The nitrogen industry, like many other sectors, faces increased criticism and costs related to its greenhouse gas emissions.

Explore this topic with CRU

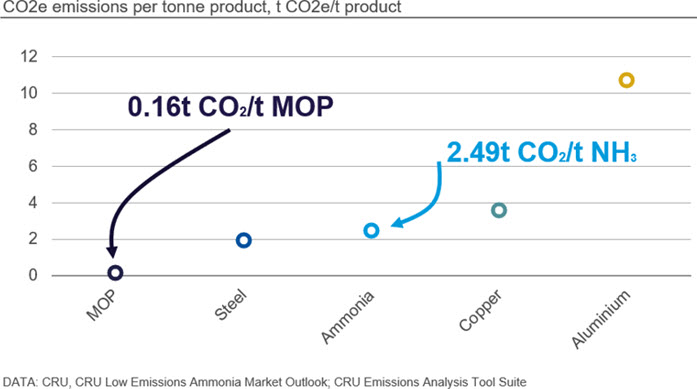

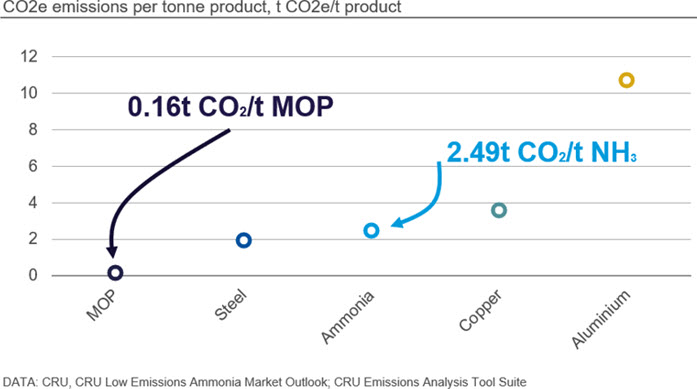

Emissions from the sector are hard to abate, comprising around 1-2% of total emissions – similar to steel or copper.

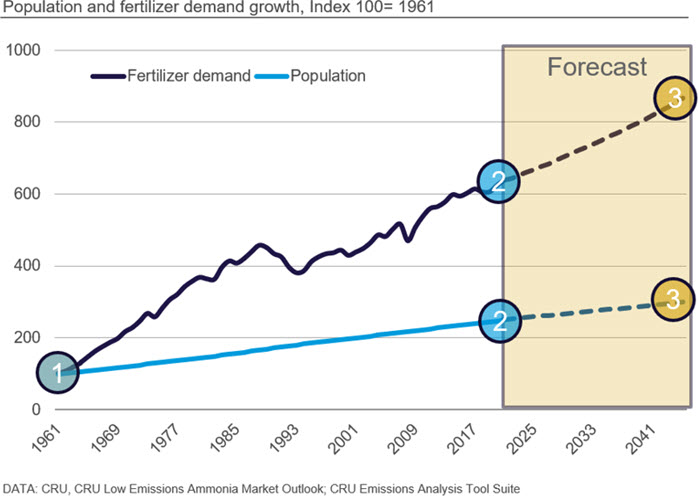

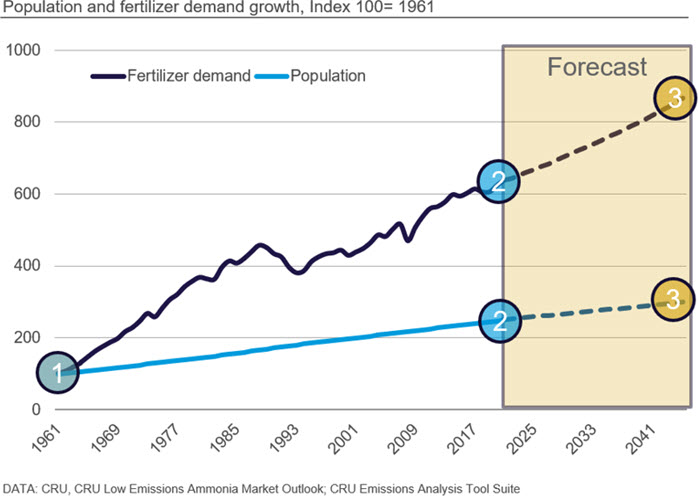

But any plans to cut emissions from the sector must balance the need for emissions reductions with the need for increasing amounts of food and the fertilizers to produce it. The global population is set to increase to nine billion by the middle of this century, leading to fertilizer demand approaching 150 Mt/year.

