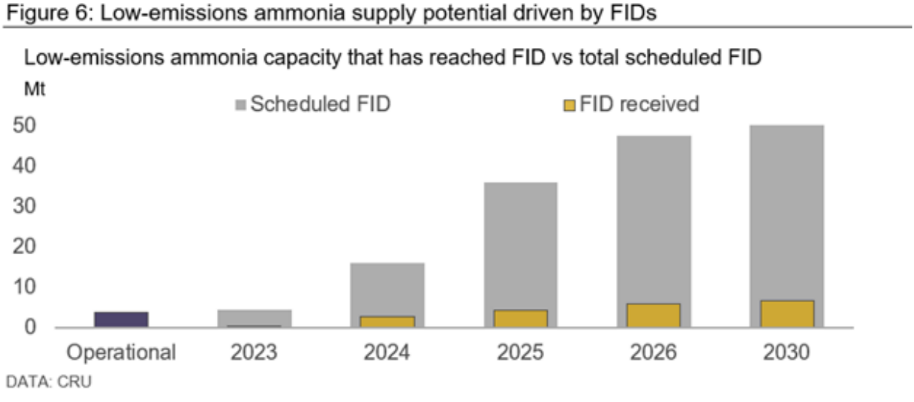

Key project milestones continue to be reached for low-emissions ammonia projects. 6.8 Mt of capacity has now reached a Final Investment Decision (FID) stage, up from 2.5 Mt at the end of 2021. Projects that are in a FrontEnd Engineering and Design (FEED) stage now account for 9 Mt of capacity, relative to 2.7 Mt at the end of 2021. However, 87% remain in a pre-FEED stage.

Low-emissions capacity surge anticipated from 2024

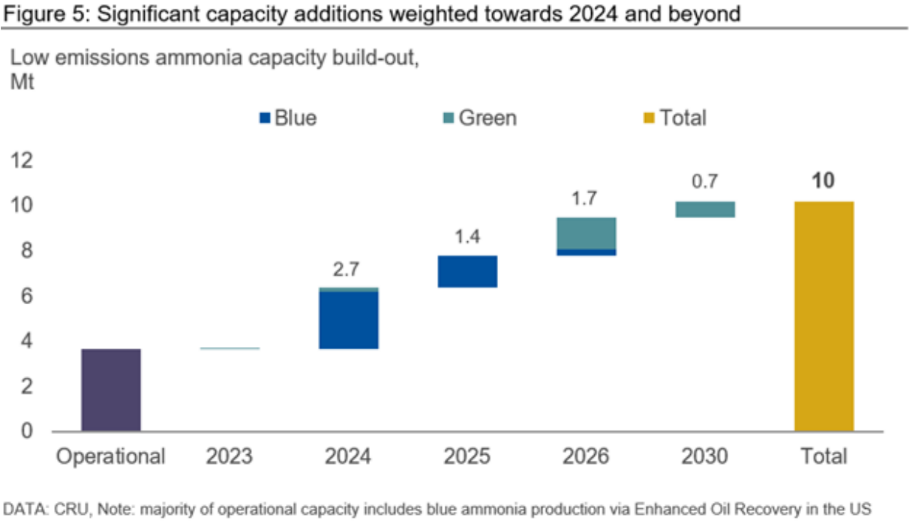

Low emissions ammonia capacity is forecast to increase by 6.5 Mt to reach 10 Mt in 2030, based on CRU’s analysis of capacity announced for the same period. Capacity additions to the tune of 2.3 Mt are expected from green ammonia projects, the majority of which are forecast to commission beyond 2026. Blue ammonia projects, which are seen as a viable mid-term carbon mitigating option, are more weighted towards 2024 – 2025, with an anticipated 4.2 Mt worth of capacity commissioning across the forecast period.

Only projects that have reached a Final Investment Decision (FID) are included in the forecast, which remains dynamic as further projects reach this key milestone.

Total low emissions ammonia capacity with scheduled FIDs amounts to 50 Mt by 2030, however many of these projects may not reach completion. Low-emissions ammonia demand is forecast to grow to 12 Mt by 2030, including 6 Mt of substitution within traditional markets, based on CRU’s analysis on end-market potential.

Green ammonia projects that have reached FID stage are predominantly concentrated in Asia (1.2 Mt), with substantial prospective capacity also located in Central and South America (0.8 Mt). Blue ammonia projects in contrast are much more concentrated, occurring entirely within North America (4.2 Mt), with the US alone accounting for 3.9 Mt.

See CRU’s latest analysis on the opportunities, challenges and potential evolution of the Low Emissions Ammonia Market here.

Explore this topic with CRU

Author Alex Amin

Analyst View profile