In late September, the Russian government introduced plans for customs duties on the majority of the country’s most significant exports from October 1 onwards. The duty rate will impact most commodities, including ores, starting with the HS code 26, which incorporates zinc, copper and lead concentrates. The duty rates will be placed on the ‘custom value’ on a sliding scale from 0–7% based on the US dollar-Russian rouble exchange rate, and will remain in effect until the end of 2024. In this Insight, we explore what impact the duties will have on production cash costs for Russian zinc-producing mines in 2024.

Author Tom Rutland

Senior Analyst View profile

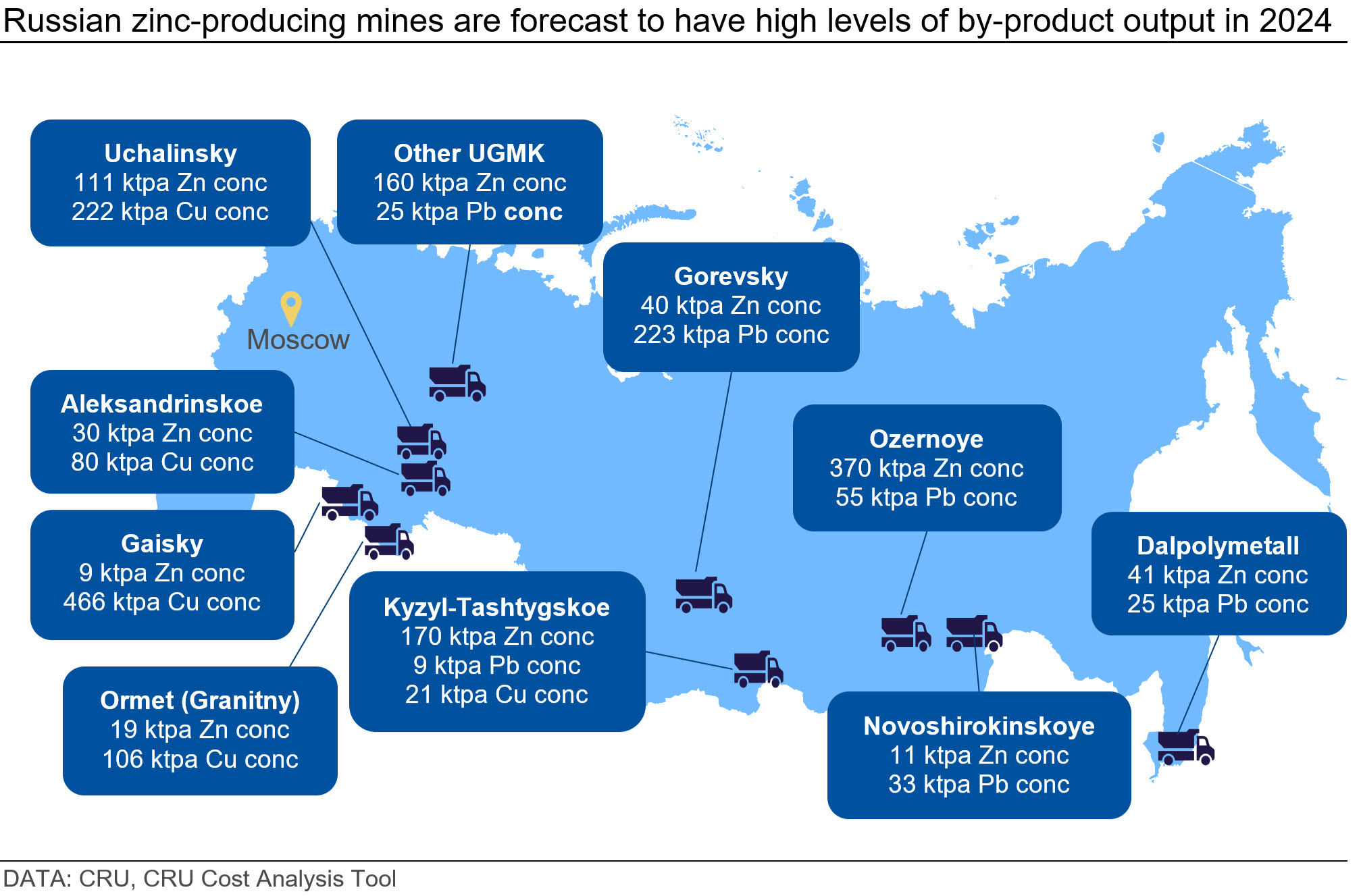

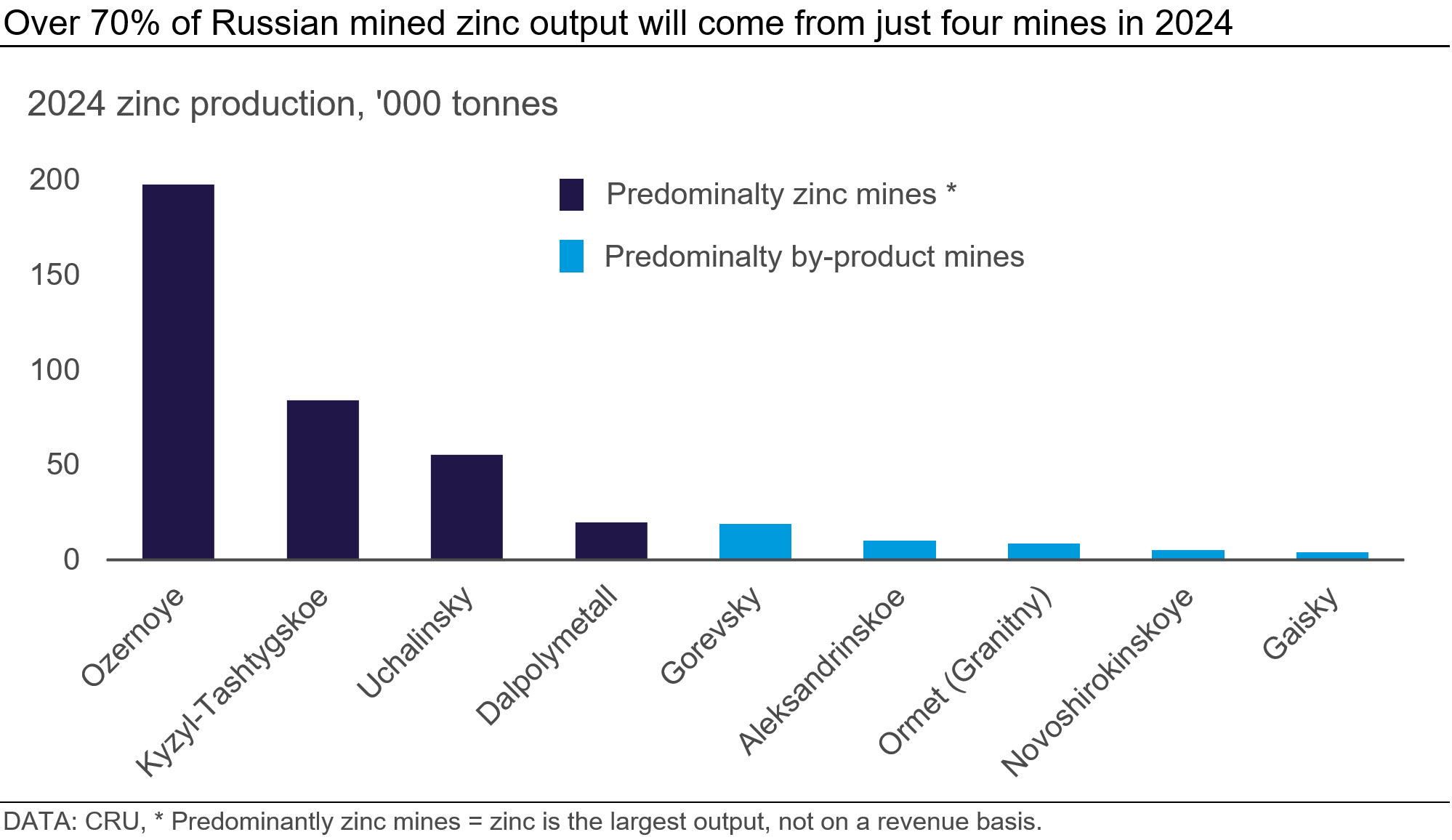

The zinc-producing mines in Russia are expected to produce a total of 502,000 t of zinc-in-concentrate in 2024. The majority (71%) of the mined zinc output will be supplied by the Ozernoye, Kyzyl-Tashtygskoe, Dalpolymetall and Uchalinsky mines. The Russian zinc-producing mines are also forecast to have a combined 222,000 t of lead-in-concentrate and 214,000 t of copper-in-concentrate during the year. Gorevsky, Aleksandrinskoe, Ormet, Novoshirokinskoye and Gaisky will account for 65% and 54% of the lead and copper production, respectively.

