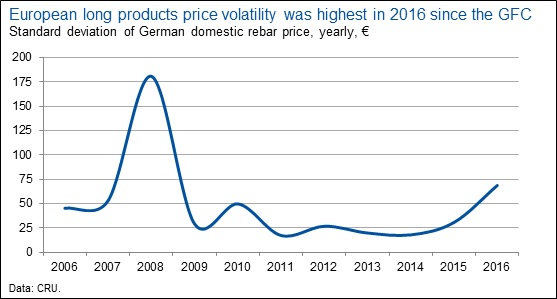

Keeping up with European long products markets may have felt like a rollercoaster ride for many this past year, and indeed price volatility in 2016 was the highest it has been since the Global Financial Crisis.

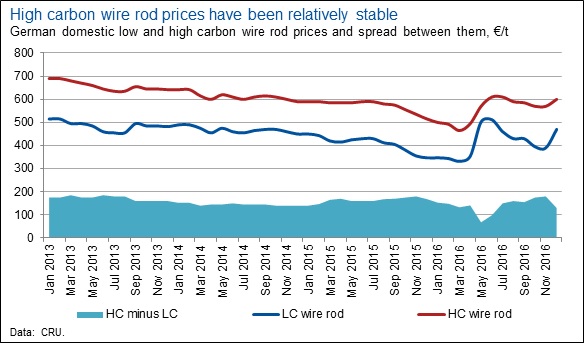

However, the extent of this volatility varied between product types, and another key feature of 2016 market dynamics was the relative stability of high carbon compared to low carbon wire rod prices. This insight will briefly review the key drivers of last year's price volatility and outline the important factors that have affected the spread between low and high carbon wire rod prices.

Prices started out 2016 near the bottom of what was a multi-year downward trend. German domestic rebar prices were €368 /t in January 2016 and bottomed out at €350 /t in March 2016. The market then underwent an incredible rally in May with prices peaking in June at €550 /t for rebar. Rebar prices increased €163 /t m/m in May: the largest month-on-month change since the price crash in October 2008. This rally followed an upward price trend in markets elsewhere and was supported in Germany by low stock levels and a tightening of supply by mills, who limited volumes of individual orders in anticipation of further price hikes. However, these price levels were unsustainable given prices in international markets. German prices corrected downwards in the summer and then fell further in the autumn, when strong import competition from CIS countries as well as Italy forced German producers to bring their prices down in line with other markets. The final quarter of the year started out on a downward trend, but quickly turned the corner following an unexpectedly sharp increase in scrap prices in November. Rebar prices increased €65 /t m/m in December on the back of ongoing cost inflation. From local short-term supply tightness to global rises in raw materials prices, various factors made 2016 a rollercoaster year for European long products prices.

Low carbon wire rod prices followed a very similar pattern to rebar prices and accordingly reached a similar level of volatility in 2016. High carbon wire rod prices were also highly volatile compared to history, but were relatively stable compared to low carbon wire rod prices (see chart above), leading to increased movement in the spread between the two prices. Importantly, the vast majority of the high carbon wire rod market is contract-based purchases in which buyers have strong relationships with the small handful of mills in Europe that produce this quality of wire rod. Some contracts for high carbon wire rod are as long as one year, and spot purchases are estimated to be just 10% of the total market. This fundamental difference between low and high carbon wire rod markets is an ongoing driver of the relative price stability for high carbon wire rod, and prevented high carbon wire rod prices from increasing as much as low carbon wire rod prices in May 2016. This relative stability of high carbon wire rod prices was further strengthened in 2016 by a couple key market conditions which have emerged over the past year.

2016 saw a stark difference in the performance of the automotive and construction industries in Europe: vehicle production growth was robust in Western Europe, while construction growth was sluggish and even contracted in some countries (see chart). Non-residential construction, which is a key source of demand for steel used in concrete reinforcing, was especially weak across the region. High carbon wire rod, often used in the manufacture of tyre cord and mechanical joining products, is much more heavily used in vehicle production than low carbon wire rod, which is relatively more exposed to the construction industry. Accordingly, the strength of end-use demand from vehicle production has been an important support for high carbon wire rod prices over the past year, helping to keep prices relatively strong compared to low carbon wire rod prices.

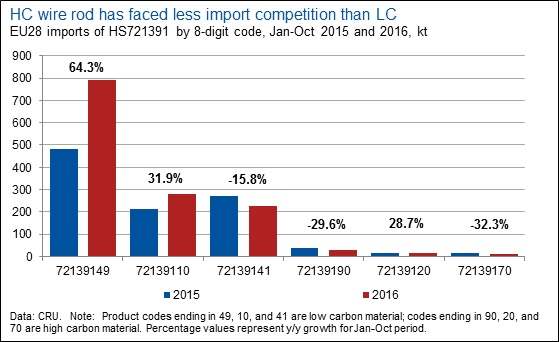

High carbon wire rod has also been less exposed to import competition than low carbon wire rod. EU28 wire rod imports increased significantly in 2016, mostly under the trade code HS721391. Imports under this trade code increased 31% y/y in January to October 2016 compared to the same period in 2015. The chart below illustrates which products within this code increased most in 2016: 72139149 and 72139110, both of which are low carbon products. Imports of high carbon material within this 6-digit trade code changed very little in volume terms. Clearly, import competition has been a significant pressure on the low carbon wire rod market in the EU over the past year, while the high carbon wire rod market has been free from this effect, allowing for greater stability in prices for high carbon material.

Conclusion

Long products price volatility was unusually high in 2016, but especially so for rebar and low carbon wire rod. High carbon wire rod prices, on the other hand, were relatively stable due to good demand from the automotive sector compared to the construction industry, less pressure from import competition compared to low carbon material, and greater use of contract-based buying compared to the low carbon wire rod market.

The spread between low carbon and high carbon wire rod prices has narrowed between November and early December, but has recently started to widen again. High carbon wire rod producers are generally BOF-based mills, while low carbon wire rod producers are EAF-based, and if scrap prices continue to lag the gains made recently in hot metal production costs then high carbon wire rod prices will be under greater pressure to increase than low carbon wire rod prices. Overall, given the unsustainable strength of coal and iron ore prices over the past couple months and subsequent rises in scrap prices, 2017 will likely be another interesting year in steel markets. We expect cost inflation to drive price increases throughout Q1 and then a downward correction to begin in Q2 following decreases in production costs. Fasten your seatbelts - the rollercoaster ride continues.

Explore this topic with CRUThe Latest from CRU

Key takeaways from CRU’s Wire and Cable Amsterdam conference

CRU held its seventeenth consecutive Wire and Cable conference in Amsterdam, during 24–26 June 2024. Day 1 kicked off with a warm welcome to around 200 conference...