Last November, the People’s Bank of China (PBoC) announced a new loan program to support carbon reduction projects. According to this, any financial institution in China can borrow from the PBoC at a 1.75% one-year lending rate for up to 60% of the green loan’s value. The institution can then offer this loan back to its clients at an interest rate close to the loan prime rate (LPR) which is currently at 3.75% and 4.45% for one and five years, respectively. Each green loan needs to be reported back to the PBoC for a third-party check of the carbon reduction information.

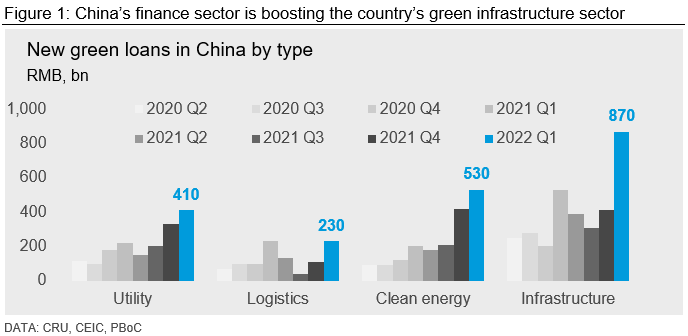

While China’s green finance market is still in its infancy – at a market size of RMB18.1 tn ($2.7 tn) as of 2022 Q1 – it is the biggest green credit market in the world. As shown in Figure 1 below, green infrastructure projects have been the largest recipient of this credit. In fact, in 2022 Q1, green infrastructure loans more than doubled from RMB410 bn to RMB870 bn. As China pledged to become carbon neutral by 2060, we expect its green finance sector to continue growing in the future.

These and other economic developments that impact commodity markets are discussed with CRU subscribers regularly. To enquire about CRU services or to discuss this topic in detail, get in touch with us.

CRU experts discussed the impact of the war in Ukraine on commodity markets in a recent webinar. Experts from all major commodity areas joined CRU’s Head of Economics and an energy specialist to discuss markets one month on from the invasion of Ukraine. The webinar is available to watch on-demand here.

Explore this topic with CRU