Zinc concentrate exports expected to increase in 2024

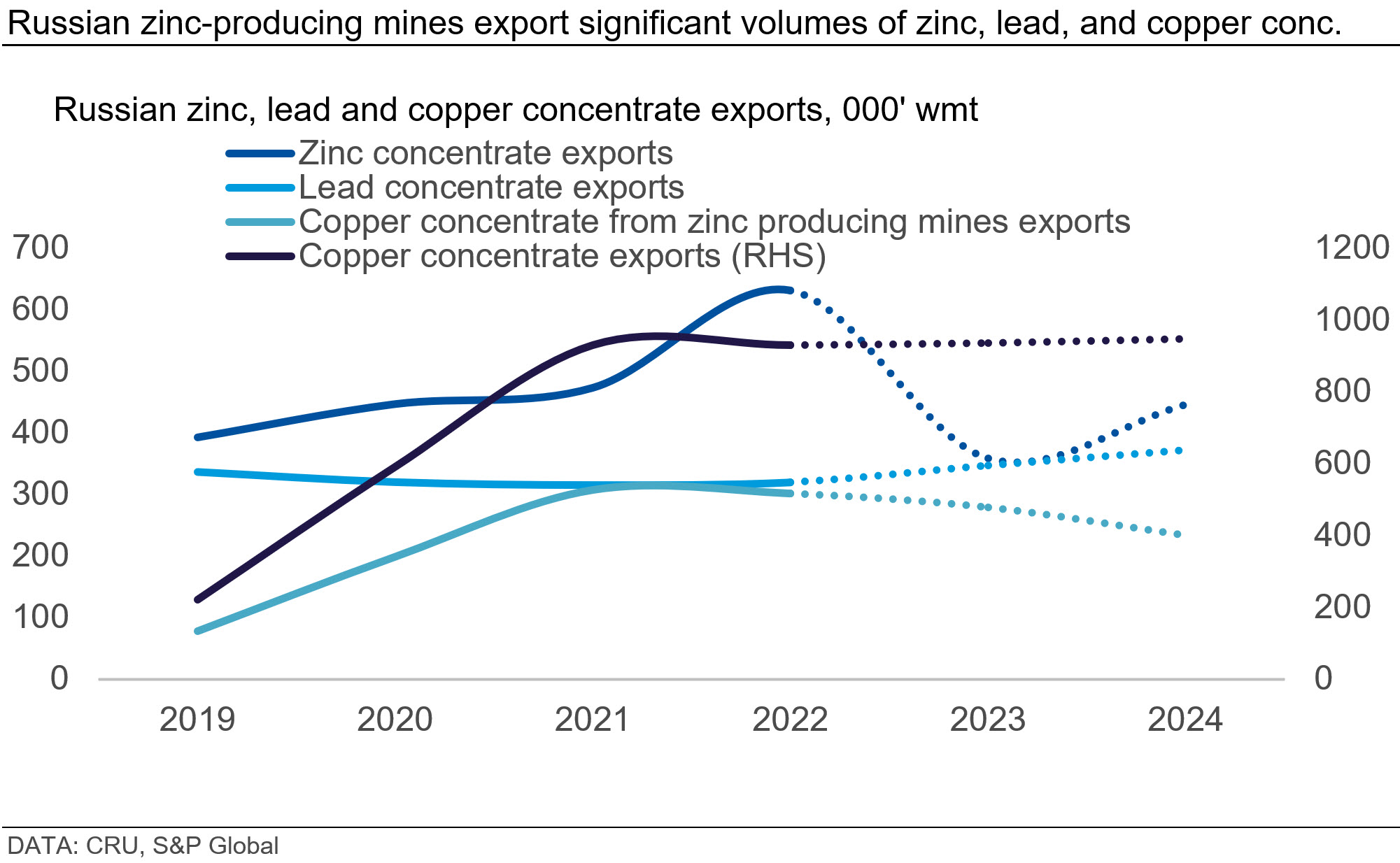

In order to determine the impact of the new duties on production costs, we need to establish how much each of the Russian mine’s output will be exported, and will therefore be liable for the new duties. Based on our mined and refined zinc supply forecasts, we expect around 203,000 t of zinc-in-concentrate, or 45% of Russia’s zinc mine supply, to be exported in 2024. This equates to approximately 446,000 t of zinc concentrate, higher than the 359,000 t we expect to be exported in 2023, which is primarily due to the ramping up of the Ozernoye mine that started producing in 2023 Q3. This will be offset by higher refined supply from the country as a result of the expected start of the 120,000 t/y Verkhny Ufalei smelter in 2024 Q3.

Meanwhile, the entirety of the mined lead produced in 2024 – which is estimated at around 372,000 t of lead concentrate – is expected to be exported from Russia due to the absence of a primary lead smelter in the country. As for copper, based on our mined and refined copper forecasts, we assess that around 947,000 t of copper concentrate will be exported from Russia next year. However, it should be noted that not all of Russian copper concentrate exports are from zinc-producing mines. Therefore, we estimate that copper concentrate exports from zinc-producing mines will total 233,000 t in 2024.

