China Macro Insight

As the geopolitical tensions and weakening global demand continued to impact China's trade performance, China has been working to reduce its dependence on the developed markets. China's efforts to diversify its export portfolio through new markets and products in recent years have been successful in mitigating the effects of these downside risks, and in opening up new avenues for long-term growth.

China has been diversifying its export portfolio

China is an export powerhouse. The dollar value of its goods exports overtook Japan in 2003, the US in 2007 and Germany in 2008, and it is now by far the largest goods exporter in the world. In 2022 it exported almost double the goods of its closest rival, the US. China is now the biggest trading partner for more countries than any other.

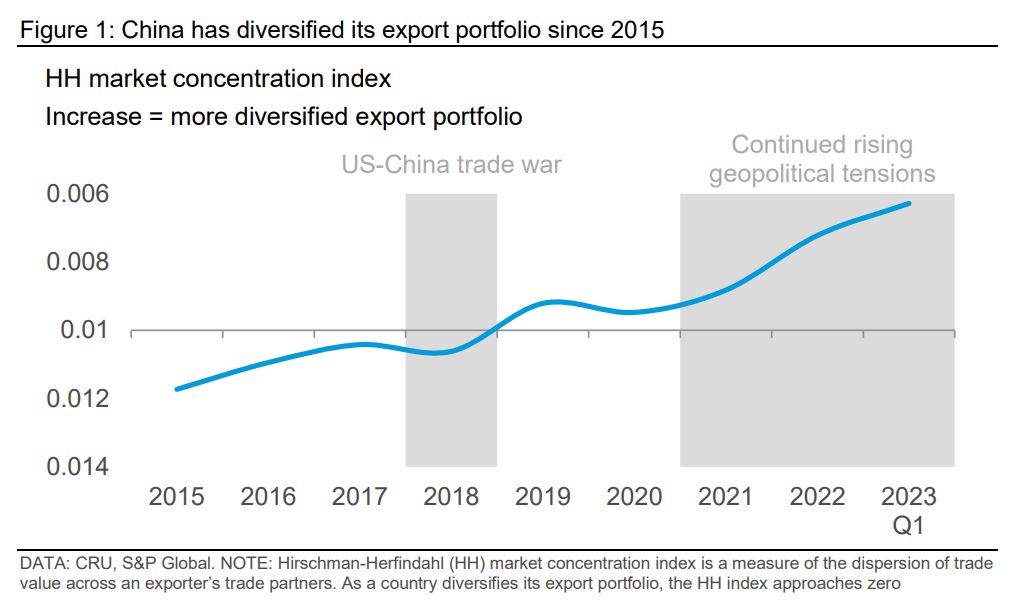

However, since the start of the US-China trade war in 2018, China has been facing a challenging economic environment, with increased tariffs on its exports to the US and other trade tensions with major trading partners in developed markets. In response, China has been diversifying its export portfolio to reduce its dependence on the US-centred developed markets. It has also been ‘moving up the value chain’, focusing on higher value-added products. As such, China’s market concentration index has fallen to 0.006 in 2023 Q1 from 0.011 in 2018, suggesting a more diversified export portfolio (Figure 1).

