Metallic Wire & Cable: what lies ahead after China’s slowdown?

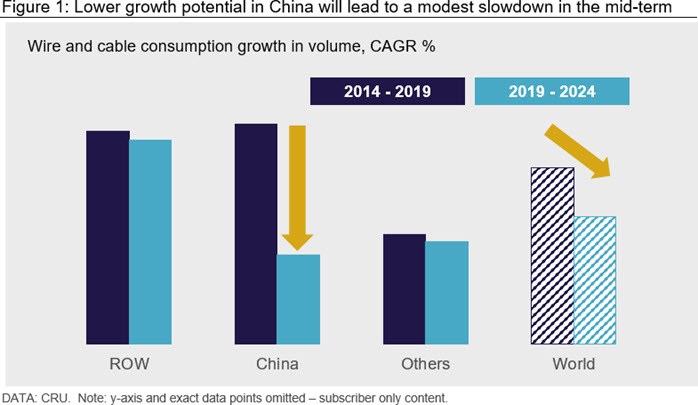

CRU estimates global insulated metallic wire and cable consumption to have grown by just under 1% y/y in 2019, almost reaching 19.0 Mt conductors. This marks the lowest growth rate since the Global Financial Crisis in 2009.

The extent of China’s slowdown is unprecedented, driven by sharp declines in electricity grid investment and automotive production. This weighed heavily on cable demand across almost all product categories, though the increase of around 1% y/y in total cable consumption last year is still marginally faster than the world average.

For cable markets outside of China, the situation was worse. Western Europe recorded a contraction in total cable consumption which was triggered by the collapse in the region’s automotive sector. Perhaps the greatest surprise came from the Indian subcontinent, where cable demand grew by only 1-2% y/y last year, down from 7.4% in 2018. The pronounced downturn in India was caused by weakness in both the automotive and construction sectors.

Looking ahead, we forecast global wire and cable demand to pick up moderately this year, growing at a rate above 1% y/y, despite a slow start. We expect accelerating growth in the second half of 2020, driven by a recovery in key markets and cable end use sectors, which is greatly discussed in CRU’s Wire and Cable Market Outlook alongside our recent Insight. On the downside, China’s perceived reduction in future electricity grid investment coupled with the outbreak of Coronavirus Covid-19 has led to further Chinese market downgrades.

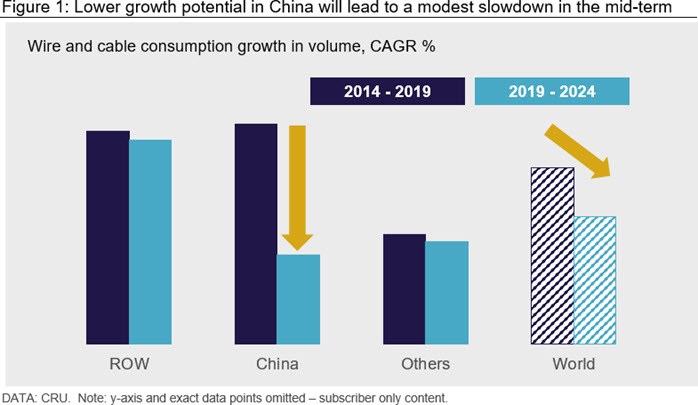

In the mid-term, our view on cable demand remains little changed. CRU still forecasts healthy growth in the global insulated metallic wire and cable market between 2019 and 2024, albeit marginally slower than the previous five-year period. Emerging markets will continue to support higher growth rates in global demand. Undoubtedly, elevated activity in construction, infrastructure, utility and industrial developments led by government and private investments will provide significant upside potential for cable demand across all product categories in these regions.

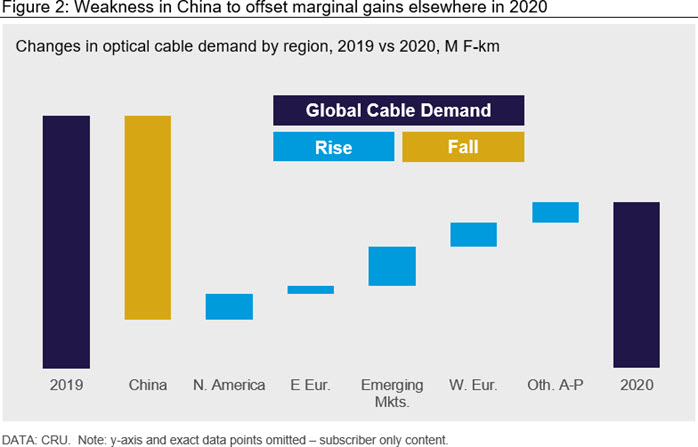

Optical Fibre: global demand to contract once again in 2020

Whilst there were a few highlights in 2019, namely the launch of commercial 5G services in over 30 countries, it was still a disappointing year for many industry participants. CRU estimate global optical cable consumption on a fibre-km basis contracted by almost 7% y/y in 2019, marking the second weakest growth rate on CRU’s records.

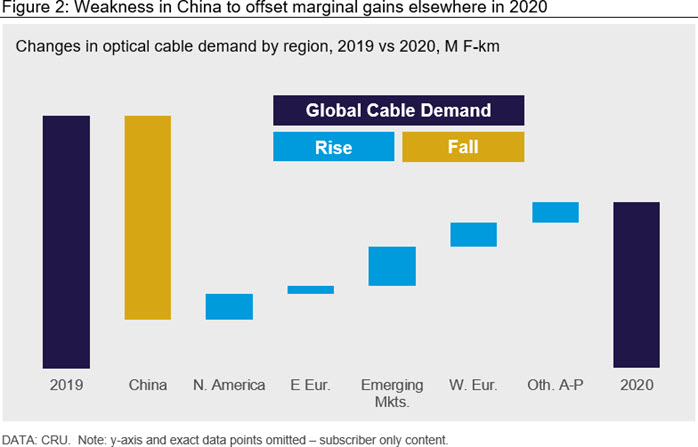

Despite experiencing relatively healthy growth in key markets like the US and Europe, this comes after numerous downgrades and a pronounced slowdown in Q4. In general, the year was marred by market weakness in China, where demand contracted sharply. This, in combination with rising inventories and excess capacity led to a collapse in domestic bare fibre prices. With Chinese producers ramping up export efforts, price weakness crept into global markets, with significant declines in domestic pricing witnessed in Europe, India, Mexico and Russia—to name just a few.

Early indications suggest there has been no change to the weak market fundamentals that dominated in the last few months of 2019. Looking ahead to this year, we expect a further contraction in Chinese optical cable demand, as demand from FTTH continues to fall and the pace of 5G network construction remains limited in early-2020. Despite modest growth in Europe and North America, the decline in China will act as a drag on global demand, which CRU forecasts will contract in the low-single digit range this year.

The near-term outlook, especially in China, is shrouded in risk as coronavirus Covid-19 induced closures and travel restrictions look set to meaningfully impact both supply and demand for optical cable (read our recent Insight here). CRU expects demand will be significantly limited in Q1 and logistical and supply-chain related issues may also temporarily delay the rollout of wider scale 5G services across the country.

We cover the above and more detailed research in our Metallic Wire and Cable Market Outlook and Telecom Cables Market Outlook. Here we include demand, supply (plant by plant), trade and price forecasts for the next five years broken down by major regions and countries.

Explore this topic with CRU