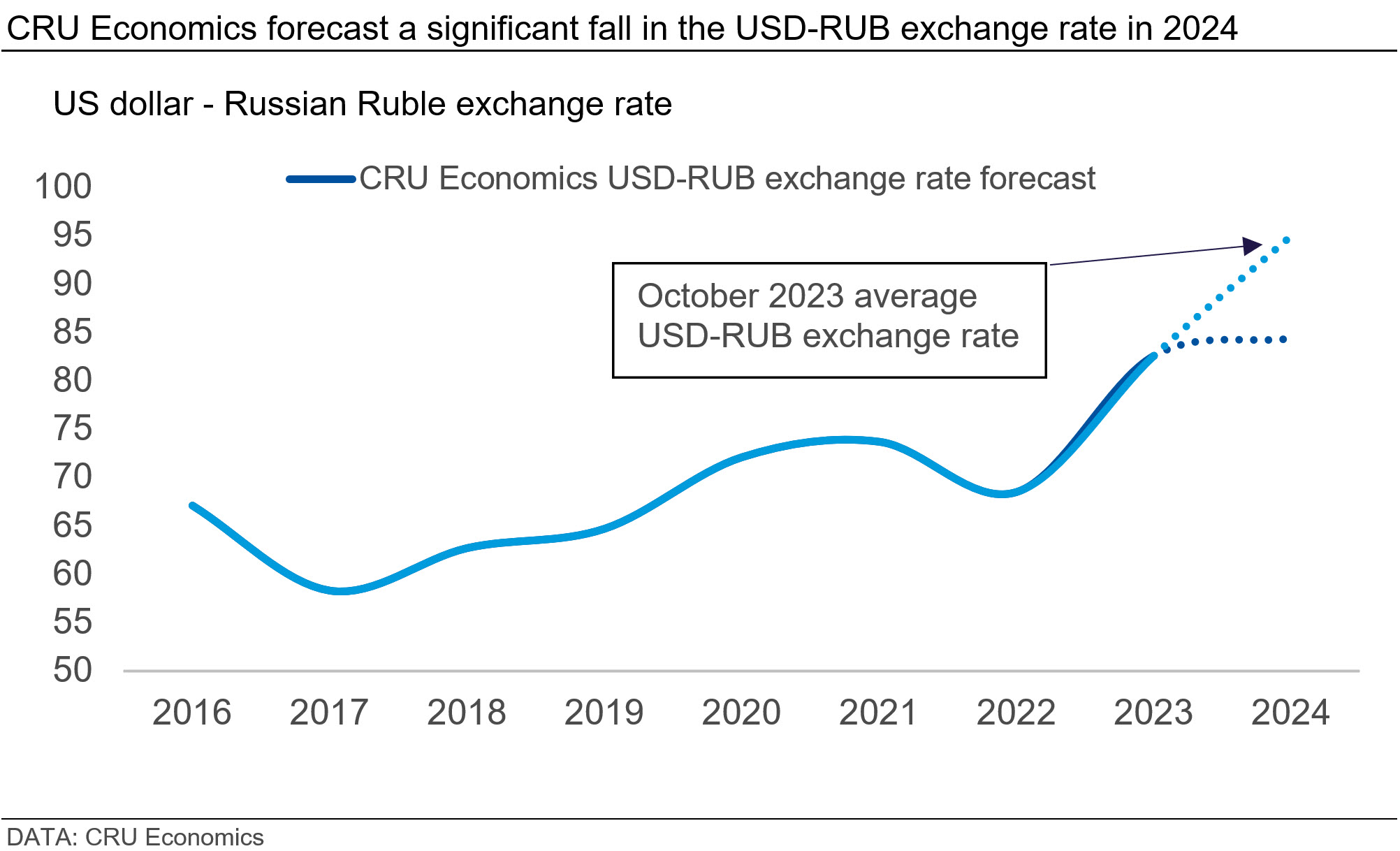

The duty rate depends on the Dollar-Rouble exchange rate

As mentioned previously, the duty rate will be on a sliding scale, which will be pegged to the US Dollar-Russian Rouble exchange rate. The press service of the Cabinet of Ministers reported that the exact duty rate on the list of commodity exports – that includes lead, zinc and copper concentrates – will be as follows:

- No duty will be imposed if the Russian Rouble is at or below 80 US dollars.

- 4% at an exchange rate of more than 80-85 Russian Roubles to the US dollar.

- 4.5% at an exchange rate of 85-90 Russian Roubles to the US dollar.

- 5.5% at an exchange rate of 90-95 Russian Roubles to the US dollar.

- 7% at an exchange rate of over 95 Russian Roubles to the US dollar.

So far in October, the US dollar to Russian Rouble exchange rate has averaged 97.7, implying that the current duty rate is 7%. However, the CRU Economics team are currently forecasting that the exchange rate will average 84.4 in 2024, which would equate to just a 4% duty rate. As this forecast shows a significant drop from current levels, we've factored in the new duties that will need to be paid by Russian zinc mines at 4% and 7%.

Estimated new duty paid by each mine varies significantly

To estimate the total duty that will be required to be paid by each of the Russian zinc-producing mines in 2024, we have used the LME cash price forecasts that are currently being used in CRU’s Cost Analysis Tool (Macro 2023 Q3), which are:

