Author Paul Butterworth

Research Manager View profile

Prices have increased rapidly this year

Graphite electrode prices and their input materials have risen sharply this year; needle coke prices have reportedly increased to about $3,200t from $450/t a year. CRU believe that these prices rises are due to supply side factors, rather than being driven by changes to demand from the Chinese steel industry. These changes are affecting the whole supply chain – with raw materials suppliers unable to meet demand from electrode manufacturers, and with steel mills around the world concerned that they will run out of replacement electrodes by the end of the year. We hear that there is currently a year long waiting period for electrodes from manufacturers.

A supply side story

A perfect storm of several supply factors have combined to result in sharp price rises. Global supply of graphite electrodes is more concentrated in China than it was pre-2014, when exports of Chinese billet substantially reduced Asian EAF route steel production, and by consequence also graphite electrode production capacity outside China. This year, there have been several environmental restriction related developments to the graphite electrode sector in China.

- Closure of nearly 300kt graphite electrode manufacturing capacity in China since H2 2016 due to environment concerns, mainly in Northern China

- There are 20% graphite electrode production restrictions in Henan and Shandong provinces

- Stockpiling of electrodes due to concerns about Chinese production closures in winter this year

We believe that environmental closures now represent nearly 30% of installed capacity and that operating capacity is now concentrated in East and North West China.

Additionally, in the near term, there is also a shortage of needle coke, a form of calcined petroleum coke (CPC), which represents approximately 70% of the input costs of graphite electrode production. This is exacerbating the ability of graphite electrode producers currently operating, to increase production rates to meet demand. A longstanding limiting factor to the increase of graphite electrode production is the supply of needle coke, which is limited to a few refineries around the world with only one independent needle coke production facility in the world (Seadrift, TX – owned by Graftech.)

No significant steel sector demand changes

We believe that the demand side influence from the installation of additional EAFs in China is trivial and we do not believe that there has been widespread replacement of IFs by EAFs. Our understanding is that there are only limited circumstances in which mills are permitted to replace IFs with EAFs;

- Mills with EAF licenses which previously built IFs rather than EAFs are not permitted to build EAFs after dismantling IFs

- Mills with EAF licenses which have idled EAFS are permitted to restart EAFs after dismantling IFs and obtaining approval from local governments

- Mills with EAF licenses are permitted to upgrade existing EAFs, but are not allowed to add capacity

- IF mills with downstream facilities are allowed to build EAFs but must close equivalent other steelmaking capacity (net addition must be zero)

Impacts on the steel industry

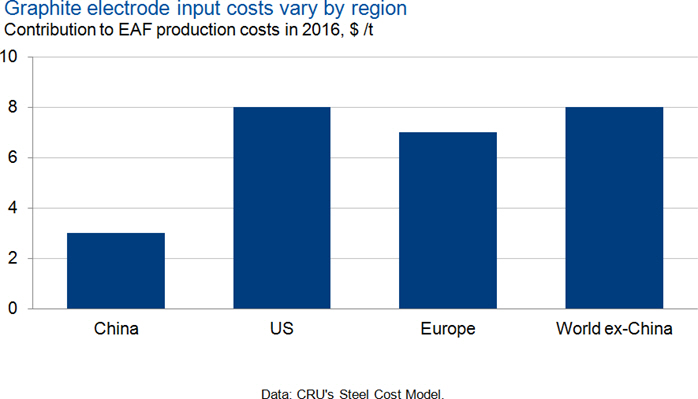

Cost increases will primarily be felt by EAF route producers. Data from CRU’s steel cost model suggest that the cost impact varied between $3 /t and $8 /t of finished steel in 2016.

Although graphite electrodes are also used in ladle furnaces and will also impact BOF producers, our cost modeling work suggests that the cost of graphite electrodes in 2016 was in the region of $1 per ton of finished steel. Therefore we expect there to be negligible impacts on the BOF-route steel producers.

Impacts on the aluminium industry

Growing environmental restrictions was the driver behind increases to anode prices earlier this year. More recently however, the supply shortage of graphite electrodes has begun to affect cathode blocks.

The shortage in the Chinese graphite electrode market has spurred on a rise in Chinese domestic low-sulphur CPC prices. 0.5-0.7%S Chinese domestic CPC prices increased significantly in July, rising by $88-206 /t m/m to trade at $471-691 /t. Prices of the raw material for CPC, green petroleum coke, have also risen due to the spike in demand and this is expected to add upward pressure on Chinese anode and cathode block prices. Therefore the recent price increases to cathode blocks has been a direct response to the graphite electrode shortage. CRU expects that this latest development will exert upward cost pressures to Chinese aluminium smelters

Market implications

Graphite electrodes represent only a small share of input costs for steel producers. However, they are an essential input material with no available substitute, hence the story over the next few months will be one of whether EAF producers can manage to source sufficient electrodes to allow EAF production to continue unaffected rather than a story of slightly higher prices for producers. The winter closures to graphite electrode capacity will be a key determining factor of prices this year and it is an issue we are continuing to track closely.

Graphite electrodes are one of the main end use sectors for needle coke, with another being the graphite anodes of EV batteries. The impacts of higher needle coke prices and graphite electrodes are beginning to affect steel producers now, whereas EV battery producers typically have longer term contracts with suppliers and hence it will take longer for them to be affected by the current price increases.

Demand for graphite electrodes and needle coke is likely to increase in the future; for instance new capacity in China is likely to be EAF based due to environmental restrictions and use of battery technology will become more prevalent. However these fundamental changes to demand will be slow enough that electrode manufacturers will be able to keep pace and it is unlikely that the current price increases will be long lasting.

Author Paul Butterworth

Research Manager View profileThe Latest from CRU

Key takeaways from CRU’s Wire and Cable Amsterdam conference

CRU held its seventeenth consecutive Wire and Cable conference in Amsterdam, during 24–26 June 2024. Day 1 kicked off with a warm welcome to around 200 conference...