Chinese exporters find new opportunities

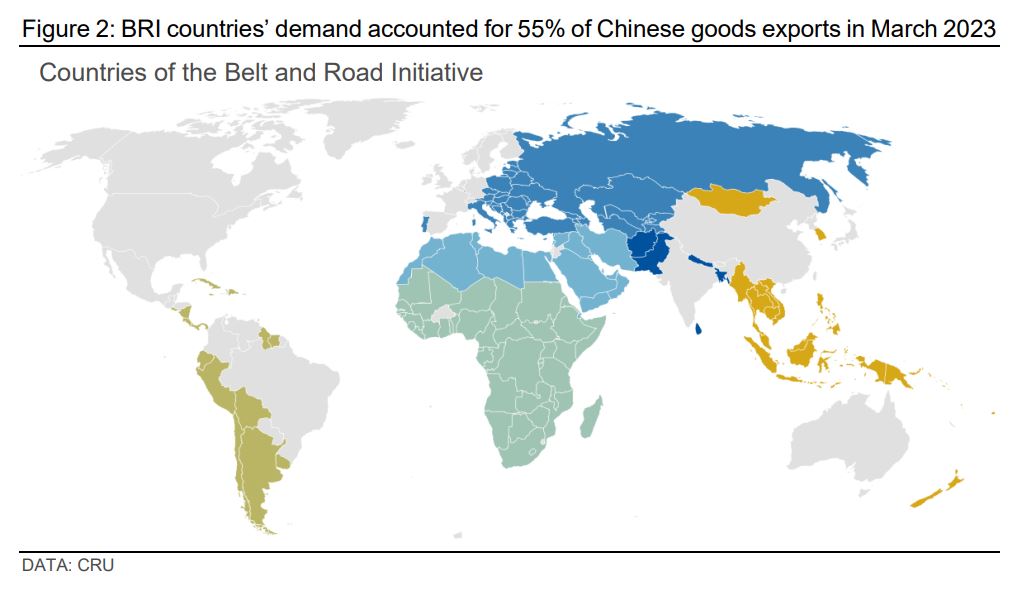

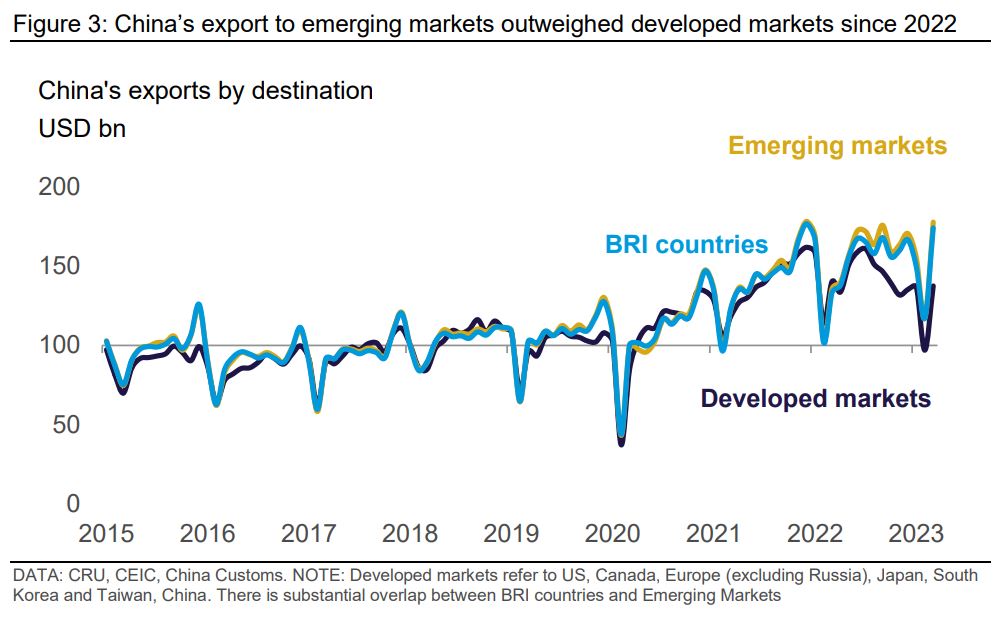

One of the key strategies that China has implemented to diversify its export portfolio is to expand its exports to new markets. According to data from China's customs, China's exports to the US fell by 17% y/y in 2023 Q1, while its exports to countries along the Belt and Road Initiative (BRI) increased by 10%. The BRI is China's ambitious infrastructure development and investment program that aims to connect Asia, Europe, and Africa through land and maritime networks. Through the BRI, China has been able to expand its exports to economies and regions such as ASEAN, Russia, Central Asia, and the Middle East, which have become important new markets for Chinese exports.

In addition to the BRI countries, China has also been focusing on increasing its exports to other emerging markets such as South Asia and Latin America. China's exports to South Asia increased by 3.8% y/y in 2023 Q1, while its exports to Latin America increased by 0.5%. These regions offer significant growth potential for China's exports, as they have large and growing populations and, in the case of India, growing middle classes. However, India’s decision not to join the RCEP trade agreement, as well as geopolitical tensions, may limit the scope for China building market share. India is also trying hard to position itself as a production hub for some consumer products that China currently dominates, such as smartphones.