- Zinc - $2,132 /t

- Lead - $2,099 /t

- Copper - $9,059 /t

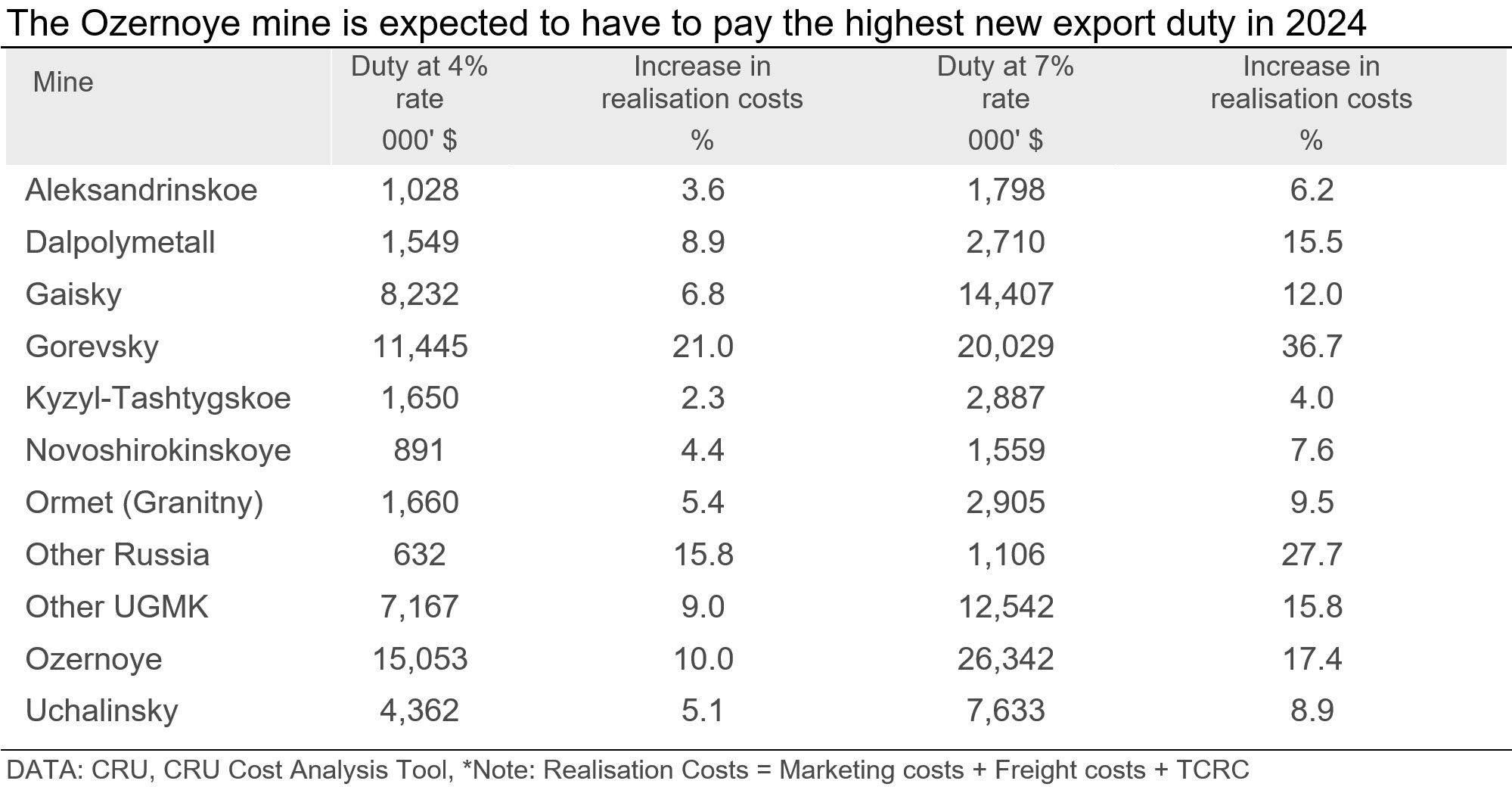

Based on our forecast for concentrate exports and metal prices, we have estimated the total duty that each of the Russian zinc-producing mines will be required to pay in 2024. This has been done based on both a 4% and 7% duty rate on the customs value of each of the assets’ exports. We have also calculated the impact of the new duties on each of the operation’s realisation costs, which can be found in the table below.

Regarding the duty expected to be paid by each of the assets, the recently started Ozernoye mine is expected to have the highest tariffs of $26.3 million when using a 7% duty rate. This reflects its scale and our expectation that the entirety of its output will be exported. However, due to the mine’s large zinc production volume, the forecast realisation costs were already large in absolute terms, and therefore, the percentage increase of 17.4% is only the third largest for an individual asset. Meanwhile, Gorevsky’s duty is estimated to total $20.0 million, equating to a 36.7% increase in realisation costs. This is due to the very high lead-zinc output ratio that is produced at the mine, as output of the latter is minimal.

As shown in the table below, the duty rate will have a significant impact on the mines’ operating costs. With a 4% duty rate, the individual assets will pay around $5.1 million, accompanied by an average 7.5% increase in realisation costs. Meanwhile, the 7% duty rate will result in an equivalent charge of $9.4 million with a 14.6% rise in costs.