Fertilizer prices are subject to market volatility, as illustrated by price increases of more than 180% in 2021. Fertilizer price increases are passed on to food prices and can hit consumers hard, which causes ethical and political issues as critical as those caused by emissions and climate change, if not more so.

Still, carbon taxes continue to proliferate across the globe, imposing additional costs on fertilizer producers. These costs will lead to higher fertilizer prices, and the carbon taxes may create trade barriers that impact global fertilizer trade flows. Understanding how carbon price policies are evolving and their implications for costs and trade are thus crucial to the nitrogen industry.

Fertilizer companies cannot avoid embracing the changes spreading through the industry and the global economy, but those who prove best at evolving may benefit from advantages. The global move towards more sustainable practices presents the fertilizer industry with challenges, but also opportunities.

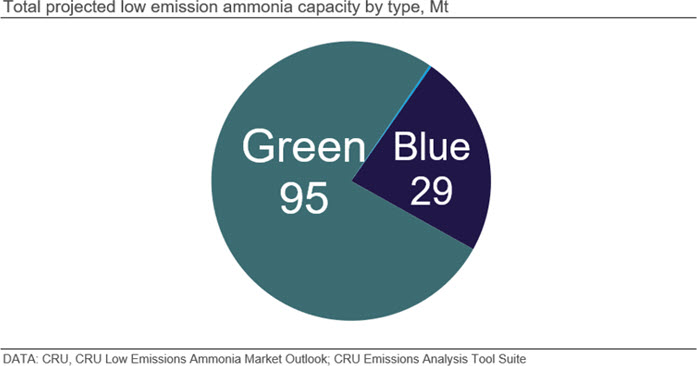

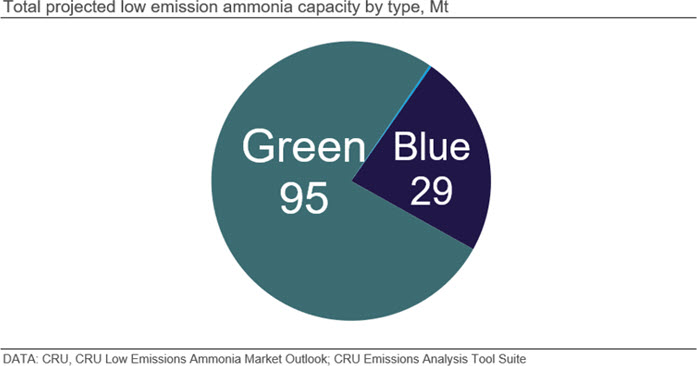

One key area of opportunity is within the hydrogen and green ammonia sector. Despite being a major sources of total global CO2 emissions, the nitrogen industry is being hailed as a potential decarbonisation solution through the production of green ammonia. The number of projects and memoranda of understanding for the production and consumption of green ammonia has quickly gathered pace.

In CRU's webinar, Food to Fuel: Critical emissions considerations for the nitrogen industry , our analysts provide answers to key questions the fertilizer industry needs to reduce its carbon footprint. How will carbon pricing pass through to the cost of fertilizer? What data and resources are available to help provide transparency and actionable insights necessary for critical strategic decision-making? To better understand the emissions footprint of the nitrogen industry, an asset-by-asset view is necessary.

CRU can help support understanding of these areas with the Nitrogen Emissions Analysis Tool, Cost Analysis Tool, and market outlooks (including our new Low Emission Ammonia Market Outlook). Request a 1-1 analyst led demo for insight into how we can help.

Request a demo

Continuing to address the latest news and updates related to sustainability in the fertilizer sector, as well as in-depth insights and analysis across a range of relevant topics, our fertilizer analysis and sustainability service subscribers can expect to have the information needed to make critical business decisions amidst the low carbon transition. To learn more or speak to our team, please click below and complete the form.

Explore this topic with CRU