On 19 March 2024, Tianqi Lithium announced it will partner with CATL and Chengxin Lithium to jointly invest RMB300 million in a 220 kV power infrastructure project in Gyabjeka ore field, also known as Jiajika. The aim is to develop the spodumene projects of Dechenongba, Yajiang Cuola and Murong, owned by the three respective companies.

Author Yiwei Yin

Senior Analyst View profile

Xiaowei Mei

Senior Battery Demand Analyst View profile

Among these mining projects, Yajiang Cuola and its operator, Snowway Mining, faced insolvency in 2022, leading to a liquidation process. Its exploration rights were put up for public auction in May 2022. However, the winning bidder failed to fulfill the payment of $300 million for a 54.3% share in Snowway – an amount that was almost 600 times the starting bid. CATL stepped in, proposing a RMB1.64 billion payment to clear its debts, with an additional RMB4.8 billion to completely acquire Snowway Mining.

Integrating with Sichuan’s upstream

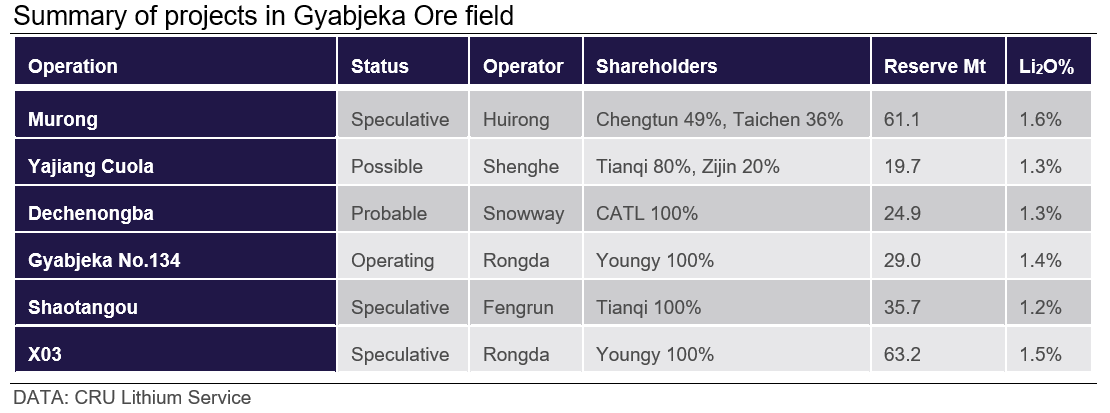

There has been a surge in interest in these spodumene projects, located in the Gyabjeka ore field – a pegmatite-hosted lithium deposit. This is the largest known lithium spodumene ore body in Asia with grades ranging from 1.30% to 1.63% Li2O, compared to an average production grade of 1.8% at Greenbushes. Situated in the western part of Sichuan Province, at the junction of three counties – Kangding, Yajiang, and Daofu – it is geologically located on the eastern margin of the Qinghai-Tibet Plateau. This falls in the middle of the Songpan-Garze Orogenic Belt, with an average altitude of 4,400 m above mean sea level.

The initiation of this joint venture may indicate that major Chinese lithium and battery producers are now prioritising development of low operating cost projects, including those in Sichuan, in response to the current low-price environment. Currently, Sichuan’s operating spodumene projects positioned below the 50th percentile line on the cost curve have value-adjusted cash costs (VACC) below $500 /dmt. This cost advantage stems from exceptional ore grades, low strip ratios and high recovery rates from beneficiation. The projects in the Gyabjeka area will be able to enjoy much larger profit margins than Jiangxi lepidolite operations, which are currently experiencing a negative cash margin under current market circumstances.

Lacking investments and infrastructure, these spodumene projects in Sichuan – classified under possible and speculative status – are not factored into CRU’s medium-term mine supply forecast. CRU assumes that the operating projects in Sichuan province will contribute to only 13% of China’s lithium mine supply in 2028. If the development of the power infrastructure project goes smoothly, we expect the three benefitting spodumene mines will deliver an additional 97 kt/y LCE production, accounting for around 19% of the total Chinese lithium supply by 2028.