New duty to have minimal effect on largest Russian mines

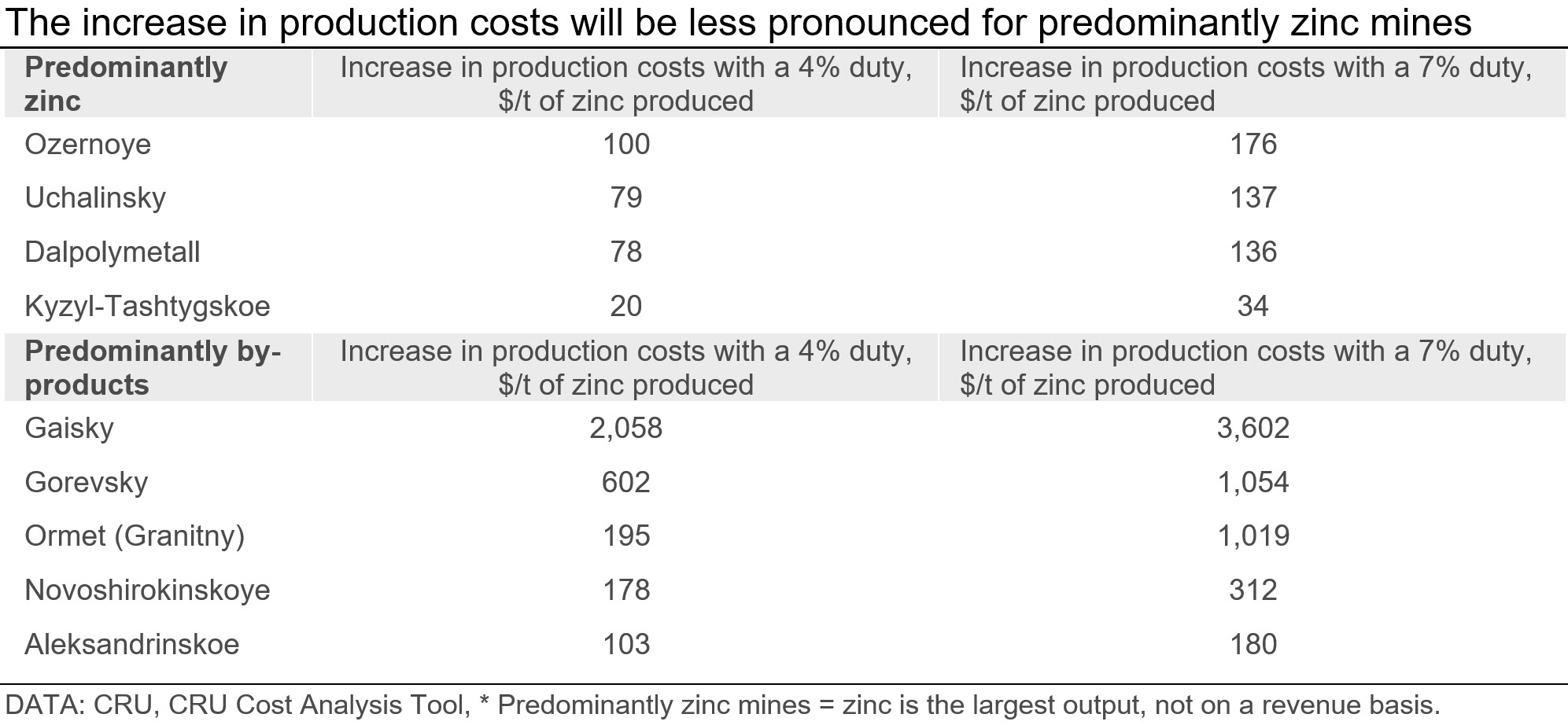

While the duties expected to be paid by each of the Russian zinc-producing mines equate to very significant fees, the impact on the costs to produce one tonne of zinc is less pronounced, particularly for the largest zinc-producing mines.

Generally, Russia’s average cash cost is on the negative side of the cost curve as it benefits from high by-product credits coming from copper, gold, silver, and lead – such as at Gorevsky, Aleksandrinskoe, Ormet, Novoshirokinskoye and Gaisky. While the impact of the production costs on these assets will be significant, the overall effect on the zinc cost curve is relatively small as they do not produce high volumes of zinc. Meanwhile, the operations that predominantly produce zinc, and account for a more significant portion of the cost curve – such as Ozernoye, Kyzyl-Tashtygskoe, Dalpolymetall and Uchalinsky – will have a less meaningful impact on their production cash costs.

