AuthorLewis Pegrum

Senior Consultant View profileEU’s flagship climate change policy, the Emissions Trading Scheme could fundamentally alter the economics of metals production in Europe.

The European Union is forging ahead on its commitments on climate change under the Paris Accord. The EU pledge to reduce greenhouse gas emissions by 20% by 2020 and 40% by 2030 from 1990 levels can only be achieved with further policy commitments; these policies are likely to have important impacts on metals and fertiliser value chains; the complexity of the rules means that some plants will be affected more than others. In this Spotlight, one in a series on the EU’s emissions trading scheme, CRU consultant Ben Jones, explains why we believe downstream European producers need to factor in higher emissions allowance prices in the long term.

The EU Emissions trading scheme (ETS) is the flagship policy for transforming Europe’s “carbon footprint”. First introduced in 2005, and currently in its third phase (ending in 2020), it limits the total number of emissions allowed in a given year (the “cap”). Metals and other producers (including power generators) are required to hold (and then retire) enough allowances to cover overall emissions at each plant (see Box 1 for additional details on the EU ETS).

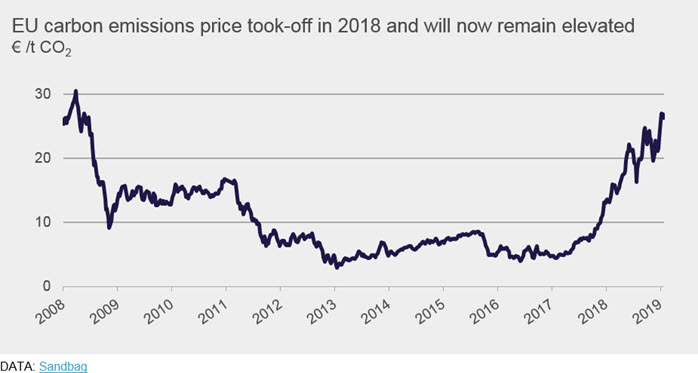

The EU ETS will change, potentially fundamentally, the economics of metals production in Europe. The value of these allowances (the carbon price) has spiralled, rising from €4.40/t in Jan 2013 to around €25/t in June 2019. This reflects recent reforms to the policy including the introduction of the “Market Stability Reserve” in Jan 2019; And further reinforcements are anticipated as part of Phase IV of the scheme, beginning in 2021.

Overview of the EU ETS

What is the EU ETS?

The EU ETS is a policy designed to reduce the EU’s emissions of man-made greenhouse gases. It is a “cap and trade” system designed to set specific limits to participants’ direct greenhouse gas emissions while allowing them to freely trade their emissions rights.

What is covered by the scheme?

The ETS currently operates in the 28 EU Member States plus Norway, Iceland and Liechtenstein. It caps emissions from sectors including iron & steel plants, coke ovens, oil refineries, cement clinkers, glass, lime bricks, ceramics, pulp & paper, power stations and other combustion plants ≥20 MW. Over 11,000 manufacturing plants and power stations are currently regulated under the scheme, including airlines.

What is driving higher carbon prices?

The carbon has more than quadrupled, between January 2013 and June 2019. There are a variety of policy and market related factors behind this, including a steady tightening of the “cap”, higher gas prices (which raise demand by encouraging fuel switching into coal), stronger economic growth, and changes to the policy itself (see below). The outlook for EU ETS prices will be discussed in more depth in a forthcoming special feature.

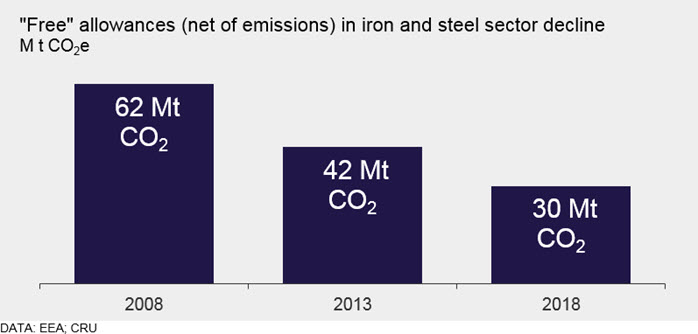

Will I receive allowances for free?

The allocation of allowances is subject to a complex methodology, reflecting a range of sector and plant specific factors. Most power producers are being required to purchase 100% of the required allowances. Other industries (including most metals and fertiliser producers) deemed ‘at risk’ of carbon leakage receive most of their allowances for free, but this proportion is declining over time.

Will the EU ETS change in the future?