Overall, shipments to emerging markets have compensated for weak demand from developed markets. Looking ahead, export growth is likely to stay in positive y/y territory in April due to base effects. However, there is a possibility that by the end of 2023 Q2, merchandise exports may decline due to concerns about elevated inventory levels and the impact of tightened interest rates on consumer and business demand all over the world.

Climbing up the quality ladder: China’s “new three items”

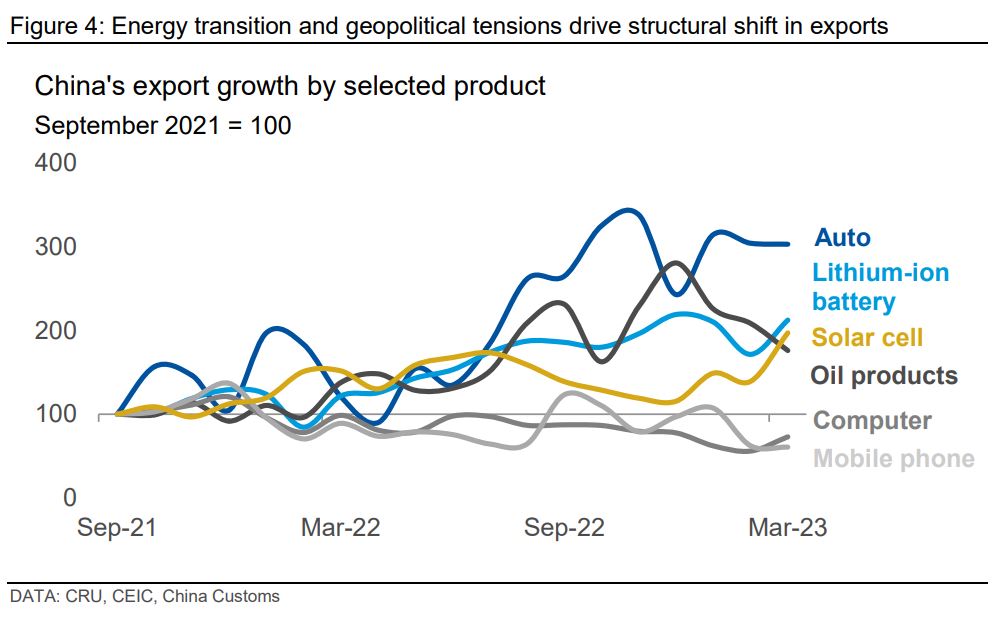

Another strategy that China has employed to diversify its export portfolio is to increase its focus on higher value-added products. Historically, China has been known for exporting lowcost, labour-intensive products such as textiles, toys, and consumer electronics. However, in recent years, China has been shifting its focus to more value-added products such as autos (particularly EVs), lithium-ion battery and solar cells, known as the “new three items” (Figure 4). These products are benefited from the global trend towards energy transition and transport electrification and will continue to grow robustly.

Furthermore, China has been importing more crude oil from Russia since the war in Ukraine, a 33% y/y growth in volume terms in 2023 Q1. Strong exports of refined petroleum products in 2023 Q1, a 77% y/y growth, reflects the re-direction of energy trade flows following the sanctions on Russian energy products. With Europe no longer buying Russian refined products, more Russian crude is being shipped to China to be refined and then re-exported.

In sum, China has been successfully diversifying its export portfolio since the start of the USChina trade war. By expanding its exports to new markets, such as the BRI countries, Africa, and Latin America, China has reduced its dependence on the US market and has mitigated the impact of the trade war. In addition, by focusing on higher value-added products, China has been able to enhance its competitiveness in the global market and has opened up new opportunities for growth. While geopolitical tensions and weakening global demand have created significant challenges for China's trade, it has also forced China to rethink its export strategy and has encouraged it to explore new markets and new product lines. As a result, China's export portfolio has become more diversified and more resilient, which will help to support its long-term economic growth.

If you are keen to hear more about our views on China and global economy, please refer to Global Economic Outlook and/or get in touch with our CRU economists:

Henry Hao: Hangwei.Hao@crugroup.com

Alex Tuckett: Alex.Tuckett@crugroup.com

Explore this topic with CRU