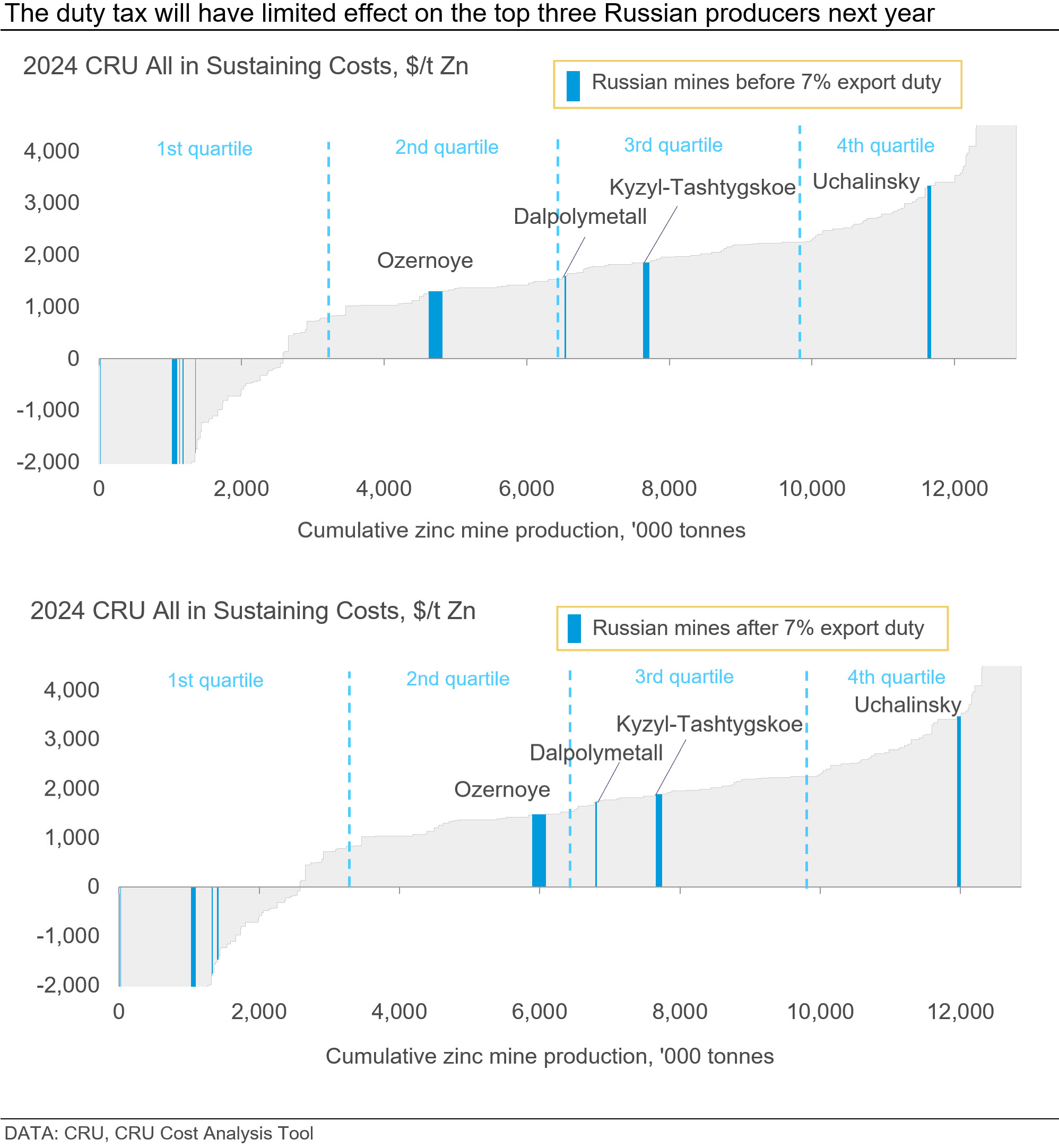

In the two 2024 cost curves shown below, we compare the production costs of the assets which predominantly produce zinc before and after the duty tax introduction. As highlighted by the charts, all four of Ozernoye, Kyzyl-Tashtygskoe, Dalpolymetall and Uchalinsky will remain within the same quartiles.

As Ozernoye will be ramping up production in 2024, it is expected to become the eighth largest zinc mine in the world, and the 7% duty tax will add $176 /t to its costs, moving it from the middle to the higher end of the second quartile. Meanwhile, Kyzyl-Tashtygskoe and Dalpolymetall’s costs will increase marginally. Additionally, Uchalinsky will move slightly higher above the 90th percentile.

Overall, the introduction of this duty tax will add some pressure on Russian miners in 2024 but will not shift costs at a significant level. The highly negative cash cost mines such as Gaisky, Gorevsky, Novoshirokinskoye and Ormet will be unaffected on a $/t of zinc basis, while Ozernoye will remain at the lower half of the curve, and Uchalinsky will move higher in the risk zone above the 90th percentile.

Explore this topic with CRU

Author Tom Rutland

Senior Analyst View profile