As 2023 draws to a close, a wave of electric vehicle (EV) subsidy and policy updates have been issued. Policymakers are caught between the need to continue supporting the developing EV market with financial incentives and cutting back on subsidies given broader macroeconomic concerns. Meanwhile, protectionism and the exclusion of Chinese OEMs from EV markets continues to be a common theme in European and North American policy.

Author Cameron Hughes

Battery Market Analyst View profile

Author Xiaowei Mei

Senior Battery Demand Analyst View profile

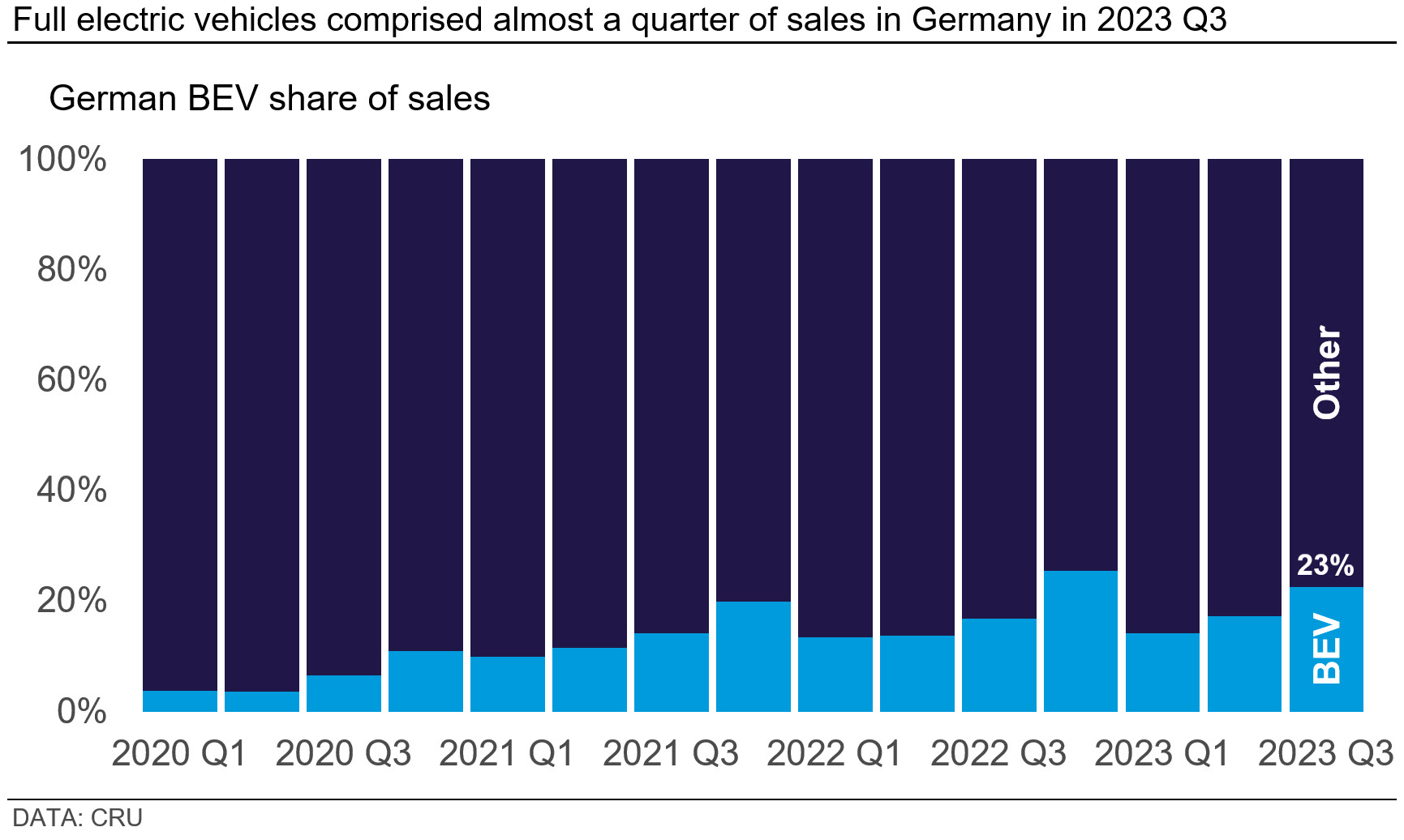

European countries have rushed to update their EV subsidy programmes in December. In Germany, the last-minute 2024 budget has put the brakes on the country’s subsidy scheme, with the decision to end it as of 17 December 2023. The programme, which started in 2016 and has since paid out EUR10 bn, was prematurely scrapped in the new slimmed down budget. BEVs comprised 18% of light vehicle sales in Germany for the year to November in 2023 but were almost a quarter of the total in the third quarter before fleet subsidies expired.

Previously, subsidies for EVs between EUR40,000-65,000 were set to expire at end-2023, whereas the policy for EVs below EUR40,000 was expected to extend end-2024. When EV subsidies for businesses expired in September 2023, sales contracted by 29% y/y. Given the private market is significantly larger than fleet sales to businesses, the sales contraction following the 17 December change is expected to be particularly strong. January is typically a slow period for EV sales, but the start of 2024 will be exceptionally sluggish in the largest European EV market.

Meanwhile, in France, consumer cash incentive rules have been revamped to favour vehicles made in France and Europe over China. 32% of BEV sales in France in 2023 were imported; 20% were from China alone.

Over 65% of EVs made in France are anticipated to be eligible for the incentives, providing up to EUR5,000 per vehicle. The new criteria for receiving the incentives includes a carbon emissions limit when manufacturing the EV, causing many Chinese vehicles to be excluded. Currently, Teslas, MGs, and Dacia Springs are the main vehicles exported from China to France. While the cheaper MGs and Dacias are expected to remain cost competitive without financial incentives, the price gap between more expensive Teslas made in China and Germany will reduce significantly, spurring sales of the domestically produced Model Y.

In China, the Shanghai government extended the free license plate policy through to 31 December 2024, which was previously set to expire at the end of 2023. The city will continue to offer this for BEV and fuel cell vehicles; however, the criteria for receiving them has been tightened. ICE vehicle owners looking to buy an EV as their second car will no longer be eligible for the scheme, creating additional cost on ICE owners.

In North America, new guidance has been released on the Inflation Reduction Act (IRA), specifically on section 45X regarding the production and sale of certain products, including some battery components and critical minerals. Find CRU’s in-depth analysis relating to the US’s IRA and its “Foreign Entity of Concern” clause in this recent insight.

Notably, the Biden administration is also reportedly discussing increasing the 25% tariff on importing specific goods from China, including EVs. The import tariff and subsidies are designed to protect domestic production and avoid a slew of cheaper Chinese vehicle imports. This may be unnecessary as the tariff is already punitively high, and the handful of Polestar, Volvo, and BMW vehicles imported from China will soon have their tariffs offset by a provision allowing manufacturers to earn credits by domestically producing vehicles.

However, consumers ultimately bear the costs of these measures. Vehicle subsidies are, in effect, a cost to the taxpayer and an additional tariff barrier to more competitive EV imports mean vehicle prices are higher than without the measure.

Explore this topic with CRU

Author Cameron Hughes

Battery Market Analyst View profile

Author Xiaowei Mei

Senior Battery Demand Analyst View profile