Developing Sichuan’s lithium mines has its challenges

Although the producers will benefit from low operating costs, there are a lot of challenges and uncertainties in the development of projects in Sichuan Province. These projects are mostly located in remote and mountainous areas, requiring higher development capital and longer periods of construction.

For instance, the Gyabjeka No. 134 project originally received its mining permits and started construction in 2005. After a five-year construction and ramp-up period, the project eventually reached ~6 kt/y LCE production capacity in 2010. Development cost was an estimated RMB320 M, as reported in 2019, and a further RMB720 M was estimated for an additional 2.5 Mt/y (~60 kt/y LCE) over two phases. Construction of these expansions had still not begun as of early 2024.

Environmental regulations have also become a lot stricter, especially in the western part of Sichuan, as it falls into the Garze Tibetan Autonomous Prefecture. Garze has a “mining in the prefecture, processing outside” policy, requiring all ore to be transported over 250 km away for further processing at the Chenggan-Ganmei Industrial Park, located near Chengdu.

By 2018, Youngy – the owner of Gyabjeka No. 134 project – had spent RMB90 M to build a 30 km-long road linking the mine site with the town of Tagong for the transportation of ore. In addition to these extra costs, the prefectural government also requires strict environmental protection standards during the development of projects, including wastewater recycling, surface rehabilitation and pollution-free air waste emissions. Previous incidents in this environmentally sensitive area have brought in more stringent regulations than in other regions.

Collaboration between major Chinese lithium and battery producers will allow for efficiencies and improve negotiating power, increasing the prospects of each of these projects. Improved infrastructure in the area also lowers capital and operational costs, and shortens the time required to construct the mines. These projects are also expected to deliver a higher quality, lower cost concentrate that will be in high demand from non-integrated refiners when compared to other Chinese pegmatite mines.

Is this investment capital better spent overseas?

While Chinese firms have invested in lithium projects on almost every continent, it is worth making a comparison to one location due to the ease of access and similar cost of investments. Africa’s lithium projects have attracted almost $2 billion in the last three years, with the majority of this concentrated in Zimbabwe.

Sichuan’s pegmatite projects have many advantages when compared to Chinese investments in Zimbabwe, including the following:

- Zimbabwean pegmatites sit in the third quartile of the cost curve, with an average of VACC CIF China of $730 /dmt. By comparison, Sichuan spodumene projects sit within the first quartile of the cost curve, benefiting from higher grades and proximity to large scale refining facilities.

- Local community relations during project development are more challenging in Zimbabwe, compared to Sichuan. Even for projects located in the Tibetan Autonomous Prefecture, it is easier to communicate with local communities as they are still under Chinese governance.

- Due to the blending of spodumene with small quantities of petalite, concentrates from Zimbabwe are of a lower quality and are more difficult to process. Only a few refineries in China have the capability to process these concentrates. Concentrates from Arcadia, for example, owned by Huayou, are only sent to Nanshi for further processing.

- Considering the distance between Africa and China, supply is highly dependent on the shipping capacity, and cost will also vary according to the ocean shipping rate. Shipping costs comprised almost 20% of the VACC CIF China for Zimbabwean projects.

A consistent and competitive source of domestic supply

Sichuan’s projects represent an important support to Chinese domestic raw material security ambitions. In 2023, China’s industry imported over two-thirds of its demand for lithium from abroad, leaving the world’s largest battery market highly exposed to the turbulence of geopolitics and trade disruptions. Ongoing investments in the upstream will already improve the independence of its supply chain, but these three mines alone could satisfy 10% of domestic consumption by 2028. That translates to reduced external vulnerability, and an improved position also strengthens Chinese buyers’ negotiations in foreign concentrate markets.

Considering the challenges facing their development, these projects do not represent a quick fix to Chinese domestic lithium supply. However, with time, Sichuan’s spodumene producers will become a serious competitor to not only local lepidolite supply, but also mines in Africa and Australia. A cautious price outlook in the mid-term is expected to encourage the shift toward more competitive production, although Jiangxi’s higher cost lepidolite producers will remain a source of swing supply, thus protecting buyers from high prices. An alternative supply will also help to alleviate environmental pressures that have been highlighted by the recent government inspections.

Explore this topic with CRU

Author Yiwei Yin

Senior Analyst View profile

Xiaowei Mei

Senior Battery Demand Analyst View profile