The recovery of the South African chrome industry over the last four months has been dramatic. Back in March, chrome ore prices were at a six-year low in nominal ZA rand terms; by July, they had rebounded to their highest levels since the global financial crisis in 2008.

The proximate cause of this turnaround is obvious: Chinese demand largely defines the chrome market, and since early Q2 it has been especially strong. A combination of stimulus-linked demand for ferrochrome in China and a relative absence of chrome inventory led to a scrabble for South African ore. Prices rose and have remained stable for about the last two months. The recovery in chrome prices also coincides with what CRU believes to be significant moves to consolidate the South African industry. These should pave the way for the creation of a stronger South African chrome sector; one that can regulate supply (both of alloy and ore) better than has been possible in recent years, while also ensuring South Africa's overall charge chrome output increases in future.

Competitiveness via integrated ore supply

The South African charge chrome producers that closed within the last year—Tata KZN, International Ferro Metals (IFM) and ASA Metals (ASA)—did so primarily because they could not rely on a fully integrated supply of ore. They either had no direct link to a South African chrome ore mine, like Tata KZN; or else were burdened with increasingly high-cost, unproductive mines, like IFM and ASA. (Hernic, although still operating, has had much the same difficulties). These plants' inability to supply their ore needs meant that all too often they had to buy material on the open market, where prices were on a par with those paid by Chinese importers. As the cost of shipping chrome ore from South Africa to China declined in recent years, the competitive advantage of being located close to chrome ore resources diminished to the point where smelters, which otherwise had no special technical attributes, were no longer profitable.

It now looks as though these plants could come back into operation as a result of a series of takeovers that would consolidate the South African charge chrome sector into two large groups, one led by Samancor, the other by Glencore. The rationale for these moves would be to integrate the currently inactive smelters into Samancor and Glencore's respective chrome ore supply chains. Here's how such a future might look:

-

Samancor has clinched the takeover of the IFM smelter, which is located close by the former's Western Chrome Mines (Mooinooi and Millsell mines). Samancor aims to have the former-IFM plant, which has a total nameplate capacity of 267ktpy, working again during Q4. (See Map 1)

-

Also, some sort of joint-venture might be possible between Samancor and Sinosteel regarding the ASA Metals plant. On paper, the ASA plant (located in Dilokong, Limpopo; nameplate capacity 410ktpy) could integrate into Samancor's Eastern Chrome Mines (located around the Steelpoort region). Progress on a new plan for ASA was anticipated by now, but CRU understands it may now be delayed. If so, other parties may show an interest in ASA Metals. From our perspective, however, the ore synergies possible with Samancor seem compelling. (See Map 2)

-

Traxys is planning to restart the former Tata KZN plant at Richards Bay (nameplate capacity 150ktpy) in the near future. Traxys will supply the plant with ore from its mines in Steelpoort and Sefateng, both of which are more than 600km away from Richards Bay.

-

These developments are likely to increase the likelihood of Glencore bidding for Hernic (currently operating, nameplate capacity 420ktpy). Mitsubishi, Hernic's majority shareholder, has previously said it would be open to offers. Glencore dominates the trade of UG2 concentrate on the Bushveld Complex's Western Limb; as such it is a good fit for the Hernic plant, which is located close to Rustenburg.

If consolidation were to occur as outlined above, Glencore's overall capacity would rise to around 2.7mtpy, while Samancor would control (via JVs) slightly more than 2mtpy of capacity. Traxys and Afarak would retain a place in the charge chrome market, but would be tiny compared to the two main producers.

The benefits of control: improved competitiveness and a means to absorb low-cost ore

Broadly speaking, consolidation appears to be the simplest means for South Africa to make the most of its existing charge chrome capacity in future. In recent years, the country's smaller producers have been locked into a pattern of trying to maximise their output regardless of market conditions in order minimise their unit costs. By contrast, two large producers would find it easier in future to cross subsidise their less efficient furnaces with output from their most efficient plants.

Besides improving the aggregate competitiveness of South Africa's existing charge chrome capacity, this would also help resolve imbalances in the chrome ore market, which currently play into the hands of Chinese buyers. Glencore has more UG2 concentrate available to it on the Western Limb of the Bushveld complex—if it were to takeover Hernic, some excess supply could be converted at that plant rather than exported to China, as potentially happens at present. Samancor would also be able to increase its use of fines and concentrate owning to the pelletizing capacity that will be available to it at the IFM plant and, depending on developments, at ASA Metals. On balance, CRU believes that consuming more of this potentially low-cost (certainly in the case of UG2) chrome ore supply within South Africa will have a supportive influence on ore export prices.

Explore this topic with CRUThe Latest from CRU

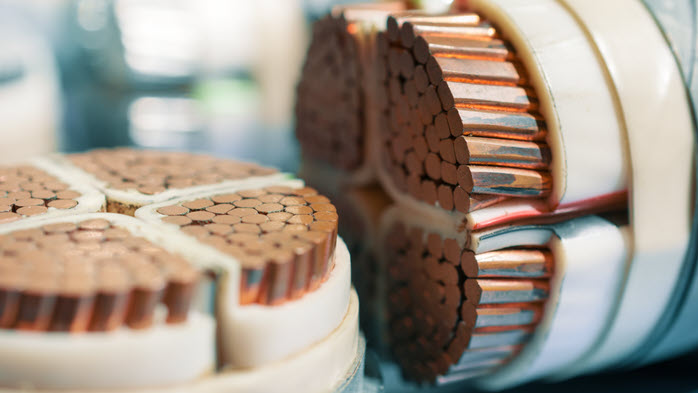

Key takeaways from CRU’s Wire and Cable Amsterdam conference

CRU held its seventeenth consecutive Wire and Cable conference in Amsterdam, during 24–26 June 2024. Day 1 kicked off with a warm welcome to around 200 conference...