The client, a Japanese trading house, asked us to aid their strategy development process by defining, separating and estimating the super cycles in historical commodity prices and to use our understanding and expertise to explain commonalities and differences.

A final section was to draw some conclusions for the future. Although one cannot forecast prices based on this method alone, the method had to be designed to extract important lessons for the future from an expert understanding of the past history of the commodity.

Our recommendation

One recommendation was to recognize that super cycles in these commodities can be influential and long-lasting and are distinct from short-lived temporary spikes and troughs. A deep analysis into the causes of the super cycles identified the main problem to be exaggerated supply reactions to what would otherwise be temporary shocks and an insufficient consideration of competitors. Our main recommendation was to address these issues through a conscious design of a planning and reaction process.

Methodology

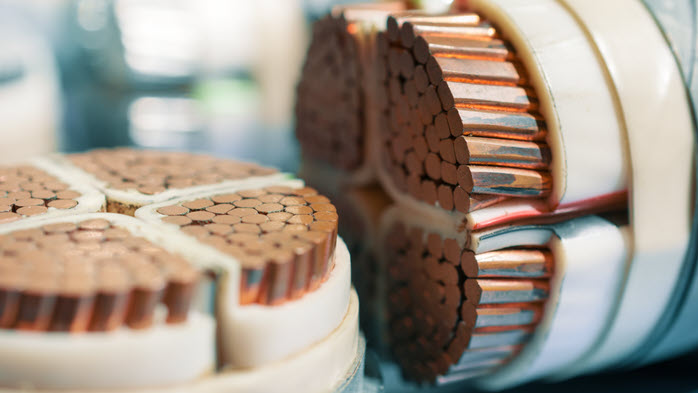

We built historical (from 1900) real prices for copper, aluminium, iron ore and coal and justified our methodology to construct and deflate the series. We then estimated the super cycles, trends and short-lived movements using the start of the art econometric methods. We then cross checked differences against the supply and demand features of each commodity, taking full account of the value chain. A final section drew lessons together, taking account of the current pipeline of investment projects in each commodity.

Outcome

The client found the different perspective very useful especially in understanding how far and how long prices can deviate from their long-run cost trends. This was a starting point for designing a planning and reaction process which acknowledged the true scale and nature of the volatility in commodity prices.