The EU ETS has been serially reformed since its initial pilot phase in 2005. Most recently, in January 2019, a new Market Stability Reserve (“MSR”) became operational. This policy (which operates a bit like the central banks’ open market operations) is designed to tackle a stock build in allowances arising from historical oversupply and has prompted a change in market expectations regarding future availability of allowances. Phase IV of the scheme is currently being designed and will take effect from 2021. Overall, while carbon prices could potentially slide in the shorter term, they are ultimately likely to rise in the longer term as emissions cuts start to bite deeper into the energy economy. EU ETS phase IV policy design choices will be discussed in more depth in a forthcoming special feature.

Pressure on EU metals and fertiliser production costs expected to mount

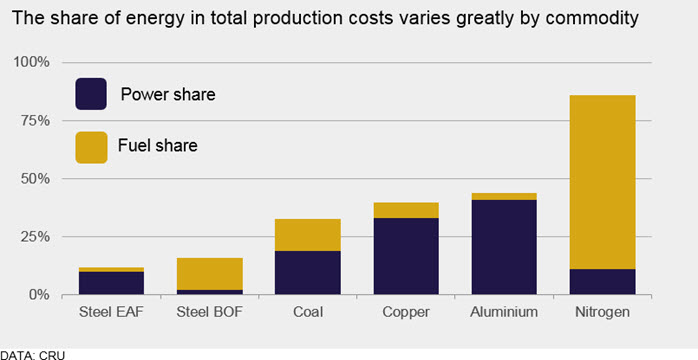

Metals and fertilisers industries are highly energy intensive, commonly accounting for 30-70% of total production costs. Higher carbon prices are thus likely to increase production costs for a broad span of European industrials, including steel, aluminium, copper and aluminium producers. The extent of these pressures reflects not only the state of the EU ETS market and the energy intensity of the particular industry value chain, but also the fuel mix and technical efficiency of a given plant. The outlook for the EU ETS will be discussed in more depth in a forthcoming special feature.

The implications for the bottom line are less obvious

So, what is the bottom line for producers? Ultimately this depends on both the carbon prices and the net allowance position of individual producers. While the carbon price could slide in the shorter term, it is ultimately likely to rise in the longer term as emissions cuts start to bite deeper into the energy economy. But understanding the extent to which individual producers and industries will be short of allowances is another critical dimension.

Under current rules, industries deemed at risk of “carbon leakage” have received allowances for free. This has substantially mitigated cost pressures arising from the policy. Indeed, the EU ETS rules have previously been extremely generous, freely allocating surplus emissions for many producers that can be sold or stored for the future. The potential implications of this at plant, firm and industry segment therefore require close attention. For example, steel production by Blast Furnace is likely to be more impacted than by Electric Arc Furnace.

Looking to the future, under Phase IV of the scheme (from 2021), the allocation of allowances is likely to remain relatively favourable overall in terms of limiting the requirements of producers to purchase pollution allowances. However, the complexity of the proposed rules means that plants with inefficient or outmoded technologies are likely to be in deficit. EU ETS phase IV policy design choices will be discussed in a forthcoming special feature.

Conclusions

The EU has pledged to reduce greenhouse gas emissions by 20% in 2020 and 40% in 2030 (compared with 1990 levels). The EU ETS, the flagship policy for achieving these goals, is beginning to take real shape. The carbon has more than quadrupled, rising from €4.40/t in Jan 2013 to around €25/t in June 2019. While carbon prices could slide in the shorter term, they are ultimately likely to rise in the longer term as emissions cuts start to bite deeper into the energy economy.

All this will put pressure on EU metals and fertiliser production costs. Ultimately the bottom line depends, not only on the carbon price, but also on the net allowance position of individual producers. Understanding the extent to which individual producers and industries are (or will be) short of allowances is thus a critical dimension. To date, the rules have been generous and firms have had surplus emissions to store of sell. However, the recent case of British Steel serves to illustrate the importance of getting such decisions right.

Policy rules for Phase IV of the EU ETS are currently being designed, and will be discussed in more depth in a forthcoming special feature. Evaluating and adapting to these changes will not be straightforward for many operators and will require deeper understanding of a range of issues including the shape of the future regulatory environment and the implications for carbon prices, and the commercial and investment implications at an industry and firm level, both in the short, medium and long terms.

If you would like to discuss any of these issues or better understand key opportunities and risks affecting your business complete the form below and member of CRU's staff will contact you.

We are also hosting a free webinar on the 11th July on this topic. A full agenda and registration link can be found on this page.

CRU Consulting