Josh Spoores

Principal Analyst View profile

Steel sheet contract negotiations are intensifying

This brief Insight highlights a few key points related to contract negotiations for the EU and North American steel sheet markets (Note: all data in this, references Europe as EU27 + UK). Negotiations for these annual contracts have started to take place, yet market fundamentals now are vastly different from a year ago. Some of these will be introduced here, yet the point of this Insight is to invite market participants to a free webinar on this topic. Please find invitation details are at the bottom of this article.

Steel producers, processors, and buyers are in active negotiations for 2023 contracts. The key fundamentals of these discussions are generally consistent from year to year:

- How will supply and demand look in 2023 versus this year?

- How have input costs and sheet prices fluctuated this year and what is the trend for 2023?

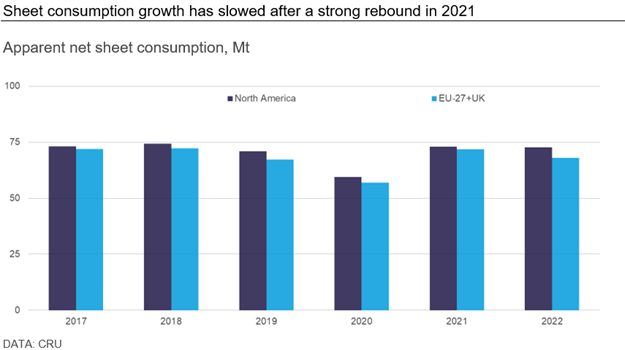

We will cover these questions in depth during the webinar and we have an initial view now. For sheet demand, we use apparent net consumption which is local mill shipments plus imports less exports. This data provides visibility to the amount of steel sheet available in the local market.

The following chart shows apparent net sheet consumption for both the EU and North American markets from 2017 through 2022. Following the worst of the pandemic lockdowns, consumption rebounded in 2021 to levels higher than 2019 for both markets. Our expectation for 2022 is for consumption to end the year at slightly lower levels. This weakness in end demand has primarily come from slower growth of industrial activity while the rebuilding of inventory from a year ago has ceased.

Sheet prices continue to correct

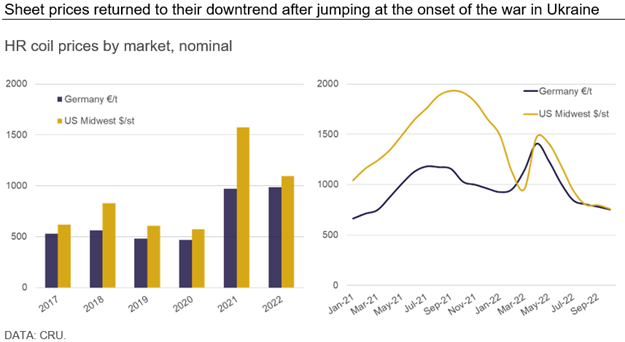

While sheet demand in Europe and North America is easing back from 2021 levels, sheet prices have been trending towards more historic levels. Prices in both markets, and around the world, had surged following the initial lockdowns as demand for steel exceeded supply, and in turn, depleted inventories throughout the full supply chain.

Earlier this year, prices stopped falling as Russia invaded Ukraine which, along with subsequent sanctions, disrupted the global trade of ferrous products throughout the supply chain. This disruption allowed sheet prices to surge and, in the case of European markets, reach new pandemic-era highs before retreating to the prior trend. Still, that upward trend in prices and costs was short-lived and prices have reverted to their downward trajectory.

Join our free, live webinar to learn more

We will cover this topic and details in more depth during a free, live webinar on 16 November at 15:00 London/10:00 Eastern. This webinar is available to both CRU clients as well as market participants.

Our goal is to cover the following three topics:

- Will sheet prices in 2023 continue to be influenced by pandemic era policies or return to more historic levels?

- The CRU View for sheet demand and supply availability in the year ahead

- The key risks we are watching that can quickly alter our base case forecast

Presenters:

Matt Watkins, James Campbell, Ryan McKinley, and Josh Spoores

Explore this topic with CRU

Josh Spoores

Principal Analyst View profile