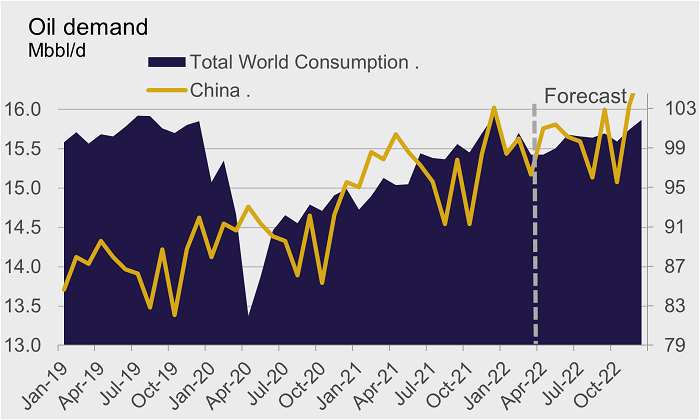

China’s prolonged Covid-19 lockdowns, coupled with a weaker global economic outlook, have taken a toll on oil prices in recent weeks. Futures prices for ICE Brent were trading at around $105/bbl as this report went to print. This represents a drop of 18% since the price spike in early March caused by Russia’s invasion of Ukraine. As per the Energy Information Administration (EIA), China’s demand dropped by 0.46Mbbl/d (2.9% m/m) in March, the month when the Omicron variant became widespread in China.

A weaker global economic outlook along with China’s outbreaks have led to a 0.81 Mbbl/d (0.8%) downside revision to 2022 global oil demand. Demand is now expected to average 99.80 Mbbl/d this year.

Despite these downside forecasts revisions, the oil market remains tight. On the demand side, the EIA still expects the global demand to grow 2.5% y/y this year, as activity continues to recover from the pandemic. Meanwhile, on the supply side, oil markets are struggling to offset a reduced flow from Russia. OPEC+ is failing to meet output targets, exacerbated by recent disruptions in Libya. An embargo by the EU would further tighten the market. Global inventory is at its lowest level since 2014. We expect these dynamics to keep oil prices above the $100/bbl level throughout the end of 2022 Q3.

These and other developments that will determine the future path of oild demand and the impacts on the commodity markets are discussed with CRU subscribers regularly. To enquire about CRU services or to discuss this topic in detail, get in touch with us.

CRU experts discussed the impact of the war in Ukraine on commodity markets in a recent webinar. experts from all major commodity areas joined CRU’s Head of Economics and an energy specialist to appraise markets one month on from the invasion of Ukraine. The webinar is available to watch on demand here.

Explore this topic with CRU